FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Choices:

A. $645 U

B. $535 U

C. $535 F

D. $635 F

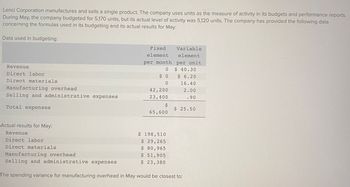

Transcribed Image Text:Lenci Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports.

During May, the company budgeted for 5,170 units, but its actual level of activity was 5,120 units. The company has provided the following data

concerning the formulas used in its budgeting and its actual results for May:

Data used in budgeting:

Revenue

Direct labor

Direct materials

Manufacturing overhead

Selling and administrative expenses

Total expenses

Actual results for May:

Revenue

Direct labor

Direct materials

Fixed

element

per month

0

$0

0

42,200

23,400

$

65,600

$ 198,510

$ 29,265

$ 80,965

$ 51,905

$ 23,380

Variable

element

per unit

$ 40.30

$ 6.20

16.40

2.00

.90

$ 25.50

Manufacturing overhead

Selling and administrative expenses

The spending variance for manufacturing overhead in May would be closest to:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On November 1, Jasper Company loaned another company $230,000 at a 12.0% interest rate. The note receivable plus interest will not be collected until March 1 of the following year. The company's annual accounting period ends on December 31. The amount of interest revenue that should be reported in the first year is: Multiple Choice $4,600. $6,675. $0. here to search 8:01 PM 100% 2/21/2022arrow_forwardD1.arrow_forward! Required information PayNet Inc. (PayNet) and Shale Ltd. (Shale) had the following balance sheets on July 31, 2022: Cash Accounts receivable Inventory Plant and equipment (net) Goodwill Trademark Total assets Current liabilities Bonds payable Common shares Retained earnings Total liabilities and equity PayNet Inc (carrying value) $280.000 100,000 60,000 200,000 $640,000 $120,000 330,000 90,000 100,000 $640,000 Shale Ltd. (carrying value) $36.000 Shale Ltd. (fair value) $36,000 45,000 20,000 75,000 40,000 24,000 80,000 8,000 12,000 24,000 $200,000 $50,000 20,000 80,000 50,000 $200,000 50,000 30,000 Assuming that PayNet acquires 70% of Shale on August 1, 2022, for cash of $196,000, what is the amount of goodwill on PayNet's consolidated balance sheet at the date of acquisition if the fair value enterprise (FVE) method was used?arrow_forward

- Puvo, Incorporated, manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours. The company uses a standard cost system and has established the following standards for one unit of product Standard Quantity 7.1 pounds 0.5 hours Direct materials Direct labor Variable manufacturing overhead During March, the following activity was recorded by the company: 0.5 hours Standard Price or Rate $.90 per pound $ 46.50 per hour $9.80 per hour . During March, 1,220 direct labor-hours were worked at a rate of $43.50 per hour. • Variable manufacturing overhead costs during March totaled $15,361. Standard Cost $6.39 $ 23.25 • The company produced 3,700 units during the month. • A total of 20,700 pounds of material were purchased at a cost of $14,880. . There was no beginning inventory of materials on hand to start the month; at the end of the month, 4,920 pounds of material remained in the warehouse. The direct materials purchases…arrow_forwardrrarrow_forwardErie Company reports the following comparative balance sheets and income statement information for the current year. All revenues are from credit sales. Comparative Balance Sheets Assets Cash Accounts receivable Prepaid insurance Inventory Property, plant & equipment Total Assets Liabilities and Stockholder's Equity Accounts payable Salaries payable Long-term notes payable Common stock Retained earnings Total Liabilities and Stockholders' Equity Income Statement Revenue Cost of goods sold Gross margin Operating expenses Net income $ What was the cash received from customers during the year? $ 290,000 (162,000) 128,000 (82,000) 46,000 Beginning of Year $ 90,000 34,000 34,000 10,000 42,000 $ 210,000 $ 50,000 18,000 26,000 22,000 94,000 $ 210,000 End of Year $ 50,000 18,000 42,000 26,000 50,000 $ 186,000 $ 34,000 42,000 34,000 22,000 54,000 $ 186,000arrow_forward

- Please help with 4a and 4barrow_forwardHambelton Ltd. issued $5,000,000 of 5% bonds payable on 1 September 20X9 to yield 4%. Interest on the bonds is paid semi-annually and is payable each 28 February and 31 August. The bonds were dated 1 March 20X8, and had an original term of five years. The accounting period ends on 31 December. The effective-interest method is used. (PV of $1, PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price at which the bonds were issued. (Round time value factor to 5 decimal places. Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.) Price of Bond 2. Prepare a bond amortization table for the life of the bond. (Round time value factor to 5 decimal places. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no cells blank - be certain to enter "O" wherever required.) Interest Interest Premium Unamortized Net Bond Date Payment Expense…arrow_forwardSean and Jenny own a home in Boulder City, Nevada, near Lake Mead. During the year, they rented the house for 40 days for $3,200 and used it for personal use for 18 days. The house remained vacant for the remainder of the year. The expenses for the house included $14,150 in mortgage interest, $3,560 in property taxes, $1,200 in utilities, $1,340 in maintenance, and $11,000 in depreciation. What is the deductible net loss for the rental of their home (without considering the passive loss limitation)? Use the Tax Court method for allocation of expenses.arrow_forward

- bdhdhdjdjdjjdis plz dont answer current ration in the following: Current Asset $20000., Current Liability $20000arrow_forwardRice Corporation is a service company that measures its output by the number of customers served. The company has provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results of operations for October. Variable Revenue Emp. salaries & wages Travel expenses Other expenses Fixed Element per Month $42,300 $31,500 Element per Customer Serviced $4,100 $1,300 $700 Actual Total for October $182,900 $98,800 $30,500 $31,900 When the company prepared its planning budget at the beginning of October, it assumed that 39 customers would have been served. However, 44 customers were actually served during October. The revenue variance for October would have been closest to:arrow_forwardMultiple Choice $26.75 $12.80 $30.05 $24.50arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education