ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

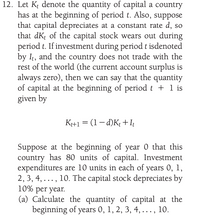

Transcribed Image Text:12. Let K denote the quantity of capital a country

has at the beginning of period t. Also, suppose

that capital depreciates at a constant rate d, so

that dK; of the capital stock wears out during

period t. If investment during period t isdenoted

by It, and the country does not trade with the

rest of the world (the current account surplus is

always zero), then we can say that the quantity

of capital at the beginning of period t + 1 is

given by

K+1 = (1– d)K; +It

Suppose at the beginning of year 0 that this

country has 80 units of capital. Investment

expenditures are 10 units in each of years 0, 1,

2, 3, 4, ..., 10. The capital stock depreciates by

10% per year.

(a) Calculate the quantity of capital at the

beginning of years 0, 1, 2, 3, 4, . .., 10.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Help with a few subparts would be great!arrow_forwardA small open economy with free capital mobility experiences a temporary adverse supply shock. This causes the world real interest rate to and the country's current account balance to remain unchanged; fall fall; fall remain unchanged; rise rise; risearrow_forwardComplete the following table. Please note that the world price of T in terms of S is 1,2arrow_forward

- From time to time, a government official will argue that a country should strive for both a trade surplus and a healthy inflow of capital from abroad. Is this possible?arrow_forwardSuppose a country experiences an inflow of labor from the rest of the world but the world relative price remains the same. In that country, output of the capital - intensive good will and output of the labor - intensive good will.arrow_forward2) On the graph below show how the Solow model will differ if we allow for trade. Assume that the country has a current account deficit. Hint: Remember that national savings is equal to sY+ = It + CA₁₁ where CA, is the nation's current account at time t. Therefore, the (per worker) capital accumulation function will become k++1 - k₁ = syt - cat - (n+ d) k₁, where ca, is the "current account per worker."arrow_forward

- Which scenario best demonstrates foreign direct investment? Salia started a Polish restaurant in her home country, the United States, after she took cooking lessons from a well-known chef in Poland. Super Blooms, a reputable vegetable plant company in Holland, exports tomato, pepper, and potato garden plants across the globe. Ups n Downs Inc., a Chinese firm, supplies roller coaster components in the United States. Domesticity, a U.S.-based office furniture company, has set up its own assembly plant in Japan to cater to the needs of the Asian market. Lux Linens, a fabric conglomerate in the United States, imports raw silk from China and Italy.arrow_forwardConsider a small open economy with perfect capital mobility and a flexible exchange rate. Suppose that net capital outflow (NCO) is negative at the world interest rate. Use a two-panel diagram to explain the following a) What is the is the effect of an increase in world interest rate on (i) national saving, (ii) domestic investment, (iii) NCO, (iv) the real exchange rate, and (v) net exports? b) What is the is the effect of an increase in the government budget surplus on (i) national saving, (ii) domestic investment, (iii) NCO, (iv) the real exchange rate, and (v) net exports? c) What is the is the effect of an increase in the government budget deficit on (i) national saving, (ii) domestic investment, (iii) NCO, (iv) the real exchange rate, and (v) net exports? d) What is the is the effect of imposing an import quota on (į) national saving, (ii) domestic investment, (iii) NCO, (iv) the real exchange rate, and (v) net exports?arrow_forwardA government official announces a new policy. The country wishes to eliminate its trade deficit, but will strongly encourage financial investment from foreign firms. Explain why such a statement is self- contradictory.arrow_forward

- Question 2 Consider an economy that lasts for two periods, period 1 and period 2. Let T B1 denotes the trade balance in period t, CA1 the current account balance in period 1, and B*1 the country’s net international investment position at the end of period 1. Let r denote the interest rate paid on assets held for one period. Assume net international payments to employees, net unilateral transfers, and valuation changes are always equal to zero, so that in period t = 1, 2: CAt =rB*t-1 =TBt (1) and CAt = B*t − B*t-1 (2) A) Which conditions are needed to show that B*2 = 0? B) Suppose that the country runs perpetual trade deficits. What can you tell about the country’s initial net foreign asset position? Justify your answer. C) If the country starts period 1 with no debt or assets, what can you say about the current account in periods 1 and 2?arrow_forwardIdentify the impact of a Foreign Direct Investment inflow on the following factors. Please explain each in one or two sentences: Employment: (Improve/Ambiguous/Deteriorate) Explanation: Competition: (Increase/Ambiguous/Decrease) Explanation: Trade balance: (Improve/Ambiguous/Deteriorate) Explanation:arrow_forwardTrue or False. Nations with persistent trade deficits often experience slower economic growth.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education