Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

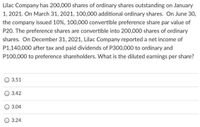

Transcribed Image Text:Lilac Company has 200,000 shares of ordinary shares outstanding on January

1, 2021. On March 31, 2021, 100,000 additional ordinary shares. On June 30,

the company issued 10%, 100,000 convertible preference share par value of

P20. The preference shares are convertible into 200,000 shares of ordinary

shares. On December 31, 2021, Lilac Company reported a net income of

P1,140,000 after tax and paid dividends of P300,000 to ordinary and

P100,000 to preference shareholders. What is the diluted earnings per share?

3.51

3.42

3.04

3.24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Atlanta Co. has 100,000 common shares outstanding as of January 1, 2020 and after-tax net income of $300,000 for 2020. On March 31, 2020 Atlanta Co repurchased 5,000 shares of its outstanding common stock. On October 1, 2020, the company issues an additional 50,000 shares of common stock. On October 31, 2020 the company distributed a stock dividend of 40%. The company also has 20,000 shares of 4% $10 par cumulative preferred stock outstanding. Assume that 5,000 shares of the preferred stock have the option to be converted to 2,000 shares of common stock at any time. In 2019 Atlanta Co. issued stock options to its 2 top executives that allow them to each purchase up to 1,000 shares of common stock at a purchase price of $25 per share. The current market price of Atlanta Co common stock is $40 per share and Atlanta Co.’s income tax rate is 30%. Compute the Basic EPS___________________________ Compute Fully Diluted EPS_________________________ *Urgentarrow_forwardABC Company issued 200,000 shares of P5 par value at P10 per share. On January 1, 2020, ABC's retained earnings amounted to P3,000,000. In March 2020, ABC reacquired 50,000 treasury shares at P20/share. In June 2020, ABC sold 10,000 of these shares to its corporate officers for P25 per share. ABC used the cost method to record treasury shares. Net income for the year ended December 31, 2020 was P600,000. On December 31, 2020, what amount should ABC report as unappropriated retained earnings? (Round answer to whole number)arrow_forwardOn January 1, 2021, Heaven Inc. reported the following shareholders' equity: Preference share capital (P75 par value, 20,000 shares) P 1,500,000 Ordinary share capital (P25 par value, 100,000 shares) 2,500,000 Share premium 3,000,000 Retained earnings 2,250,000 At the beginning of 2021, Heaven Inc sold for cash 20,000 additional ordinary shares for P45 per share. It was discovered late in 2021 that 2020 depreciation expense was overstated by 500,000. Heaven Inc. had a net income of P2,000,000 for 2021. It also declared cash dividend of P500,000 on preference shares and P1,000,000 on its ordinary shares during 2021. What amount should be reported as retained earnings on December 31, 2021? A. 2,500,000B. 2,750,000C. 3,250,000D. 4,750,000arrow_forward

- The shareholders’ equity of Jungkook Corporation as of October 1, 2020 is presented below: Ordinary Share Capital, 100,000 shares, P 10 par- P1,000,000 Ordinary Share Premium- P500,000 Retained Earnings- P800,000 During October, 2020, the corporation had the following transactions: > Oct. 5- Reacquired 40,000 shares of its own Ordinary Shares for P 520,000. > Oct. 15- Sold 20,000 Treasury Shares at P 15 per share > Oct. 25- Sold another 10,000 Treasury shares for P 70,000. What is the balance of the Retained Earnings after the above transactions?arrow_forwardFor the year ending 30 June 2020, Don Ltd reports a net profit after tax of $6.1 million. At the beginning of the financial year Evita Ltd had 2,500,000 fully paid ordinary shares outstanding. Don Ltd also had 1,000,000 partly paid shares. These shares were partly paid to 0.50 cents and had an original issue price of $1. The partly paid shares carry the rights to dividends in proportion to the amount paid relative to the total issue price. They were still partly paid at year end. Don Ltd also has the following securities outstanding: • $2.0 million of 10 per cent notes issued on 1 July 2019. The notes have a life of five years and give holders the right to convert the notes into 500,000 fully paid ordinary shares. • In 2016, employees were provided with options, at no initial cost, which gave them the right to acquire 750,000 shares at an exercise price of $2.50. The options expire five years after their original issue date. Given the time period to option expiry, the directors believe…arrow_forwardInformation from the financial statemets of Henderson-Niles Industries included the following at December 31, 2021: 12 Comnon shares outstanding throughout the year Convertible preferred shares (convertible into 32 million shares of common) Convertible 8% bonds (convertible into 13.5 million shares of common) 100 million 60 million $900 million Henderson-Niles's net income for the year ended December 31, 2021, is $520 million. The income tax rate is 25%. Henderson-Niles paid dividends of $2 per share on its preferred stock during 2021. 01:54:48 Required: Compute basic and diluted earnings per share for the year ended December 31, 2021. (Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Round "Earnings per share" answers to 2 decimal places.) Numerator Denominator Earnings per share Basic Diluted I ||| |arrow_forward

