Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

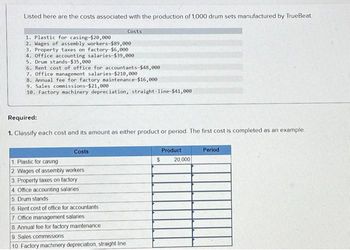

Transcribed Image Text:Listed here are the costs associated with the production of 1,000 drum sets manufactured by TrueBeat.

1. Plastic for casing-$20,000

2. Wages of assembly workers-$89,000

3. Property taxes on factory-$6,000

4. Office accounting salaries-$39,000

5. Drum stands-$35,000

6. Rent cost of office for accountants-$48,000

7. Office management salaries-$210,000

8. Annual fee for factory maintenance $16,000

9. Sales commissions-$21,000

10. Factory machinery depreciation, straight-line-$41,000

Costs

Required:

1. Classify each cost and its amount as either product or period. The first cost is completed as an example.

Costs

1. Plastic for casing

2. Wages of assembly workers

3. Property taxes on factory

4. Office accounting salaries

5. Drum stands

6. Rent cost of office for accountants

7. Office management salaries

8. Annual fee for factory maintenance

9 Sales commissions

10 Factory machinery depreciation, straight-line i

$

Product

20,000

Period

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Listed here are the costs associated with the production of 1,000 drum sets manufactured by TrueBeat. 1. Plastic for casing-$23,000 Costs 2. Wages of assembly workers-$81,000 3. Property taxes on factory-$6,000 4. Office accounting salaries-$35,000 5. Drum stands-$32,000 6. Rent cost of office for accountants-$24,000 7. Office management salaries-$155,000 8. Annual fee for factory maintenance-$20,000 9. Sales commissions-$12,000 10. Factory machinery depreciation, straight-line-$48,000 2. Compute the average manufacturing cost per drum set. Calculation of Manufacturing Cost per Drum Set Manufacturing costs Total manufacturing costs $ 0arrow_forwardListed here are the total costs associated with the production of 1,000 drum sets manufactured by TrueBeat. The drum sets sell for $510 each. Costs 1. Plastic for casing—$17,000 2. Wages of assembly workers—$86,000 3. Property taxes on factory—$6,000 4. Accounting staff salaries—$36,000 5. Drum stands (1,000 stands purchased)—$31,000 6. Rent cost of equipment for sales staff—$48,000 7. Upper management salaries—$170,000 8. Annual flat fee for factory maintenance service—$13,000 9. Sales commissions—$20 per unit 10. Machinery depreciation, straight-line—$45,000 2. Compute the manufacturing cost per drum set. TrueBeat Calculation of Manufacturing Cost per Drum Set Item Total cost Per unit cost Variable production costs Total variable production costs Fixed production costs Total fixed production costs Total production costarrow_forwardListed here are the total costs associated with the production of 1,000 drum sets manufactured by TrueBeat. The drum sets sell for $510 each. Costs 1. Plastic for casing—$17,000 2. Wages of assembly workers—$86,000 3. Property taxes on factory—$6,000 4. Accounting staff salaries—$36,000 5. Drum stands (1,000 stands purchased)—$31,000 6. Rent cost of equipment for sales staff—$48,000 7. Upper management salaries—$170,000 8. Annual flat fee for factory maintenance service—$13,000 9. Sales commissions—$20 per unit 10. Machinery depreciation, straight-line—$45,000 Required:1. Classify each cost and its amount as (a) either variable or fixed and (b) either product or period. (The first cost is completed as an example.) Cost by Behavior Cost by Function Costs Variable Fixed Product Period 1. Plastic for casing $17,000 $17,000 2. Wages of assembly workers 3. Property taxes on factory 4. Accounting…arrow_forward

