Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Solve this general accounting question not use

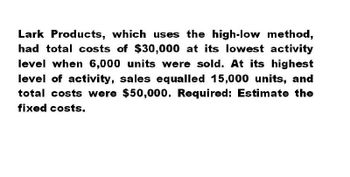

Transcribed Image Text:Lark Products, which uses the high-low method,

had total costs of $30,000 at its lowest activity

level when 6,000 units were sold. At its highest

level of activity, sales equalled 15,000 units, and

total costs were $50,000. Required: Estimate the

fixed costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rose Company has a relevant range of production between 10,000 and 25.000 units. The following cost data represents average cost per unit for 15,000 units of production. Using the cost data from Rose Company, answer the following questions: If 10,000 units are produced, what is the variable cost per unit? If 18,000 units are produced, what is the variable cost per unit? If 21,000 units are produced, what are the total variable costs? If 11,000 units are produced, what are the total variable costs? If 19,000 units are produced, what are the total manufacturing overhead costs incurred? If 23,000 units are produced, what are the total manufacturing overhead costs incurred? If 19,000 units are produced, what are the per unit manufacturing overhead costs incurred? If 25,000 units are produced, what are the per unit manufacturing overhead costs incurred?arrow_forwardThe following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardLark would estimate fixed costs as .....?arrow_forward

- Lark would estimate fixed costs as .....? General accountingarrow_forwardMeadow uses the high-low method, had total costs of $300,250 at its lowest level of activity when 10,500 units were sold. When, at its highest level of activity, sales equaled 16,700 units, total costs were $397,900. Meadow would estimate fixed costs as: $262,525 $97,650 $134,875 Ⓒ$485,050arrow_forwardXYZ Company uses the high low method to analyze the mixed cost. According to the cost formula derived, the total fixed cost is $10,000. Total cost at the high level of activity was $73,000 and at the low level of activity was $25,000. If the low level of activity was 2,500 units, what was the high level of activity in units? Select one: O a. 10,500 O b. 11,500 O c. None of the answers given O d. 7,300 O e. 11,000arrow_forward

- Bruno Company accumulates the following data concerning a mixed cost, using miles as the activity level. Miles Driven Total Cost January 8,015 February 7,510 Miles Driven Total Cost $14,195 March 8,500 $15,000 13,515 April 8,205 14,495 a. Compute the variable cost per mile using the high-low method. b. Compute the fixed cost elements using the high-low method. Arsons company is planning to produce 2,100 units of product in 2017. Each unit requires 1.60 pounds of materials at $6.40 per pound and a half-hour of labor at $16.00 per hour. The overhead rate is 60% of direct labor. A. Compute the budgeted amounts for 2017 for direct materials to be used, direct labor, and applied overhead. B. Compute the standard cost of one unit of production (round answer to 2 decimal places).arrow_forwardStancil Dry Cleaners has determined the following about its costs: Total variable expenses are$42,000,total fixed expenses are $24,000, and the sales revenue needed to break even is $48,000. Determine the company's current 1) sales revenue and 2) operating income. (Hint: First, find the contribution margin ratio; then prepare the contribution margin income statement.) Use the contribution margin income statement and the shortcut contribution margin approaches to determine Stancil's current (1) sales revenue and (2) operating income. Begin by computing the contribution margin ratio. (Enter the result as a whole number.) The contribution margin ratio is %.arrow_forwardStancil Dry Cleaners has determined the following about its costs: Total variable expenses are$42,000,total fixed expenses are $24,000, and the sales revenue needed to break even is $48,000. Determine the company's current 1) sales revenue and 2) operating income. (Hint: First, find the contribution margin ratio; then prepare the contribution margin income statement.) Use the contribution margin income statement and the shortcut contribution margin approaches to determine Stancil's current (1) sales revenue and (2) operating income. Begin by computing the contribution margin ratio. (Enter the result as a5 whole number.) The contribution margin ratio is 50 %. Prepare the contribution margin income statement at the calculated sales level. NOTE: the other picture is to show the options.arrow_forward

- The Miramichi Company uses the high-low method to estimate its cost function. The information for the current year is provided below: Highest observation of cost driver Lowest observation of cost driver $12,500 Machine-hours a. O b. $0 O C. $25,000 O d. $125,000 O e. $225,000 2,000 1,000 What is the constant for the estimating cost equation? Costs $225,000 $125,000arrow_forwardAdams, Inc. has the following cost data for Product X, and unit product cost using absorption costing when production is 2,000 units, 2,500 units, and 5,000 units. (Click on the icon to view the cost data.) (Click on the icon to view the unit product cost data.) Product X sells for $175 per unit. Assume no beginning inventories. Read the requirements. Data table Begin by selecting the labels and computing the gross profit for scenario a. and then compute the gross profit for scenario b. and c. Absorption costing a. b. C. Gross Profit Reference 2,000 units 2,500 units 5,000 units 42 $ 42 52 52 11 11 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total unit product cost Print $ $ 42 S 52 11 10 115 $ Done 8 113 $ 4 109 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Print Done $42 per unit 52 per unit 11 per unit 20,000 per yeararrow_forwardConnell Co. collects the following data concerning a mixed cost, using miles as the activity level. Miles Driven Total Cost January 10,000 $17,000 February 8,000 $13,500 March 9,000 $14,400 April 7,000 $12,500 Instructions: Compute the variable and fixed cost elements using the high-low method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College