ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Show the solution for the derivatives. Note not dY*/dG, dY*/dY... but dY/dG, dY/Y, dY/dS

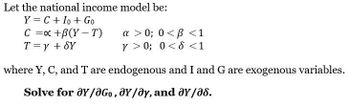

Transcribed Image Text:Let the national income model be:

Y = C + Io + Go

C = x +B(Y-T)

T = y + SY

a >0; 0<B<1

Y>0; 0 < d < 1

where Y, C, and T are endogenous and I and G are exogenous variables.

Solve for ay/aGo, Y/Oy, and ay/a8.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Given that a country will analyze the total benefit of its oil supply-demand in two periods of time by using the following data: Period I Deman curve: P = -0.2 Q₁ + 210 Suply curve: P = 0.04 Q₁ + 30 Interest rate : 10%, Oil reserve : 3.6 billion barrels of oil Units: P in USD, Q in million barrel Period II Deman curve: P = -0.2 Q₂ +210 Suply curve: P = 0.05 Q₂ + 30 Find the efficient allocation! (Q₁, Q₂, P₁, P₁, NB₁, NB₂, TNB), draw a graphical illustration!arrow_forwardHow many points (out of the 6 shown) can be explicitly plotted to form the IS curve given the goods market equilibrium?A goods market equilibrium is shown below: A, B, C, D, E, F 32- A goods market equilibrium is shown below: S₁ (Y= 400) 28- Real Interest Rate, r (%) S2(Y=600) S3 (Y = 800) 226 24- A 20- B C 16- 12- E 4- 0- 0 l(r) F 50 100 150 200 250 300 Desired national saving / desired investment We recommend that you drow out the IS curve before answeringarrow_forwardWhenever the interest charge for any interest period (a year, for example) is based on the remaining principal amount plus any accumulated interest charges up to the beginning of that period, the interest is said to be: a. effective interest b. compound interest c. simple interest d. nominal interest e. none of the choicesarrow_forward

- 2. C = 50 + .8YD = 50 + .8(Y – T) %3D | = 150 %3D G = 200 T = 200 a) Calculate AY if AG = 100 (assuming that G could change all by itself). b) Calculate AY if AT = 100 (assuming that T could change all by itself). c) Calculate AY for AG = AT = 100.arrow_forwardHello, can you explain how I’m supposed to figure this out? How am I supposed to know which Qs and Qd correlate?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education