- Ivy Corp declared a share capital dividend entitling its shareholders to one additional share for each share held on June 1, 2021. At the time the dividend was declared, the market value was P100 per share and the par value was P50 per share. On this date, Ivy had 65,000 shares issued and 5,000 shares in the treasury.How much is the amount to be debited to retained earnings on the declaration of dividends?arrow_forwardAUBURN Corporation had 120,000 of ordinary shares issued and outstanding at January 1, 2021. OnOn January 2 of the same year, the company issued 80,000 preference shares. During the year, the corporation declared and paid P420,000 cash dividend on the ordinary shares and P240,000 on the preference shares. Net income for the year was P1,500,000. What should be the basic earnings per share in 2021? A. ₱ 10.50 B. ₱ 9.00 C. ₱ 15.75 D. ₱ 12.50arrow_forwardOn August 15, 2021, EasyMoney, Inc.'s Board of Directors meets and declares that EasyMoney will pay a dividend to its stockholders. Each share of EasyMoney's Common Stock will be paid a dividend of $1.25 per share. There are currently 100,000 shares of EasyMoney's Common Stock held by EasyMoney's shareholders. The following are the facts related to this dividend: D Dividend per Share D Date of Declaration D Date of Record D Date of Payment $1.25 August 15, 2021 September 5, 2021 September 20, 2021 The following is a partial list of the accounts in EasyMoney, Inc.'s General Ledger. These are the only accounts you need for this problem. D Cash D Dividends Payable > Retained Earnings As of August 1, 2021, the Beginning Balance in the Dividends Payable account is $0 and the Beginning Balance in the Retained Earnings account is $625,000.arrow_forward

- Information from the financial statements of Ames Fabricators, Inc., included the following: December 31 2021 2020 Common shares 100,000 100,000 Convertible preferred shares (convertible into 64,000 shares of common) 24,000 24,000 8% convertible bonds (convertible into 30,000 shares of common) $ 1,000,000 $ 1,000,000 Ames’s net income for the year ended December 31, 2021, is $700,000. The income tax rate is 25%. Ames paid dividends of $5 per share on its preferred stock during 2021. Required: Compute basic and diluted earnings per share for the year ended December 31, 2021.arrow_forwardOn January 1, 2021, Heaven Inc. reported the following shareholders' equity: Preference share capital (P75 par value, 20,000 shares) P 1,500,000 Ordinary share capital (P25 par value, 100,000 shares) 2,500,000 Share premium 3,000,000 Retained earnings 2,250,000 At the beginning of 2021, Heaven Inc sold for cash 20,000 additional ordinary shares for P45 per share. It was discovered late in 2021 that 2020 depreciation expense was overstated by 500,000. Heaven Inc. had a net income of P2,000,000 for 2021. It also declared cash dividend of P500,000 on preference shares and P1,000,000 on its ordinary shares during 2021. How much the total shareholders' equity on December 31, 2021? A. 9,650,00B. 11,150,000C. 6,650,000D. 8,150,000arrow_forwardLilac Company has 200,000 shares of ordinary shares outstanding on January 1, 2021. On March 31, 2021, 100,000 additional ordinary shares. On June 30, the company issued 10%, 100,000 convertible preference share par value of P20. The preference shares are convertible into 200,000 shares of ordinary shares. On December 31, 2021, Lilac Company reported a net income of P1,140,000 after tax and paid dividends of P300,000 to ordinary and P100,000 to preference shareholders. What is the diluted earnings per share? Group of answer choices A. 3.51 B. 3.42 C. 3.04 D. 3.24arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education