FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

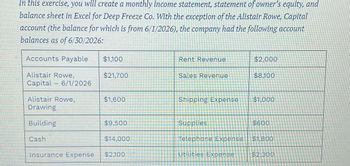

Transcribed Image Text:In this exercise, you will create a monthly income statement, statement of owner's equity, and

balance sheet in Excel for Deep Freeze Co. With the exception of the Alistair Rowe, Capital

account (the balance for which is from 6/1/2026), the company had the following account

balances as of 6/30/2026:

Accounts Payable

Alistair Rowe,

Capital - 6/1/2026

Alistair Rowe,

Drawing

Building

Cash

Insurance Expense

$1,100

$21,700

$1,600

$9,500

$14,000

$2,100

Rent Revenue

Sales Revenue

Shipping Expense

Supplies

Telephone Expense

Utilities Expense

$2,000

$8.100

$1,000

$600

$1,800

$2,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How do I write journal entries for these separate transactions? And which are debit/credit?arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) Tamarisk Inc. had the following balance sheet at December 31, 2024. Tamarisk Inc. Balance Sheet December 31, 2024 Cash $22,640 Accounts payable $32,640 Accounts receivable 23,840 Notes payable (long-term) 43,640 Investments 34,640 Common stock 102,640 Plant assets (net) 81,000 Retained earnings 25,840 Land 42,640 $204,760 $204,760 During 2025, the following occurred. 1. Tamarisk Inc. sold part of its debt investment portfolio for $16,327. This transaction resulted in a gain of $4,727 for the firm. The company classifies these investments as available-for-sale. 2. A tract of land was purchased for $15,640 cash. 3. Long-term notes payable in the amount of $17,327 were retired before maturity by…arrow_forwardYou work as a freelance accounting professional and have been recently engaged by the auditors of Life-Positive Inc. for an assignment. In examining the company’s records, you have extracted the following information: Life-Positive’s Account Balances 2021 ($) 2022 ($) Accounts Payable 24,600.00 21,250.00 Accounts receivable 15,700.00 12,340.00 Cash 23,450.00 28,600.00 Cost of goods sold 19,700.00 23,000.00 Depreciation 3,090.00 4,590.00 Dividends 5,800.00 10,800.00 Interest 2,340.00 2,890.00 Inventory 7,050.00 8,640.00 Long-term debt 28,000.00 30,000.00 Net fixed assets 41,500.00 48,000.00 Other expenses 2,400.00 2,800.00 Sales 58,000.00 62,500.00 Short-term Notes Payable 2,890.00 2,340.00 Shares outstanding 85,000.00 90,000.00 Note: The tax rate is 32% Required: 1. Prepare a balance sheet for 2021 and 2022 for the company, clearly showing information about…arrow_forward

- Please answer attached question thanksarrow_forwardMargaret Moore is the bookkeeper for Carla Vista Company. Margaret has been trying to determine the correct balance sheet for Carla Vista Company, shown as follows. Cash Assets Supplies Equipment Owner's drawings Total assets CARLA VISTA COMPANY Balance Sheet December 31, 2022 $15,000 Accounts payable Accounts receivable Owner's capital Total liabilities and owner's equity 8,000 46,000 13,000 Liabilities $82,000 $24,448 (7,567) 65,119 $82,000arrow_forwardThe completed financial statement columns of the spreadsheet for Oriole Company are shown as follows: The completed financial statement columns of the worksheet for Oriole Company are shown as follows: Oriole Company Worksheet For the Year Ended December 31, 2022 Income Statement Balance Sheet Account Account Titles Dr. Cr. Dr. Cr. No. 101 Cash 9,100 112 Accounts Receivable 11,000 130 Prepaid Insurance 2,800 157 Equipment 24,300 158 Accumulated Depreciation-Equip. 4,500 201 Accounts Payable 9,200 212 Salaries and Wages Payable 2,500 301 Owner's Capital 19,500 306 Owner's Drawings 11,000 400 Service Revenue 60,500 622 Maintenance and Repairs Expense 1,700 711 Depreciation Expense 2,900 722 Insurance Expense 2,000 726 Salaries and Wages Expense 29,900 732 Utilities Expense 1,500 Totals 38,000 60,500 58,200 35,700 22,500 22,500 Net Income 60,500 60,500 58,200 58,200arrow_forward

- Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Current Year 1 Year Ago 2 Years Ago Assets $ 39,900 56,491 58,411 4,616 256,082 $ 33,783 $ 39,888 71,898 89,474 10,785 286,555 Cash Accounts receivable, net Merchandise inventory 97,913 125,594 10,989 Prepaid expenses Plant assets, net 310,097 $ 578,376 Total assets $ 498,600 $ 415,500 Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings $ 144,016 109,822 $ 81,735 113,531 $ 54,298 91,826 163,500 105,876 163,500 161,038 163,500 139,834 Total liabilities and equity $ 578,376 $ 498,600 $ 415,500 For both the current year and one year ago, compute the following ratios: Exercise 17-9 (Algo) Analyzing risk and capital structure LO P3 The company's income statements for the current year and one year ago, follow. For Year Ended December 31…arrow_forwardQuick and EZ Delivery Income Statement Year Ended December 31, 2018 Revenues: Service Revenue $192,000 Expenses: Salaries Expense $65,000 Rent Expense 9,000 Interest Expense 7,600 Insurance Expense 2,600 Total Expenses Net Income Choose from any list or enter any number in the input fields and then click Check Answer. 2 parts remaining Clear All Final Check Data Table Land $12,000 Common Stock $20,000 Notes Payable 34,000 Accounts Payable 9,000 Property Tax Expense 3,100 Accounts Receivable 1,300 Dividends 35,000 Advertising Expense 10,000 Rent Expense 9,000 Building 139,600 Salaries Expense 65,000 Cash 2,200…arrow_forwardPlease help me with all answers thankuarrow_forward

- please check answer, thank youarrow_forwardYou are the accountant for Kamal Fabricating, Inc. and you oversee the preparation of financial statements for the year just ended 6/30/2020. You have the following information from the company’s general ledger and other financial reports (all balances are end-of-year except for those noted otherwise): Cash $9,000 Common stock 8,000 Accounts receivable 7,000 Accounts payable 2,000 Cash dividends declared for the year 2,000 Additional paid-in capital 6,000 Prepaid insurance 5,000 Prior period adjustment, net of income taxes (2,000) Unearned revenue 4,000 Retained earnings, beginning of the year 6,000 Net income for the year 9,000 Prepare the company’s Statement of Retained Earnings. Kamal Fabricating, Inc. Statement of Retained Earnings Year Ended June 30, 2020 $fill in the blank 2 fill in the blank 4 $fill in the blank 6 fill in the blank 8 $fill in the blank 9 fill in the blank 11 $fill in the blank 13arrow_forwardPlease help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education