FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:ces

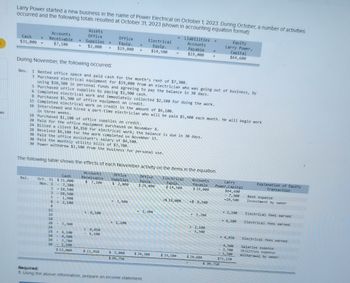

Larry Power started a new business in the name of Power Electrical on October 1, 2023. During October, a number of activities

occurred and the following totals resulted at October 31, 2023 (shown in accounting equation format):

Cash

$31,000+

Accounts

Receivable

$7,100

Assets

Office

+

Supplies

+ $2,000

+

Office

Equip.

Electrical

Equip.

Liabilities

Accounts

+

Payable

+ $29,000

$14,500

$19,000

+

Equity

Larry Power,

Capital

$64,600

During November, the following occurred:

Nov. 1 Rented office space and paid cash for the month's rent of $7,300.

3 Purchased electrical equipment for $19,000 from an electrician who was going out of business, by

using $10,500 in personal funds and agreeing to pay the balance in 30 days.

5 Purchased office supplies by paying $1,900 cash.

6 Completed electrical work and immediately collected $2,100 for doing the work.

8 Purchased $5,300 of office equipment on credit.

15 Completed electrical work on credit in the amount of $6,100.

16 Interviewed and hired a part-time electrician who will be paid $5,400 each month. He will begin work

in three weeks.

18 Purchased $1,100 of office supplies on credit.

20 Paid for the office equipment purchased on November 8.

24 Billed a client $4,850 for electrical work; the balance is due in 30 days.

28 Received $6,100 for the work completed on November 15.

30 Paid the office assistant's salary of $4,500.

30 Paid the monthly utility bills of $3,700.

30 Power withdrew $1,500 from the business for personal use.

The following table shows the effects of each November activity on the items in the equation.

Nov. 17,300

Accounts

Payable

$ 19,000

Larry

Power, Capital

$64,600

7,300

+10,500

Explanation of Equity

Transaction

Rent expense

Investment by owner

Cash

Accounts

Receivable

Bal.

Oct. 31 $31,000

$ 7,100

Office

Supplies

$ 2,000

Office

Equip.

$ 29,000

Electrical

Equip.

$ 14,500

3 +10,500

3 -10,500

5

- 1,900

6

b

+ 2,100

8

+ 1,900

5,300

15

6,100

16

18

+ 1,100

20

5,300

24

28

6,100

4,850

6,100

30

4,500

30

- 3,700

30

1,500

$15,000

$ 11,950

$ 5,000

$99,750

$ 34,300

$ 33,500

$ 28,600

+$ 19,000

+$ 8,500

+ 2,100

Electrical fees earned

+ 5,300

+ 6,100

Electrical fees earned

1,100

5,300

+ 4,850

Electrical fees earned

4,500

Salaries expense

3,700

Utilities expense

1,500

Withdrawal by owner

$71,150

$ 99,750

Required:

1. Using the above information, prepare an income statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Larry Power started a new business in the name of Power Electrical on October 1, 2023. During October, a number of activities occurred and the following totals resulted at October 31, 2023 (shown in accounting equation format): Assets = Liabilities + Equity Cash + Accounts Receivable + Office Supplies + Office Equip. + Electrical Equip. = Accounts Payable + Larry Power, Capital $35,000 + $7,500 + $2,400 + $33,000 + $16,500 = $23,000 + $71,400 During November, the following occurred: Nov. 1 Rented office space and paid cash for the month’s rent of $7,700. 3 Purchased electrical equipment for $23,000 from an electrician who was going out of business, by using $12,500 in personal funds and agreeing to pay the balance in 30 days. 5 Purchased office supplies by paying $2,300 cash. 6 Completed electrical work and immediately collected $2,500 for doing the work. 8 Purchased $5,700 of office equipment on credit. 15 Completed electrical work on credit in the…arrow_forwardNatale Gold is the owner of the marketing agency Vivid Voice. The company focuses on online consulting services, such as online marketing campaigns and blog services. The June transactions for VIvid Voice resulted In totals at June 30, 2020, as shown In the following accounting equation format: Assets = Liabilities Equity Accounts Accounts Natalie Explanation of Equity + Supplies $1,900 + Equipment= $6,500 Payable $4,e00 Cash Receivable Gold, Capital $11,600 Transaction $6,000 + $1, 200 + During July, the following occurred: a. Collected $800 from a credit customer. b. Pald $2,500 for equipment purchased on account In June. c. Did work for a client and collected cash; $1,100. d. Pald a part-time consultant's wages; $950. e. Pald the July rent; $1,200. f. Pald the July utlitles; $600. g. Performed services for a customer on credit; $1,600. h. Called an Information technology consultant to fix the agency's photo editing software in August; It will cost $350. Show the effects of the…arrow_forwardUse the following information to complete the balance sheet of Adelphi Construction as of December 31, 2018. (1) The company was organized on January 1, 2018 and has operated for the full year 2018. (2) Earnings were $275,000 and dividends of $70,000 were paid to stockholders. (3) Cash and accounts receivable together amount to one and one-half times as much as notes payable. Adelphi Construction Balance Sheet December 31, 2018 Assets Liabilities & Owners' Equity Cash Liabilities: Accounts receivable 85,000 96,000 250,000 184,000 Notes payable Accounts payable Income taxes payable Total liabilities Owners' equity: Capital stock Retained earnings Total liabilities and owners' equity 2$ Equipment Building Land $ 40,000 $215,000 %24 Total assets $620.000arrow_forward

