FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

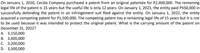

Transcribed Image Text:On January 1, 2020, Cecilia Company purchased a patent from an original patentee for P2,400,000. The remaining

legal life of the patent is 15 years but the useful life is only 12 years. On January 1, 2021, the entity paid P550,000 in

successfully defending the patent in an infringement suit filed against the entity. On January 1, 2022, the entity

acquired a competing patent for P1,500,000. The competing patent has a remaining legal life of 15 years but it is not

to be used because it was intended to protect the original patent. What is the carrying amount of the patent on

December 31, 2022?

А. 3,150,000

B. 3,600,000

С. 3,200,000

D. 3,500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How to get the answer which is 78,350?arrow_forward9arrow_forwardOn April 1, 2020, the Tech Corp. acquired a patent for $162,000. This patent has an estimated useful life of 12 years with an estimated residual value of $18,000. Required: a. In determining the 12-year useful life of this patent, what two lives of the patent did Tech consider? b. Which of these two lives did Tech use as the patent's useful life or is that determinable? c. Make the December 31, 2020, entry for Tech to record the 2020 amortization of this patent in the manner that Tech would have to use in this class. d. What will be the book value of this patent on the December 31, 2023, balance sheet? 14 010 120m 20 1arrow_forward

- Which of the following statements concerning intangibles is true? a. a copyright should be considered an intangible with an indefinite lifeb. organization costs must be expensed as incurredc. a patent should be amortized over the shorter of the inventor’s life or its economic lifed. the registration of a trademark or tradename lasts for 20 years and is nonrenewablearrow_forwardSwifty Company incurred $551000 of research and development cost in its laboratory to develop a patent granted on January 1, 2027. On July 31, 2027, Swifty paid $83600 for legal fees in a successful defense of the patent. The total amount debited to Patents through July 31, 2027, isarrow_forward1. A patent was acquired from another company on January 1, 2019, for $25,000.The useful life is 10 years. 2. On April 2, 2019, the company was successful in obtaining a patent. The legal fees paid to an outside law firm were $8,400. The development costs paid to engineers who were employees of Bishop were $75,000. The useful life is 10 years. 3. On July 1, 2019, Bishop acquired all the assets net of the liabilities of Fargo Company. The identifiable net assets' market values at the time of purchase totaled $100,000. Bishop acknowledged the superior earnings and loyal customer following of Fargo Company. Therefore, Bishop and Fargo agreed on a total purchase price of $145,000. Any goodwill arising from the purchase is not to be amortized. 4. On December 31, 2019, Bishop paid a consulting firm $17,000 to develop a trademark. In addition, legal fees paid in connection with the trademark were $3,000. Assume a useful life of 20 years. 5. On August 1, 2019, Bishop acquired intangible asset…arrow_forward

- A patent: A. Gives its owner the exclusive right to publish and sell a musical or literary work during the life of the creator plus 70 years.B. Gives its owner an exclusive right to manufacture and sell a patented item or to use a process for 20 years.C. Gives its owner an exclusive right to manufacture and sell a device or to use a process for 50 years.D. Is the amount by which the value of a company exceeds the fair market value of a company's net assets if purchased separately.E. Gives its owner the exclusive right to publish and sell a musical or literary work during the life of the creator plus 17 years.arrow_forwardPresented below is information related to copyrights owned by Carla Vista Company at December 31, 2020. Cost $8,630,000 Carrying amount 4,480,000 Expected future net cash flows 4,140,000 Fair value 3,330,000 Assume that Carla Vista Company will continue to use this copyright in the future. As of December 31, 2020, the copyright is estimated to have a remaining useful life of 10 years. The fair value of the copyright at December 31, 2021, is $3,500,000. Prepare the journal entry necessary to record the increase in fair value.arrow_forward1. Pharoah purchased a patent from Vania Co. for $2,700,000 on January 1, 2018. The patent is being amortized over its remaining legal life of 10 years, expiring on January 1, 2028. During 2020, Pharoah determined that the economic benefits of the patent would not last longer than 7 years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of accumulated amortization, at December 31, 2020? The amount to be reported 2$ 2. Pharoah bought a franchise from Alexander Co. on January 1, 2019, for $979,000. The carrying amount of the franchise on Alexander's books on January 1, 2019, was $635,000. The franchise agreement had an estimated useful life of 20 years. Because Pharoah must enter a competitive bidding at the end of 2028, it is unlikely that the franchise will be retained beyond 2028. What amount should be amortized for the year ended December 31, 2020? The amount to be amortized 3. On January 1, 2020, Pharoah incurred organization…arrow_forward

- Your answer is partially correct, costs of $171, 720 in successfully defending the patent in an infringement suit, manually. List all debit entries before credit entries.) Date Account Titles and Explanation December 31, 2025 Amortization Expense Patents Debit Credit Credit.arrow_forwardDanzerarrow_forward9. Pronghorn Corporation purchases a patent from Crane Company on January 1, 2017, for $120,000. The patent has a remaining legal life of 15 years. Pronghorn feels the patent will be useful for 8 years. Prepare Pronghorn's journal entries to record the purchase of the patent and 2017 amortization. Accounts DR CR Purchase Amortarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education