SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

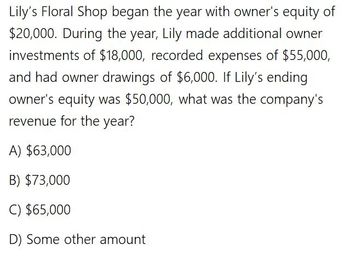

Transcribed Image Text:Lily's Floral Shop began the year with owner's equity of

$20,000. During the year, Lily made additional owner

investments of $18,000, recorded expenses of $55,000,

and had owner drawings of $6,000. If Lily's ending

owner's equity was $50,000, what was the company's

revenue for the year?

A) $63,000

B) $73,000

C) $65,000

D) Some other amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the end of Year 1, Herkimer Co. sells two laptops for 1,800 each. Based on the information in RE11-6 in Year 1, prepare the journal entries to record the purchase of the laptops, the depreciation on the laptops, and the sale of the laptops.arrow_forwardMarrow_forwardConsider the following transactions for Huskies Insurance Company: 1. Equipment costing $42,000 is purchased at the beginning of the year for cash. Depreciation on the equipment is $7,000 per year. 2. On June 30, the company lends its chief financial officer $50,000; principal and interest at 7% are due in one year. 3. On October 1, the company receives $16,000 from a customer for a one-year property insurance policy. Deferred Revenue is credited.Required: For each item, record the necessary adjusting entry for Huskies Insurance at its year-end of December 31. No adjusting entries were made during the year.arrow_forward

- Wetty Company began the year with owner's equity of $105,000. During the year, Wetty receive additional owner investments of $147,000, recorded expenses of $420,000, and had owner drawings of $28,000. If LWetty's ending owner's equity was $290,000, what was the company's revenue for the year? Select one: a. $486,000. b. $458,000. C. $605,000. O d. $633,000 Previous page Next pa hparrow_forwardThe net income of Edwards Corporation amounted to $65,000 for this year. The beginning balance of owner's equity was $20,000 and the ending balance was $80,000. The company received $15,000 additional contributions during the year. What was the amount of the owner's withdrawals during the year?arrow_forwardBlossom Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $2,016,000 on March 1, $1,296,000 on June 1, and $3,041,650 on December 31.Blossom Company borrowed $1,115,400 on March 1 on a 5-year, 13% note to help finance construction of the building. In addition, the company had outstanding all year a 9%, 5-year, $2,469,300 note payable and an 10%, 4-year, $3,155,500 note payable. Compute the weighted-average interest rate used for interest capitalization purposes. (Round answer to 2 decimal places, e.g. 7.58%.)arrow_forward

- Ayayai Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $3,600,000 on March 1, $2,400,000 on June 1, and $6,000,000 on December 31.Ayayai Company borrowed $2,000,000 on March 1 on a 5-year, 10% note to help finance construction of the building. In addition, the company had outstanding all year a 12%, 5-year, $4,000,000 note payable and an 11%, 4-year, $7,000,000 note payable. Compute avoidable interest for Ayayai Company. Use the weighted-average interest rate for interest capitalization purposes. (Round "Weighted-average interest rate" to 4 decimal places, e.g. 0.2152 and final answer to 0 decimal places, e.g. 5,275.)arrow_forwardBonita Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1,896,000 on March 1, $1,296,000 on June 1, and $3,025,000 on December 31. Bonita Company borrowed $1,089,000 on March 1 on a 5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 10%, 5-year, $2,327,000 note payable and an 11%, 4-year, $3,795,000 note payable. Compute avoidable interest for Bonita Company. Use the weighted-average interest rate for interest capitalization purposes. (Round weighted- average interest rate to 4 decimal places, e.g. 0.2152 and final answer to O decimal places, e.g. 5,275.) Avoidable interest $ Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardVaughn Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1,968,000 on March 1, $1,248,000 on June 1, and $3,046,000 on December 31. Vaughn Company borrowed $1,086,000 on March 1 on a 5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 9%, 5-year, $2,448,000 note payable and an 10%, 4-year, $3,546,000 note payable. Compute avoidable interest for Vaughn Company. Use the weighted-average interest rate for interest capitalization purposes. (Round weighted- average interest rate to 4 decimal places, e.g. 0.2152 and final answer to O decimal places, e.g. 5,275.) Avoidable interest $arrow_forward

- Grouper Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1.440.000 on March 1. $960.000 on June 1. and $2 400.000 on December 31 Grouper Company borrowed $800,000 on March 1 on a 5-year. 10% note to help finance construction of the building. In addition, the company had outstanding all year a 12%, 5- year, $1,600.000 note payable and an 11%. 4-year. $2,800,000 note payable. Compute avoidable interest for Grouper Company. Use the weighted average interest rate for interest capitalization purposes.arrow_forwardMartinez Enterprises began the year with owner's equity of $18,000. During the year, Martinez received additional owner investments of $25,000, recorded expenses of $72,000, and had owner drawings of $5,000. If Martinez's ending owner's equity was $52,000, what was the company's revenue for the year?arrow_forwardWildhorse Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $2,004,000 on March 1, $1,284,000 on June 1, and $3,055,000 on December 31. Wildhorse Company borrowed $1,163,000 on March 1 on a 5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 10%, 5-year, $2,377,000 note payable and an 11%, 4-year, $3,691,000 note payable. Compute avoidable interest for Wildhorse Company. Use the weighted-average interest rate for interest capitalization purposes. (Round weighted-average interest rate to 4 decimal places, e.g. 0.2152 and final answer to 0 decimal places, e.g. 5,275.) Avoidable interestarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning