FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

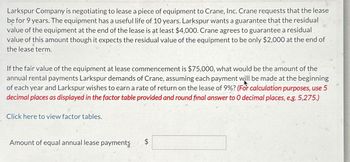

Transcribed Image Text:Larkspur Company is negotiating to lease a piece of equipment to Crane, Inc. Crane requests that the lease

be for 9 years. The equipment has a useful life of 10 years. Larkspur wants a guarantee that the residual

value of the equipment at the end of the lease is at least $4,000. Crane agrees to guarantee a residual

value of this amount though it expects the residual value of the equipment to be only $2,000 at the end of

the lease term.

If the fair value of the equipment at lease commencement is $75,000, what would be the amount of the

annual rental payments Larkspur demands of Crane, assuming each payment will be made at the beginning

of each year and Larkspur wishes to earn a rate of return on the lease of 9%? (For calculation purposes, use 5

decimal places as displayed in the factor table provided and round final answer to O decimal places, e.g. 5,275.)

Click here to view factor tables.

Amount of equal annual lease payments

SA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rumsfeld Corporation leased a machine on December 31, 2018, for a three-year period. The lease agreement calls for annual payments in the amount of $17,500 on December 31 of each year beginning on December 31, 2018. Rumsfeld has the option to purchase the machine on December 31, 2021, for $21,500 when its fair value is expected to be $31,500. The machine's estimated useful life is expected to be five years with no residual value. The appropriate interest rate for this lease is 8%. n/i 1 period, 8% 2 periods, 8% 3 periods, 8% PV of $1 PV, ordinary annuity PV, annuity due 0.92593 0.92593 1.00000 0.85734 1.78326 1.92593 0.79383 2.57710 2.78326 Required: 1. Calculate the amount to be recorded as a right-of-use asset and the associated lease liability. 2. Prepare an amortization schedule for this lease. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the amount to be recorded as a right-of-use asset and the associated lease liability.…arrow_forwardCharlotte Corp., a machinery dealer, leased a machine to Eleanor Corp. on January 1, 2022. The lease is for an 8-year period, is noncancelable and requires equal annual payments of $35,013 at the beginning of each year. The first payment is received on January 1, 2022. Charlotte had purchased the machine during 2021 for $160,000. The FMV of the machine is 200,000. The present value of the minimum lease payments is also $200,000. Collectibility of lease payments is reasonably predictable, and no important uncertainties surround the amount of costs yet to be incurred by Charlotte. Charlotte set the annual rental to ensure an 11% rate of return. The machine has an economic life of 10 years with no residual value and reverts to Charlotte at the termination of the lease. Required: What type of lease is this for Charlotte (lessor) and why Prepare all of Charlotte’s journal entries for 2022.arrow_forwardBravo Manufacturing Company is negotiating with a customer for the lease of a large machine manufactured by Bravo. The machine has a cash price of $780,000. Bravo wants to be reimbursed for financing the machine at a 12% annual interest rate over the five-year lease term.arrow_forward

- Federated Fabrications leased a tooling machine on January 1, 2024, for a three-year period ending December 31, 2026. The lease agreement specified annual payments of $31,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2025. The company had the option to purchase the machine on December 30, 2026, for $40,000 when its fair value was expected to be $55,000, a sufficient difference that exercise seems reasonably certain. The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor's implicit rate of return was 11%. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Calculate the amount Federated should record as a right-of-use asset and lease liability for this finance lease. 2. Prepare an amortization schedule that describes the pattern of interest expense for Federated over the lease term. 3. Prepare the…arrow_forwardMarshall Inc. is negotiating an agreement to lease equipment to a lessee for 5 years. The equipment has a useful life of 8 years. The fair value of the equipment is $ 64,000 and the lessor expects a rate of return of 5% on the lease contract. Marshall Inc. expects the equipment to have a fair value of $24,000 at the end of 5 years; however, the lessee does not guarantee the residual amount. If the first annual payment is required at the commencement of the lease, what fixed lease payment should Marshall Inc. charge in order to earn its expected rate of return on the contract? Note: Enter the answer in dollars and cents, rounded to the nearest penny. Note: Do not use a negative sign with your answer.arrow_forwardCrane, Inc. leased equipment from Tower Company under a 4-year lease requiring equal annual payments of $224152, with the first payment due at lease inception. The lease does not transfer ownership, nor is there a bargain purchase option. The equipment has a 4- year useful life and no salvage value. If Crane, Inc.'s incremental borrowing rate is 11% and the rate implicit in the lease (which is known by Crane, Inc.) is 9%, what is the amount recorded for the leased asset at the lease inception? 9%, 4 periods 11%, 4 periods O $695420 O$791546 O $771914 O $726190 PV Annuity Due 3.53129 3.44371 PV Ordinary Annuity 3.23972 3.10245 Attempts: 0 of 1 used Submit Answerarrow_forward

