FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

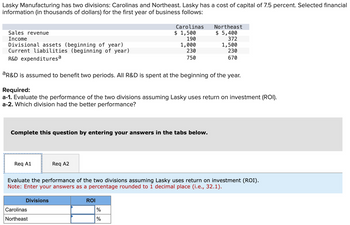

Transcribed Image Text:Lasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial

information (in thousands of dollars) for the first year of business follows:

Sales revenue

Income

Divisional assets (beginning of year)

Current liabilities (beginning of year)

R&D expenditures a

Carolinas

$ 1,500

190

1,000

230

750

Northeast

$ 5,400

372

1,500

230

670

aR&D is assumed to benefit two periods. All R&D is spent at the beginning of the year.

Required:

a-1. Evaluate the performance of the two divisions assuming Lasky uses return on investment (ROI).

a-2. Which division had the better performance?

Complete this question by entering your answers in the tabs below.

Req A1

Req A2

Evaluate the performance of the two divisions assuming Lasky uses return on investment (ROI).

Note: Enter your answers as a percentage rounded to 1 decimal place (i.e., 32.1).

Divisions

Carolinas

Northeast

ROI

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- a-2. which division had the better performance? east or westarrow_forwardSamsun company operates with two divisions, sam and sun. The results of the operations last year showed the company earning a net operating income of P468,000 while allocating P1,040,000 ccommon fixed expenses. The contribution margin of Sam was P780,000 while contribution margin ratio for sun ws 40%. Sun was able to generate sales of P3,250,000, and its segment margin was P832,000. The segment margin for sam was: A. P676,000 B. 1,508,000 C. P208,000 D. P832,000arrow_forwardDartford Company reported the following financial data for one of its divisions for the year; average investment center total assets of $3,500,000; investment center income $610,000; a target income of 12% of average invested assets. The residual income for the division is:arrow_forward

- Giardin Outdoors is a recreational goods retaller with two divisions: Online and Stores. The two divisions both use the services of the corporate Finance and Accounting (F and A) Department. Annual costs of the F and A Department total $5.2 million a year. Managers In the two operating divisions are measured based on division operating profits. The following selected data are available for the two operating divisions: Revenues (5000) $ 74,100 39,900 Online Stores Required: Determine the cost allocation if $3.8 million of the F and A costs are fixed and allocated on the basis of revenues, and the remaining costs, which are variable, are allocated on the basis of transactions. Note: Do not round Intermediate calculations. Enter your answers in dollars, not in millions or thousands. Fixed Variable Total $ Transactions (000) 1,066.5 283.5 Online $ Storesarrow_forwardThe following is partial information for Charleston Company’s most recent year of operation. It manufactures lawn mowers and categorizes its operations into two divisions: Bermuda and Midiron. Bermuda Division Midiron Division Sales revenue ? $ 600,000 Average invested assets $ 2,500,000 ? Net operating income $ 160,000 $ 150,000 Profit margin 20 % ? Investment turnover ? 0.16 Return on investment ? ? Residual income $ 40,000 $ (30,000 ) Required:1. Without making any calculations, determine whether each division’s return on investment is above or below Charleston’s hurdle rate.2. Determine the missing amounts in the preceding table.3. What is Charleston’s hurdle rate?4-a. Suppose Charleston has the opportunity to invest additional assets to help expand the company’s market share. The expansion would require an average investment of $2,800,000 and would generate $140,000 in additional income. Calculate…arrow_forwardHansabenarrow_forward

- The following selected data pertain to the belt division of Allen Corp. for last year: Sales = $500,000 Average operating Assets = $200,000 Operating Income = $80,000 Turnover = 2.5 Min. Required Return = 20% What was the return on investment?arrow_forwardA-1. Evaluate the performance of the two divisions assuming BMI uses economic value added (EVA). A-2. Which division had the better performance?arrow_forwardPDT Co. has two divisions, East and West. Invested assets and condensed income statement data for each division for the past year ended December 31 are as follows: East Division West Division Revenues $1,200,000 $800,000 Operating expenses 950,000 640,000 Service department charges 145,000 72,000 Invested assets 800,000 500,000 (a) Prepare condensed income statements for the past year for each division. (b) Using the expanded expression, determine the profit margin, investment turnover, and rate of return on investment for each division. Round to one decimal place.arrow_forward

- Lasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial information (in thousands of dollars) for the first year of business follows: Carolinas Northeast Sales revenue $ 900 $ 4,200 Income 170 372 Divisional assets (beginning of year) 1,000 1,500 Current liabilities (beginning of year) 170 170 R&D expendituresa 450 370 aR&D is assumed to benefit two periods. All R&D is spent at the beginning of the year. Required: a-1. Evaluate the performance of the two divisions assuming Lasky Manufacturing uses economic value added (EVA). a-2. Which division had the better performance?arrow_forwardFar Sight is a division of a major corporation. The following data are for the latest year of operations: Required: a. What is the division's return on investment (ROI)?b. What is the division's residual income? Sales 24,480,000 Net operating income 1.738.000 average operating assets 6,000 rate of return 16%arrow_forwardAdams Cough Drops operates two divisions. The following information pertains to each division for Year 1. \table[[, Division A, Division B], [Sales, $203,000, $78,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education