FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Q.LawnCare USA does 30 landscape designs for its customers each year. Estimate the total cost for the Sunset Office park job if LawnCare USA allocated costs of the Landscape Design activity based on the number of landscape designs rather than the number of landscape design-hours. How much would LawnCare USA bid to perform the job? Which cost driver do you prefer for the Landscape Design activity? Why?

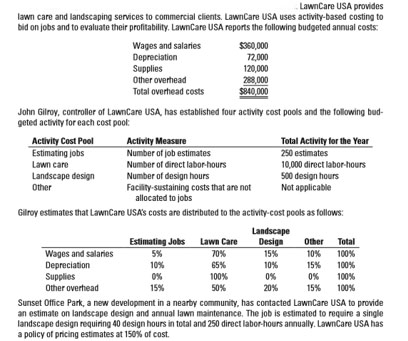

Transcribed Image Text:LawnCare USA provides

lawn care and landscaping services to commercial clients. LawnCare USA uses activity-based costing to

bid on jobs and to evaluate their profitability. LawnCare USA reports the following budgeted annual costs:

Wages and salaries

Depreciation

Supplies

Other overhead

$360,000

72,000

ు.©

288,000

$840,000

Total overhead costs

John Gilroy, controller of LawnCare USA, has established four activity cost pools and the following bud-

geted activity for each cost poot:

Activity Cost Pool

Estimating jobs

Total Activity for the Year

250 estimates

Activity Measure

Number of job estimates

Lawn care

Number of direct labor-hours

10,000 direct labor-hours

500 design hours

Not applicable

Landscape design

Number of design hours

Facility-sustaining costs that are not

allocated to jobs

Other

Gilroy estimates that LawnCare USA's costs are distributed to the activity-cost pools as follows:

Landscape

Design

15%

Estimating Jobs

Lawn Care

70%

Other

10%

Total

100%

Wages and salaries

Depreciation

Supplies

Other overhead

5%

10%

65%

10%

15%

100%

0%

100%

0%

0%

100%

15%

50%

20%

15%

100%

Sunset Office Park, a new development in a nearby community, has contacted LawnCare USA to provide

an estimate on landscape design and annual lawn maintenance, The job is estimated to require a single

landscape design requiring 40 design hours in total and 250 direct labor-hours annually. LawnCare USA has

a policy of pricing estimates at 150% of cost.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 8 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tasty Treats is a snow cone stand near the local park. To plan for the future, it wants to determine its cost behavior patterns. It has the following information available about its operating costs and the number of snow cones served Month January February March. April May June Number of snow cones 6,400 7,000 6,200 6,900 7,600 7,250 Total operating costs $5,830 $6,400 $5,840 $6,330 $6,820 $6,575 Using the high-low method, the monthly operating costs, if Tasty Treats sells 8,000 snow cones in a month, are:arrow_forwardCustomer Profitability Analysis HyStandard Services, Inc. provides residential painting services for three home building companies, Alpine, Blue Ridge, and Pineola, and it uses a job costing system for determining the costs for completing each job. The job cost system does not capture any cost incurred by HyStandard for return touchups and refinishes after the homeowner occupies the home. HyStandard paints each house on a square footage contract price, which includes painting as well as all refinishes and touchups required after the homes are occupied. Each year, the company generates about one-third of its total revenues and gross profits from each of the three builders. The HyStandard owner has observed that the builders, however, require substantially different levels of support following the completion of jobs. The following data have been gathered: Cost per Driver Unit $60 100 40 Support activity Driver Major refinishes Touchups Hours on jobs Number of visits Communication Number…arrow_forwardCan you please review my homework? I am sending answer and what I think is the solution That is the only information I have . I have submiited the question before but they said information was missing in the question I sent. ⦁ Big Sky Dermatology Specialist are setting the price on a new office location. Here are the relevant data estimates:Variable Cost Per Visit $8.00Annual Direct fixed Cost $650,000Annual overhead allocation $65,000Expected annual utilization 10,000 visits ⦁ What per visit price must be set for the service to break-even? To earn an annual profit of $100,000?Insert your response here. Per visit price= Variable cost + fixed cost + annual overhead / total # number of visits(variable cost *volume) Per visit price = 8*10,000 + 650,000 + 65,000/ 10,000= 80,000 + 650,000 + 65,000/ 10,000= 795,000/10,000Per visit price = 79.5 Per visit price = total cost incurred by + desired profit/ total number of visits=79.5*10,000 + 100,000 /10,000= 895,000/10,000= 89.5To earn an annual…arrow_forward

