FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

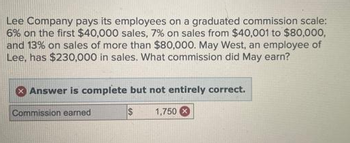

Transcribed Image Text:Lee Company pays its employees on a graduated commission scale:

6% on the first $40,000 sales, 7% on sales from $40,001 to $80,000,

and 13% on sales of more than $80,000. May West, an employee of

Lee, has $230,000 in sales. What commission did May earn?

Answer is complete but not entirely correct.

Commission earned

1,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Avon Corporation sells phone cases to public and private companies. They are located at 123 Locus Rd, Markham, ON. They employ 200 full time employees who work in sales, customer service and office support roles. They have had an annual remuneration of over $1,000,000 for the past several years therefore their EHT rate is 1.95%. Pay period #1 started December 27, 2020. All are paid on a bi-weekly basis. All benefits are processed each pay on an as enjoyed basis. The first pay day for employees is Jan 13, 2021. They have three staff in the Customer Service Department answering questions from clients and the general public. They all work Monday to Friday and do not work statutory holidays but are paid for them. Neema has been with Avon for 3 years and answers calls specifically from clients. She earns $18.25 per hour and works 35 hours per week. She also does not work any overtime. She is paid bi-weekly. Her employer provides the following: · Health and Dental - at a total…arrow_forwardOrnell sells televisions for Bay City Electronics. He is on an incremental commission schedule of 1.4% of sales up to $120,000 and 2.8% on sales over $120,000. What was Ornell's total gross pay for last month if his sales volume was $194,500?arrow_forwardWrite double entry Creg works as an agent for a number of smaller contractors, earning commission of 10%. Creg’s revenue includes $6,000 received from clients under these agreements with $5,400 in cost of sales representing the amount paid to the contractors.arrow_forward

- Write double entry Creg works as an agent for a number of smaller contractors, earning commission of 10%. Creg’s revenue includes $6,000 received from clients under these agreements with $5,400 in cost of sales representing the amount paid to the contractors.arrow_forwardBMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. a. b. c. Gross Pay through August 31 $ 6,400 2,700 133,300 Gross Pay for September $1,700 2,800 9,900 Assuming situation (a), prepare the employer's September 30 journal entry to record the employer's payroll taxes expense and its related liabilities. Complete this question by entering your answer in the tabs below. Employer Payroll taxes Payroll Taxes General Journal Expense Assuming situation (a), compute the payroll taxes expense. (Round your answers to 2 decimal places.) September earnings subject to tax Tax Ratearrow_forward[The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August 31 Gross Pay for September a. $ 6,000 $ 1,500 b. 2,000 2,100 c. 132,900 9,500 Exercise 11-9 (Algo) Payroll-related journal entries LO P3 Assuming situation (a), prepare the employer’s September 30 journal entry to record the employer’s payroll taxes expense and its related liabilities. Record the employer's September 30 payroll taxes expense and its related liabilities. Note: Enter debits before credits. Date General Journal Debit Credit September 30 Payroll taxes expense FICA—Social security taxes payable FICA—Medicare taxes payable Federal…arrow_forward

- A restaurant supply seller works for a 6% commission. If the total sales for the week were S 18,200, determine the gross income for this seller. 4. 5. Determine the Social Security contribution (6.2%) and the medical care contribution (1.45%) for an employee with a gross income of $ 515. Round to the nearest penny. 6. An employee has a net income of $ 880 and total deductions of $ 262, determines the gross income.arrow_forwardShawn, an outside sales representative for Marosh Communications in Caldwell, Idaho, receives a 5 percent commission on all new marketing packages sold within the sales territory. During the week of April 6, there were $9,500 of new subscriptions sold during 40 hours of work. Required: 1. What is Shawn's gross pay? 2. Are the wages subject to minimum wage laws? 1. Gross pay 2. Are the wages subject to minimum wage laws?arrow_forwardMarwick’s Pianos, Inc., purchases pianos from a large manufacturer for an average cost of $1,499 per unit and then sells them to retail customers for an average price of $2,600 each. The company’s selling and administrative costs for a typical month are presented below: Costs Cost Formula Selling: Advertising $ 961 per month Sales salaries and commissions $ 4,799 per month, plus 4% of sales Delivery of pianos to customers $ 60 per piano sold Utilities $ 647 per month Depreciation of sales facilities $ 4,956 per month Administrative: Executive salaries $ 13,422 per month Insurance $ 702 per month Clerical $ 2,456 per month, plus $37 per piano sold Depreciation of office equipment $ 879 per month During August, Marwick’s Pianos, Inc., sold and delivered 56 pianos. Required: 1. Prepare a traditional format income statement for August.arrow_forward

- Marwik Pianos. Inc purchases pianos from a large manufacturer for an average cost of $1,482 per unit and then sells them to retail Customers for an average price or S2,100 each. The company's selling and administrative costs for a typical month are presented below Costs Cost Formuala Selling $965 per month Advertising $4,793 per month plus 5% of Sales Sales Salaries and commissions $57 per piano sold Delivery of Pianos to customers $670 per month Utilities $4,903 per month Depreciaiton of Sales Facilities Administrative Executive Salaries $13,506 per month Insurance $701 per month Clerical $2,480 per month,plus $ 37 per piano sold Depreciation of Office Equipment $916 per month During August, Marvik Pianos sold and delivered 63 pianos. Prepare Traditional Income Statement and also prepare contribution format income statement for cost(Show costs and revenues on both a total and a per unit basis down through contribution margin)arrow_forwardRoyall Company purchased a delivery truck at $25,000 plus 8% sales taxes. Royall paid $3,000 in cash and financed the rest at 6% requiring 40 equal monthly payments at the end of each month. Compute the amount of the monthly payment that Royall must pay.arrow_forwardDepartment R sells goods to Department S at a profit of 25% on cost and Department T at 10% profit on cost. Department S sells goods to R and T at a profit of 15% and 20% on sales respectively. Department T charges 20% and 25% profit on cost to Department R and S respectively. Department manages are entitled to 10% commission on net profit subject to unrealized profit on departmental sales being eliminated. Departmental profits after charging manager's commission, but before adjustment of unrealized profit, are as under : Department $ 54,000; Department S $ 40,500 ; Department T$ 27,000. Stocks lying at different departments at the end of the year are as under : Deptt. R Deptt. S Deptt. T $ Transfer from Department R 22,500 16,500 Transfer from Department S Transfer from Department T 21,000 18,000 9,000 7,500 Find out the correct departmental profits after charging manager's commission.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Expert Answers to Latest Homework Questions

Q: ROA-FINANCIAL ACCOUNTING

Q: ROA??

Q: NONE

Q: Sanchez company's output for the current period solve this question general Accounting

Q: I'm waiting for accurate step by step answer to this accounting Q

Q: who said "I love humanity but I hate humans".

Q: I need this question answer general Accounting

Q: First In First Out

Q: Don't used Ai solution

Q: Your hotel served 32,500 guests with a $31,000

labor cost (the highest) in June and 20,000 guests…

Q: Answer? ? Financial accounting

Q: Provide answer general Accounting

Q: General accounting question

Q: Kindly help me with general accounting question

Q: Do fast answer of this accounting questions

Q: I won't to this question answer general Accounting

Q: General accounting

Q: Please given correct answer general accounting

Q: Don't use ai given answer accounting questions

Q: Hii expert please provide correct answer general Accounting

Q: Hello tutor please provide this question solution general accounting