FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

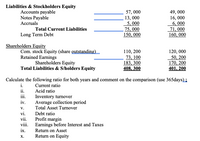

Transcribed Image Text:Liabilities & Stockholders Equity

Accounts payable

Notes Payable

Accruals

57, 000

13, 000

5, 000

75, 000

150, 000

49, 000

16, 000

6, 000

71, 000

160, 000

Total Current Liabilities

Long Term Debt

Shareholders Equity

Com. stock Equity (share outstanding)

Retained Earnings

110, 200

73, 100

183, 300

408, 300

120, 000

50, 200

170, 200

401, 200

Shareholders Equity

Total Liabilities & S/holders Equity

Calculate the following ratio for both years and comment on the comparison (use 365days) ;

i.

Current ratio

Acid ratio

Inventory turnover

Average collection period

Total Asset Turnover

ii.

ii.

iv.

V.

vi.

Debt ratio

Profit margin

viii. Earnings before Interest and Taxes

vii.

ix.

Return on Asset

х.

Return on Equity

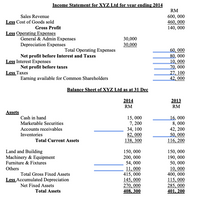

Transcribed Image Text:Income Statement for XYZ Ltd for year ending 2014

RM

Sales Revenue

600, 000

460, 000

140, 000

Less Cost of Goods sold

Gross Profit

Less Operating Expenses

General & Admin Expenses

Depreciation Expenses

30,000

30,000

60, 000

80, 000

10, 000

70, 000

27, 100

42, 000

Total Operating Expenses

Net profit before Interest and Taxes

Less Interest Expenses

Net profit before taxes

Less Taxes

Earning available for Common Shareholders

Balance Sheet of XYZ Ltd as at 31 Dec

2014

2013

RM

RM

Assets

15, 000

7, 200

34, 100

82, 000

138, 300

16, 000

8, 000

42, 200

50, 000

116, 200

Cash in hand

Marketable Securities

Accounts receivables

Inventories

Total Current Assets

Land and Building

Machinery & Equipment

Furniture & Fixtures

150, 000

200, 000

54, 000

11, 000

415, 000

145, 000

270, 000

408, 300

150, 000

190, 000

50, 000

10, 000

400, 000

115, 000

285, 000

401, 200

Others

Total Gross Fixed Assets

Less Accumulated Depreciation

Net Fixed Assets

Total Assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QUESTION I Below are the balances available for Delima Berhad as at 31 December 2015: Statement of Financial Position of Delima Berhad as 31 December 2015 RM 170,000,000 115,000,000 150,000,000 435,000,000 Non-current assets Current assets (except cash at hank) Cash at bank Issued share capital 100,000,000 ordinary shares Retained profits Non-current liability 50,000,000 5% redeemable preference shares Current liabilities Additional information: On 1 January 2016, the directors decided on the following matters 100,000,000 3. To redeem 5% redeemable preference shares at a premium of 10% 240,000,000 55,000,000 20,000,000 435,000,000 1. To issue bonus shares of one (1) ordinary shares for every ten (10) shares held to the existing shareholders. 2. To repurchase 2,000,000 ordinary shares at RM1.50 each for cancellation. (u 4 To issue 30,000,000 ordinary shares at RMI. The application were paid and fully subscribed Required: a) Prepare journal entries to record above transactions b) Prepare…arrow_forwardQuestion 1 The following information relates to a company listed on Luse- Mungwi PLC ZMK Issued share capital (1000 shares) Share premium. Reserves. Share holders funds. 6% Irredeemable Debentures. 9% Redeemable Debentures. Bank loan. Total Long Term Liabilities. Million 4 000 2 600 290 6,890 2,800 2,900 1 000 6 700 The current cum interest market value per k100 units is k103 and k105 fir the 6% and 9% Debentures respectively. The 9% Debenture is redeemable at par in 10 years time. The bank loan bears interest rate of 2% above the base rate (current base rate is 15%). The current ex-div market price of shares is k1, 100 and a dividend of K100 per share which is expected to grow at a rate of 5% per year has just been paid. The effective corporation tax rate for Mungwi is 30%. Required: A) Calculate the effective after tax weighted Average Cost of Capital (WACC) fir Mungwi PLCarrow_forwardManishaarrow_forward

- answer in text form please (without image)arrow_forwardStockholder Profitability Ratios The following information pertains to Capital Corporation: Net income $2,420,000 Average common equity $18,250,000 Preferred stock, $10 par, 310,000 issued, 10% cumulative $3,100,000 Average common shares outstanding 675,000 Required: Calculate the return on common equity and the earnings per share.arrow_forwardThe table below shows a partial view of Webster Corporation's balancesheet. Webster CorporationBalance Sheet (partial)At December 31, 2021 Long-term debt Notes payable 10% $2,000,00010% convertible bonds payable 2,500,00012% convertible bonds payable 3,000,000Total long-term debt $7,500,000 Stockholders' equity 6% cumulative, convertiblepreferred stock, $100 par, 50,000shares outstanding. 5,000,000 Common stock, $1 par, 600,000shares outstanding. 600,000Additional paid-in capital 2,500,000 Retained earnings 8,500,000Total stockholders' equity $16,600,000 Notes and Assumptions December 31, 20211. Options were granted in December 2020 to purchase 25,000 shares of common stock at $25 per share. The average market price of common stock during 2021 was $35 per share. All options are still outstanding atthe end of 2021 2. Both the 10 percent and 12 percent convertible bonds were issued in2020 at face value. Each convertible bond is convertible into 50 shares of common stock.…arrow_forward

- Godoarrow_forwardPlease do not give solution in image format thankuarrow_forwardDenia Corporation Balance Sheet (partial) At December 31, 2020 Paid-in Capital Common Stock, $9 par value, 3,000,000 shares authorized, $10,530,000 shares issued, and shares outstanding Additional Paid-in Capital in Excess of Par $4,680,000 Total Paid-in Capital $15,210,000 Retained Earnings $11,380,000 Total Shareholders’ Equity $26,590,000 Instructions: Complete the following statements and show your calculations! a) The number of shares of common stock issued and outstanding was b) The average sales price of the common stock when issued was $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education