FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

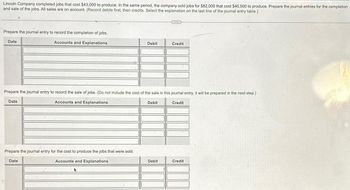

Transcribed Image Text:Lincoln Company completed jobs that cost $43,000 to produce. In the same period, the company sold jobs for $82,000 that cost $40,500 to produce. Prepare the journal entries for the completion

and sale of the jobs. All sales are on account. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Prepare the journal entry to record the completion of jobs.

Accounts and Explanations

Date

Debit

Prepare the journal entry for the cost to produce the jobs that were sold.

Date

Accounts and Explanations

Prepare the journal entry to record the sale of jobs. (Do not include the cost of the sale in this journal entry, it will be prepared in the next step.)

Accounts and Explanations

Debit

Credit

Debit

Credit

Credit

Walle

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following account appears in the ledger prior to recognizing the jobs completed in August: Work in Process Balance, August 1 $ 59,050 Direct materials 335,000 Direct labor 494,700 Factory overhead 226,200 Jobs finished during August are summarized as follows: Job 210 $178,300 Job 216 232,250 Job 224 149,500 Job 230 328,250 Required: a. Journalize the entry on Aug. 31 to record the jobs completed. Refer to the Chart of Accounts for exact wording of account titles. b. Determine the cost of the unfinished jobs at August 31.arrow_forwardIvanhoe Company uses a job order cost system. On May 1, the company has a balance in Work in Process Inventory of $3,780 and two jobs in process: Job No. 429 $2,160, and Job No. 430 $1,620. During May, a summary of source documents reveals the following. Job Number MaterialsRequisition Slips Labor TimeTickets 429 $2,700 $2,080 430 3,780 3,240 431 4,780 $11,260 8,200 $13,520 General use 920 1,240 $12,180 $14,760 Ivanhoe Company applies manufacturing overhead to jobs at an overhead rate of 60% of direct labor cost. Job No. 429 is completed during the month. Post the entries to Work in Process Inventory, and prove the agreement of the control account with the job cost sheets. (Post entries in the order of journal entries presented in the previous part.) Work in Process Inventory enter a debit amount enter a debit…arrow_forwardThe Goods in Process Inventory account of a manufacturing company that uses an overhead rate based on direct labor cost has a $7,200 debit balance after all posting is completed. The cost sheet of the one job still in process shows direct material cost of $3,400 and direct labor cost of $1,150. What is the company's overhead application rate?arrow_forward

- Prepare journal entries to record the transactions given .arrow_forwardThe journal entry to record the Labor Time Tickets includes a debit to the Manufacturing Overhead account of what dollar amount? Materials Labor Requisition Time For Slips Tickets Job No. 429 $ 3,500 $ 4,400 Job No. 430 2,600 3,400 Job No. 431 3,400 4,200 Job No. 432 3,000 4,000 Sub-Total 12,500 16,000 General Use 1,000 1,500 Total Cost $ 13,500 17,500 $17,500 $1,500 $16,000 $13,500arrow_forwardHarper Company uses a job order cost system. Journalize the entries for materials and labor, based on the following data:Raw materials issued: Job No. 609, $850; for general use in factory, $600Labor time tickets: Job No. 609, $1,600; $400 for supervision If an amount box does not require an entry, leave it blank. fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 fill in the blank 8 fill in the blank 9 fill in the blank 11 fill in the blank 12 fill in the blank 14 fill in the blank 15 fill in the blank 17 fill in the blank 18arrow_forward

- Please help me with show all calculation thankuarrow_forwardEdwin Parts, a job shop, recorded the following transactions in May: Purchased $87,200 in materials on account. Issued $3,650 in supplies from the materials inventory to the production department. Issued $43,600 in direct materials to the production department. Paid for the materials purchased in transaction (1). Incurred wage costs of $67,200, which were debited to Payroll, a temporary account. Of this amount, $22,300 was withheld for payroll taxes and credited to Payroll Taxes Payable. The remaining $44,900 was paid in cash to the employees. See transactions (6) and (7) for additional information about Payroll. Recognized $34,700 in fringe benefit costs, incurred as a result of the wages paid in (5). This $34,700 was debited to Payroll and credited to Fringe Benefits Payable. Analyzed the Payroll account and determined that 65 percent represented direct labor; 15 percent, indirect manufacturing labor; and 20 percent, administrative and marketing costs. Applied overhead on the basis…arrow_forwardPrepare T-accounts for inventories, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entries to these T-accounts (don’t forget to enter the opening balances in your inventory accounts). Compute an ending balance in each account.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education