FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Don't want wrong answer

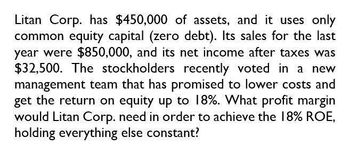

Transcribed Image Text:Litan Corp. has $450,000 of assets, and it uses only

common equity capital (zero debt). Its sales for the last

year were $850,000, and its net income after taxes was

$32,500. The stockholders recently voted in a new

management team that has promised to lower costs and

get the return on equity up to 18%. What profit margin

would Litan Corp. need in order to achieve the 18% ROE,

holding everything else constant?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- I Want Answerarrow_forwardLitan Corp. has $450,000 of assets, and it uses only common equity capital (zero debt). Its sales for the last year were $850,000, and its net income after taxes was $32,500. The stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 18%. What profit margin would Litan Corp. need in order to achieve the 18% ROE, holding everything else constant?arrow_forwardLeCompte Corp. has $312,900 of assets, and it uses only common equity capital (zero debt). Its sales for the last year were $620,000, and its net income after taxes was $24,655. Stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15%. What profit margin would LeCompte need in order to achieve the 15% ROE, holding everything else constant? a. 7.57% b. 7.95% c. 8.35% d. 8.76% e. 9.20%arrow_forward

- Chang Corp. has $375,000 of assets, and it uses only common equity capital (zero debt). Its sales for the last year were $550,000, and its net income was $25,000. Stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15%. What profit margin would the firm need in order to achieve the 15% ROE, holding everything else constant? Do not round your intermediate calculations. a. 10.13% b. 10.64% c. 10.23% d. 8.59% e. 9.92%arrow_forwardBurger Corp has $500,000 of assets, and it uses only common equity capital (zero debt). Its sales for the last year were $600,000, and its net income after taxes was $25,000. Stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15%. What profit margin would Burger need in order to achieve the 15% ROE, holding everything else constant?arrow_forwardProvide Answer of this Questionarrow_forward

- New Doors Corp. has $375,000 of total assets, and it uses $187,500 of total shareholder's equity capital. Its sales for the last year were $520,000, and its net income was $25,000. Stockholders recently voted in a new management team that has promised to lower costs and get the return on equity (ROE) up to 15.0%. What profit margin (PM) would the firm need in order to achieve the 15% ROE, holding everything else constant? 1. 10.71% 2. 5.41% 3. 9.41% 4. 12.66% 5. 8.11%arrow_forward13. Chang Corp. has $375,000 of assets, and it uses only common equity capital (zero debt). Its sales for the last year were $595,000, and its net income was $25,000. Stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15.0%. What profit margin would the firm need in order to achieve the 15% ROE, holding everything else constant?arrow_forwardChauhan Corporation has a debt-equity ratio of .90. The company is considering a new plant that will cost $102 million to build. When the company issues new equity, it incurs a flotation cost of 7.2 percent. The flotation cost on new debt is 2.7 percent. a. What is the initial cost of the plant if the company raises all equity externally? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. What is the initial cost of the plant if the company typically uses 60 percent retained earnings? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) c. What is the initial cost of the plant if the company typically uses 100 percent retained earnings? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole…arrow_forward

- 7. J Peterman Corp. has $425,000 of assets, and it does not use any debt to finance their operations. Peterman's sales for the last year were $625,000, and its net income was $50,000. Stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 20%. What profit margin would the firm need in order to achieve the 20% ROE, holding everything else constant? (2 points)arrow_forwardTrower Corp. has a debt−equity ratio of .80. The company is considering a new plant that will cost $103 million to build. When the company issues new equity, it incurs a flotation cost of 7.3 percent. The flotation cost on new debt is 2.8 percent. What is the initial cost of the plant if the company raises all equity externally? (Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations and round your answer to the nearest whole dollar, e.g., 1,234,567.) Initial cash outflow $ What is the initial cost of the plant if the company typically uses 55 percent retained earnings? (Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations and round your answer to the nearest whole dollar, e.g., 1,234,567.) Initial cash outflow $ What is the initial cost of the plant if the company typically uses 100 percent retained earnings? (Enter your answer in dollars, not millions of dollars. Do not round…arrow_forwardTarget Corporation (TGT) has $2.14 million in assets that are currently financed with 100% equity. TGT’s EBIT is $385,000, and its tax rate is 25%. If TGT changes its capital structure to include 50% debt, its return on equity will increase. Assume the interest rate on debt is free. (justify your answer with numerical calculation) True Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education