- You are asked to recommend whether a firm should make or purchase product A. The following are data conceming the two options For the purchase option, the firm can buy product A at $19 per unit. For the make option, the firm can produce product A based on the following cost estimation data. The firm has to pay a weekly rental payment of $19,000 for the production facility With the use of this facility, the firm also has to hire five operators to help make product A Each operator works eight hours per day, five days per week at the rate of $10 per hour. In other words, the rental and labor expenses are fixed costs. The material cost for the make option is $14 per unit of product A a. Find a weekly amount of product A that provides the breakeven point for the firm. The breakeven point in this problem indicates the firm's indifference between purchasing or making product A. b. If the firm estimates the sale of product A to be 5,600 units per week, should it make or purchase product A? a.…arrow_forward1. Assume that your company is considering the lease of one of these HP copiers, and you expect that the average price for a color. Opt for your company would be $0.075 because you would carefully prioritize color copy jobs and reduce the number of copies requiring a large amount of color. You expect that training your copy center staff to properly use the new copier would cost about $12,400 for materials and lost work time. What is the break even number of color copies per year that would make you indifferent between the new HP copier and your current copier? 2. As in requirement 1, assume you expect that your per-copy cost for color copies with the HP copier will be $0.075, the training costs are $12,400, and you expect to make 200,000 copies per year for the next 3 years. In your negotiations with Ricoh concerning the new lease and the cost of color copies , what price would you bargain for?arrow_forwardFlavor Enterprises has been approached about providing a new service to its clients. The company will bill clients $170 per hour; the related hourly variable and fixed operating costs will be $80 and $14, respectively. If all employees are currently working at full capacity on other client matters, the per hour opportunity cost of being unable to provide this new service is: Multiple Choice $0. $76. $90. $94. $170.arrow_forward

- Hello! Please help me answer the table in the image, and the questions at the end of the page. thank you!! :) As the project manager for HomeGrown, you are responsible for deciding which if any of the proposals to accept. HomeGrown's minimum acceptable rate of return is 20%. You receive the following data from the three contractors: Proposal Type of Floor Plan Initial Costif Selected ResidualValue Alpha Very open, like an indoor farmer’s market $1,472,000 $0.00 Beta Standard grocery shelving and layout, minimal aisle space 5,678,900 0.00 Gamma Mix of open areas and shelving areas 2,125,560 0.00 You have computed estimates of annual cash flows and average annual income from customers for each of the three contractors' plans. You believe that the annual cash flows will be equal for each of the 10 years for which you are preparing your capital investment analysis. Your conclusions are presented in the following table. Proposal Estimated AverageAnnual…arrow_forwardActivity-Based Life-Cycle Costing Kagle design engineers are in the process of developing a new “green” product, one that will significantly reduce impact on the environment and yet still provide the desired customer functionality. Currently, two designs are being considered. The manager of Kagle has told the engineers that the cost for the new product cannot exceed $600 per unit (target cost). In the past, the Cost Accounting Department has given estimated costs using a unit-based system. At the request of the Engineering Department, Cost Accounting is providing both unit- and activity-based accounting information (made possible by a recent pilot study producing the activity-based data). Unit-based system:Variable conversion activity rate: $110 per direct labor hourMaterial usage rate: $15 per partABC system:Labor usage: $20 per direct labor hourMaterial usage (direct materials): $25 per partMachining: $80 per machine hourPurchasing activity: $150 per purchase orderSetup activity:…arrow_forwardRequirement 3. Dr. Young had a chance to do some school physicals that would have boosted physician contact hours billed to patients from 200 to 250 hours. Suppose Dr. Young, guided by the linear cost function, rejected this job because it would have brought a total increase in contribution margin of $9,000, before deducting the predicted increase in total overhead cost, $10,000. What is the total contribution margin actually forgone? Determine the total contribution margin actually forgone by rejecting the special job that would have boosted professional labor-hours from 200 to 250 hours. The job would have brought a total increase in contribution margin of $9,000, before deducting the predicted increase in total overhead cost, $10,000. Contribution before deducting incremental overhead $9,000 Less: Incremental overhead based on actual 6,000 Total contribution margin actually forgonearrow_forward

- Answer in typingarrow_forwardStep Costs, Relevant RangeVargas, Inc., produces industrial machinery. Vargas has a machining department and a group ofdirect laborers called machinists. Each machinist is paid $25,000 and can machine up to 500 units per year. Vargas also hires supervisors to develop machine specification plans and to over-see production within the machining department. Given the planning and supervisory work, a supervisor can oversee three machinists, at most. Vargas’s accounting and production historyreveal the following relationships between units produced and the costs of direct labor andsupervision (measured on an annual basis): Required:1. Prepare two graphs: one that illustrates the relationship between direct labor cost and unitsproduced, and one that illustrates the relationship between the cost of supervision and unitsproduced. Let cost be the vertical axis and units produced the horizontal axis.2. How would you classify each cost? Why?3. Suppose that the normal range of activity is between…arrow_forwardMarine Components produces parts for airplanes and ships. The parts are produced to specification by their customers, who pay either a fixed price (the price does not depend directly on the cost of the job) or price equal to recorded cost plus a fixed fee (cost plus). For the upcoming year (year 2), Marine expects only two clients (client 1 and client 2). The work done for client 1 will all be done under fixed-price contracts while the work done for client 2 will all be done under cost-plus contracts. The controller at Marine Components chose direct labor cost as the allocation base in year 2, based on what she considered reflected the relation between overhead and direct labor cost. Year 3 is approaching and again the company only expects two clients: client 1 and client 3. Work for client 1 will continue to be billed using fixed-price contracts, and client 3 will be billed based on cost-plus contracts. Manufacturing overhead for year 3 is estimated to be $18 million. Other…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education