- Teal Mountain Inc. wishes to lease machinery to Thiensville Company. Thiensville wants the machinery for 4 years, although it has a useful life of 10 years. The machinery has a fair value at the commencement of the lease of $38,000, and Teal Mountain expects the machinery to have a residual value at the end of the lease term of $27,000. However, Thiensville does not guarantee any part of the residual value. Thiensville does expect that the residual value will be $36,000 instead of $27,000. What would be the amount of the annual rental payments Teal Mountain demands of Thiensville, assuming each payment will be made at the end of each year and Teal Mountain wishes to earn a rate of return on the lease of 5%? (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to 0 decimal places, e.g. 5,275.) Click here to view factor tables. Amount of equal annual lease payments %24arrow_forwardJelly Co. processes jam and sells it to the public. Jelly leases equipment used in its production processes from Squishy, Inc. This year, Jelly leases a new piece of equipment from Squishy. The lease term is 5 years and requires equal rental payments of $15,000 at the beginning of each year. In addition, there is a renewal option to allow Jelly to keep the equipment one extra year for a payment at the end of the fifth year of $10,000 (which Jelly is reasonably certain it will exercise). The equipment has a fair value at the commencement of the lease of $76,024 and an estimated useful life of 7 years. Squishy set the annual rental to earn a rate of return of 5%, and this fact is known to Jelly. The lease does not transfer title, does not contain a bargain purchase option, and the equipment is not of a specialized nature. Which of the 5 lease tests does the lease qualify as a finance lease for? Choose all that apply. Transfer of Ownership Test [Select ] Bargain Purchase Option Test […arrow_forwardPepper, Inc. agrees to lease equipment from the Blue Corporation for 10 years at $25,000 at the end of each year. The equipment has a fair value of $175,000 and an estimated useful life of 10 years. The lease includes a guaranteed residual value of $10,000. In addition to the lease payments, Pepper will pay $5,000 per year for a maintenance agreement. Pepper can finance this lease with its bank at a 12% rate. The lessor’s implicit lease rate, known to the lessee, is 10%. The lessor and the lessee use ASC 842 guidelines for lease accounting. Present value interest factors are: 10% 12% PV factor of $1 for 10 periods 0.38554 0.32197 PV factor for ordinary annuity for 10 periods 6.14457 5.65022 The Pepper lease is a(n): Multiple Choice A. operating lease because ownership does not automatically transfer to the lessee at the end of the lease term. B. short-term lease because the lease value is less than the fair value of the asset. C. operating lease because the…arrow_forward

- Teal Mountain Company is negotiating to lease a piece of equipment to MTBA, Inc. MTBA requests that the lease be for 9 years. The equipment has a useful life of 10 years. Teal Mountain wants a guarantee that the residual value of the equipment at the end of the lease is at least $4,000. MTBA agrees to guarantee a residual value of this amount though it expects the residual value of the equipment to be only $2,500 at the end of the lease term.If the fair value of the equipment at lease commencement is $60,000, what would be the amount of the annual rental payments Teal Mountain demands of MTBA, assuming each payment will be made at the beginning of each year and Teal Mountain wishes to earn a rate of return on the lease of 6%? (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to 0 decimal places, e.g. 5,275.)arrow_forwardABC Company leased equipment to Best Corporation under a lease agreement that qualifies as a direct finance lease. The cost of the asset is OMR 22,000. The lease contains a bargain purchase option that is effective at the end of the fifth year. The expected economic life of the asset is five years. The lease term is 5 years. The asset is expected to have a residual value of OMR 2,000 at the end of ten years. Using the straight-line method, what would Best record as annual depreciation? Select one: a. OMR 2,000 b. OMR 4,500 c. OMR 5,000 d. OMR 4,000arrow_forwardOn January 1, Garcia Supply leased a truck for a four-year period, at which time possession of the truck will revert back to the lessor. Annual lease payments are $10,000 due on December 31 of each year, calculated by the lessor using a 5% discount rate. Negotiations led to Garcia guaranteeing a $36,000 residual value at the end of the lease term. Garcia estimates that the residual value after four years will be $35,000. What is the amount to be added to the right-of-use asset and lease liability under the residual value guarantee? Note: Use tables, Excel, or a financial calculator. Enter your answer in whole dollars. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education