- Listed here are the costs associated with the production of 1,000 drum sets manufactured by TrueBeat. Costs 1. Plastic for casing—$21,000 2. Wages of assembly workers—$80,000 3. Property taxes on factory—$8,000 4. Office accounting salaries—$41,000 5. Drum stands—$35,000 6. Rent cost of office for accountants—$12,000 7. Office management salaries—$165,000 8. Annual fee for factory maintenance—$12,000 9. Sales commissions—$15,000 10. Factory machinery depreciation, straight-line—$39,000 1. Classify each cost and its amount as either product or period. The first cost is completed as an example. 2. Compute the average manufacturing cost per drum set. Please don't provide solution image based thnxarrow_forwardRequired information [The following information applies to the questions displayed below.] Listed here are the costs associated with the production of 1,000 drum sets manufactured by TrueBeat. Costs 1. Plastic for casing-$17,000 2. Wages of assembly workers-$82,000 3. Property taxes on factory-$5,000 4. Office accounting salaries-$35,000 5. Drum stands-$26,000 6. Rent cost of office for accountants- $10,000 7. Office management salaries-$125,000 8. Annual fee for factory maintenance- $10,000 9. Sales commissions-$15,000 10. Factory machinery depreciation, straight-line-$40,000 Required: 1. Classify each cost and its amount as either product or period. The first cost is completed as an example. Costs 1. Plastic for casing 2. Wages of assembly workers 3. Property taxes on factory 4. Office accounting salaries 5. Drum stands 6. Rent cost of office for accountants 7. Office management salaries 8. Annual fee for factory maintenance 9. Sales commissions 10. Factory machinery depreciation,…arrow_forwardRequired information [The following information applies to the questions displayed below.] Listed here are the costs associated with the production of 1,000 drum sets manufactured by TrueBeat. ▶▶▶ 1. Plastic for casing-$21,000 2. Wages of assembly workers-$83,000 3. Property taxes on factory-$6,000 4. Office accounting salaries-$42,000 5. Drum stands-$34,000 Costs 6. Rent cost of office for accountants-$48,000 7. Office management salaries-$140,000 8. Annual fee for factory maintenance-$19,000 9. Sales commissions-$25,000 10. Factory machinery depreciation, straight-line-$35,000 2. Compute the average manufacturing cost per drum set. Manufacturing costs Calculation of Manufacturing Cost per Drum Set Total manufacturing costsarrow_forward

- The cost of direct labor was 58000. The charging rate of the CBS was 25% of the cost of direct labour. The company's expenses during the above period were: depreciation = 1500, exhibition expenses = 800, factory insurance premiums = 650, administrative employees' fees=22000, depreciation of factory machinery = 1400, rent=6500, salesmen's travel expenses = 1500, factory warden salaries = 2200, cleaning costs = 450, subscriptions = 150, maintenance costs = 320, indirect production materials = 750, factory maintenance costs = 1100, advertising costs = 5100, salaries of salesmen = 10000, utility costs = 4800, sample costs = 650, indirect work = 3600, interest debit & related financial expenses = 750, foreman salaries = 4100, other promotion costs = 390, lawyers' fee = 10000, accountants' fee = 11000, miscellaneous production consumables = 900. how much is the CBS?arrow_forwardVikarmbhaiarrow_forwardThe Company manufactures furniture at its central Kentucky factory. Some of its costs from the past year include: Wages paid to maintenance workers $60,700 Fabric used to upholster furniture $80,500 Wages paid to assembly-line workers $100,200 Lumber used to build product $15,100 Sales commissions $7700 Insurance costs for factory $21,900 Freight-in (on raw materials) $3900 Utilities in factory $12,400 Factory supervisor salary $60,100 Depreciation on factory equipment $18,200 Utilities in sales office $26,400 Costs of delivery to customers $8500 Depreciation on sales office $1700 Lubricants used in factory equipment $500 Direct material costs for the Company totaled $15,100. $95,600. $99,500. $80,500.arrow_forward

- Guaranteed Appliance Co. produces washers and dryers in an assembly-line process. Labor costs incurred during a recent period were: corporate executives, $555,000; assembly-line workers, $187,000; security guards, $55,000; and plant supervisor, $137,000. What is the total of Guaranteed’s direct labor cost?arrow_forwardPretty Pillows, Mfg., manufactures silk throw pillows. Last month the company produced 3,890 pillows.The following incurred the following costs: Production facility utilities, $1,600; Depreciation on production equipment, $650; Indirect materials, $400; Direct materials, $5,300; Indirect labor, $1,000; Direct labor, $3,500; Sales commissions, $4,000; President's salary, $8,000; Insurance on production facility, $1,000; Advertising expense, $900; Rent on production facility, $6,000; Rent on sales office, $4,000; Legal expense, $600. WIP (beginning balance) $3,200 WIP (ending balance) $2,400 Determine the PRIME COST of manufacturing the pillows.arrow_forwardPretty Pillows, Mfg., manufactures silk throw pillows. Last month the company produced 3,890 pillows.The following incurred the following costs: Production facility utilities, $1,600; Depreciation on production equipment, $650; Indirect materials, $400; Direct materials, $5,300; Indirect labor, $1,000; Direct labor, $3,500; Sales commissions, $4,000; President's salary, $8,000; Insurance on production facility, $1,000; Advertising expense, $900; Rent on production facility, $6,000; Rent on sales office, $4,000; Legal expense, $600. WIP (beginning balance) $3,200 WIP (ending balance) $2,400 Calculate the cost of the pillows manufactured.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College