FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

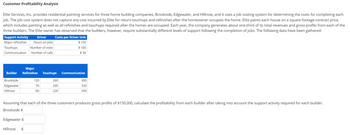

Transcribed Image Text:Customer Profitability Analysis

Elite Services, Inc. provides residential painting services for three home building companies, Brookside, Edgewater, and Hillrose, and it uses a job costing system for determining the costs for completing each

job. The job cost system does not capture any cost incurred by Elite for return touchups and refinishes after the homeowner occupies the home. Elite paints each house on a square footage contract price,

which includes painting as well as all refinishes and touchups required after the homes are occupied. Each year, the company generates about one-third of its total revenues and gross profits from each of the

three builders. The Elite owner has observed that the builders, however, require substantially different levels of support following the completion of jobs. The following data have been gathered:

Support Activity

Driver

Major refinishes

Hours on jobs

Number of visits

Touchups

Communication Number of calls

Major

Builder Refinishes Touchups

Brookside

Edgewater

Hillrose

Costs per Driver Unit

$ 150

$ 100

$30

120

70

80

Edgewater $

Hillrose $

260

205

220

Communication

900

530

590

Assuming that each of the three customers produces gross profits of $150,000, calculate the profitability from each builder after taking into account the support activity required for each builder.

Brookside $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is available regarding the total repair costs of Alexander Design Company for six months of 2022: Units Produced Repair Cost January 1,500 $15,875 February 1,750 $16,500 March 1,000 $11,250 April 1,250 $15,250 May 1,875 $17,750 June 2,250 $20,250 Using the least-square regression analysis on Excel, construct a cost formula. Run a regression analysis on the data above and provide your response to the following three questions. Round decimals to the nearest tenth (i.e, two decimal points). (1) Provide the regression output and construct a cost model. (2) According to the cost model, what is the estimated total fixed cost? (3) According to the cost model, what is the estimated variable cost per unit?arrow_forwardUse CVP and compute the rooms sales necessary to achieve a net income of 156000 for a single product motel with total fixed cost of $180,000 and average room rate of $50 and a variable cost per room of $20 the motels income tax rate is 35%arrow_forward6. Fabulous Fabricators needs to decide how to allocate space in its production facility this year. It is considering the following contracts: a. What are the profitability indexes of the projects? b. What should Fabulous Fabricators do? **round to two decimal places**arrow_forward

- Rent on a manufacturing plant donated by the city, where the agreement calls for a fixed-fee payment unless 200,000 labor-hours are worked, in which case no rent is paid.arrow_forwardPrepare a contribution margin income statement for next year that shows the expected results with the machine installed. Assume sales are $1,425,000.arrow_forwardAssume the following financial data pertains to a certain single-product lodging business:Room Sales - $400,000Total Variable - $260,000Costs Contribution Margin - $140,000Total Fixed Costs - $ 76,000IBIT - $ 64,000Based on the financial data provided, the contribution margin percentage is __________ percent.arrow_forward

- Branzini, Inc. has two divisions, Nord and Sud, the revenues of which constitute $60,000,000 and $20,000,000 accordingly. If the rental costs of Branzini are $2,000,000, each of the two divisions should be charged $1,000,000. Select one: True Falsearrow_forwardSubject - account Please help me. Thankyou.arrow_forwardBrookbury Accounting completed 150 tax returns in the month of March. Its Effective Capacity is 170 tax returns and its Design Capacity is 175 tax returns. Calculate the Efficiency and Utilization for Brookbury Accounting. What do these two numbers tell you?arrow_forward

- Manjiarrow_forwardi need full details solution with explanation......arrow_forwardMartini Hotel & Casino is situated on beautiful Lake Tahoe in Nevada. The complex includes a 300-room hotel, a casino, and a restaurant. As Martini's new controller, your manager asks you to recommend the basis the hotel should use for allocating fixed overhead costs to the three divisions in 2020. You are presented with the following income statement information for 2019: (Click the icon to view the data.) Requirement 1. Calculate division margins in percentage terms prior to allocating fixed overhead costs. (Round your answers to two decimal places, X.XX.) Restaurant Casino Hotel 42.69 % Allocated fixed overhead costs Operating margin Operating margin % Data table Revenues Direct costs Segment margin Division margin Requirement 2. Allocate indirect costs to the three divisions using each of the three allocation bases suggested. For each allocation base, calculate division operating margins after allocations, in dollars and as a percentage of revenues Allocate the indirect costs, then…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education