- Smith Legal Services opened their business in 2019. Record the following transactions in the space provided below Performed $43,000 in services on account Incurred operating expenses of $34,000 on account Paid cash for salaries of $4,500 Collected $39,000 of the accounts receivable Paid cash of $28,000 on accounts payablearrow_forwardOn January 1, 20Y5, Fahad Ali established Mountain Top Realty, which completed the following transactions during the month: Jan. 1 Fahad Ali transferred cash from a personal bank account to an account to be used for the business, $53,000. 2 Paid rent on office and equipment for the month, $7,950. 3 Purchased supplies on account, $4,240. 4 Paid creditor on account, $2,320. 5 Earned fees, receiving cash, $24,180. 6 Paid automobile expenses (including rental charge) for month, $2,490, and miscellaneous expenses, $560. 7 Paid office salaries, $6,630. 8 Determined that the cost of supplies used was $1,860. 9 Withdrew cash for personal use, $2,600. Required: Journalize entries for transactions Jan. 1 through 9. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will…arrow_forwardThe following transactions were made during the first month (January 2022) of Mr. X Carwash's (sole proprietor) business operation:REQUIRED:a) an Income Statement for January 2022b) Balance Sheet as of January 31, 2022.arrow_forward

- Accounting Shane Tamarisk began a business, on January 1 2024 with an investment of $115,000. The company had the following assets and liabilities on the dates indicated: December 31 total assets $376,000 $440,000 $525,000 total liabilities $205,000 $280,000 $325,000 2024 2025 2026 1) In 2024, assuming Shanes's drawings were $50,000 for the year how much was his profit or loss? 2) In 2025, assuming Shane made an additional investment of $51,000 for the year and no drawings in 2024, how much was his profit or loss? 3) In 2026, assuming Shanes made an additional investment of $10,000 and his drawings were $41,000 for the year, how much was his profit or loss?arrow_forwardK Service had het income for the year of $28,000. In addition, the balance sheet reports the following balances: (Click the icon to view the balances.) Calculate the return on assets for Alexia Appliance Service for the year ending December 31, 2024. Etext pages Data table Notes Payable Cash Office Furniture Building Accounts Payable Total Owner's Equity Accounts Receivable Equipment Office Supplies Print Get more help. + $ Jan 1, 2024 40,000 $ 30,000 24,000 180,000 13,500 214,100 3,400 25,000 5,200 Done = Dec 31, 2024 60,000 142,200 50,000 180,000 13,000 359,400 19,400 40,000 800 ROA X % Clear all Check answarrow_forwardIn alphabetical order below are balance sheet items for Robinson Company at December 31, 2022. Sandra Robinson is the owner of Robinson Company. Accounts payable Accounts receivable Cash Owner's capital Total Assets Liabilities $94,600 Prepare a balance sheet. (List Assets in order of liquidity.) Owner's Equity 72,400 45,700 23,500 ROBINSON COMPANY Balance Sheet For the Year Ended December 31, 2022 Assets Liabilities and Owner's Equity Total Liabilities and Owner's Equity $ $ $ 118,100 94,600 23,500 118,100arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education