FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Alpesh

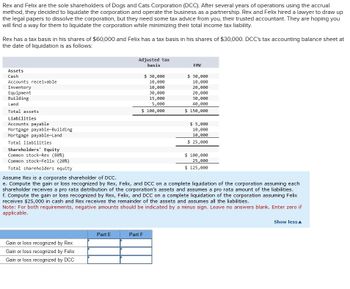

Transcribed Image Text:Rex and Felix are the sole shareholders of Dogs and Cats Corporation (DCC). After several years of operations using the accrual

method, they decided to liquidate the corporation and operate the business as a partnership. Rex and Felix hired a lawyer to draw up

the legal papers to dissolve the corporation, but they need some tax advice from you, their trusted accountant. They are hoping you

will find a way for them to liquidate the corporation while minimizing their total income tax liability.

Rex has a tax basis in his shares of $60,000 and Felix has a tax basis in his shares of $30,000. DCC's tax accounting balance sheet at

the date of liquidation is as follows:

Assets

Cash

Accounts receivable

Inventory

Equipment

Building

Land

Total assets

Liabilities

Accounts payable

Mortgage payable-Building

Mortgage payable-Land

Total liabilities

Shareholders' Equity

Common stock-Rex (80%)

Common stock-Felix (20%)

Total shareholders equity

Assume Rex is a corporate shareholder of DCC.

Adjusted tax

basis

$ 30,000

FMV

$ 30,000

10,000

10,000

10,000

20,000

30,000

20,000

15,000

30,000

5,000

40,000

$ 100,000

$ 150,000

$ 5,000

10,000

10,000

$ 25,000

$ 100,000

25,000

$ 125,000

e. Compute the gain or loss recognized by Rex, Felix, and DCC on a complete liquidation of the corporation assuming each

shareholder receives a pro rata distribution of the corporation's assets and assumes a pro rata amount of the liabilities.

f. Compute the gain or loss recognized by Rex, Felix, and DCC on a complete liquidation of the corporation assuming Felix

receives $25,000 in cash and Rex receives the remainder of the assets and assumes all the liabilities.

Note: For both requirements, negative amounts should be indicated by a minus sign. Leave no answers blank. Enter zero if

applicable.

Gain or loss recognized by Rex

Gain or loss recognized by Felix

Gain or loss recognized by DCC

Part E

Part F

Show less▲

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education