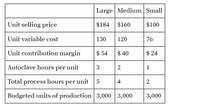

Product decisions under bottlenecked operations Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $85,000 for the company as a whole. In addition, the following information is available about the three products:

a. Determine the contribution margin by glass type and the total company income from operations for the budgeted units of production.

b. Prepare an analysis showing which product is tile most profitable per bottleneck hour.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- Hercules Steel Company produces three grades of steel: high, good, and regular grade. Each of these products (grades) has high demand in the market, and Hercules is able to sell as much as it can produce of all three. The furnace operation is a bottleneck in the process and is running at 100% of capacity. Hercules wants to improve steel operation profitability. The variable conversion cost is $15 per process hour. The fixed cost is $200,000. In addition, the cost analyst was able to determine the following information about the three products: Category High Grade Good Grade Regular Grade Budgeted units produced 4,900 4,900 4,900 Total process hours per unit 11 10 9 Furnace hours per unit 4 3 2.5 Unit selling price $270 $260 $240 Direct materials cost per unit $85 $81 $75 The furnace operation is part of the total process for each of these three products. Thus, for example, 4.0 of the 12.0 hours required to process…arrow_forwardGlide Behind Corporation manufactures and sells small cargo trailers. The Wheel Division creates parts that are both sold externally and transferred internally to the Assembly Division. Variable production costs of wheel set #102 are $80, and each set sells externally for $150. What would you recommend as the internal transfer price from the Wheel Division to the Assembly Division if a competitive external market exists for wheel set #102? Would your answer change if there were no external market this component? Why? What would the transfer price be if upper management required cost plus 25 percent as the transfer price?arrow_forwardHaving trouble with some questions from the last chapter.arrow_forward

- Blossom Industries is a decentralized firm. It has two production centres: Vancouver and Kamloops. Each one is evaluated based on its return on investment. Vancouver has the capacity to manufacture 330,000 units of component TR222. Vancouver's variable costs are $150 per unit. Kamloops uses component TR222 in one of its products. Kamloops adds $90 of variable costs to the component and sells the final product for $465. Consider the following independent situations: Vancouver can sell all 330,000 units of TR222 on the open market at a price of $240 per unit. Kamloops is willing to buy 33,000 of those units. What should the transfer price be? Transfer price eTextbook and Medial Of the 330,000 units of component TR222 it can produce, Vancouver can sell 231,000 units on the open market at a price of $240 per unit. Kamloops is willing to buy an additional 33,000 units. What should the minimum transfer price be? Minimum transfer price eTextbook and Media Transfer price per unit $ $ Of the…arrow_forwardArtisan Metalworks has a bottleneck in their production that occurs within the engraving department. Jamal Moore, the COO, is considering hiring an extra worker, whose salary will be $54,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,000 more units per year. Currently, the selling price per unit is $25.00 and the cost per unit is $7.80. Direct materials $3.50 Direct labor 1.10 Variable overhead 0.40 Fixed overhead (primarily depreciation of equipment) 2.80 Total $7.80 Using the information provided, calculate the annual financial impact of hiring the extra worker. Profit $_____ ______arrow_forwardProduct Decisions Under Bottlenecked Operations Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $158,000 for the company as a whole. In addition, the following information is available about the three products: Large Medium Small Unit selling price $235 $429 $149 Unit variable cost 185 351 131 Unit contribution margin $ 50 $ 78 $ 18 Autoclave hours per unit 4 6 2 Total process hours per unit 8 12 6 Budgeted units of production 2,400 2,400 2,400 a. Determine the contribution margin by glass type and the total company income from operations for the budgeted units of production. Large Medium Small Total Units…arrow_forward

- Product Decisions Under Bottlenecked Operations Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $296,000 for the company as a whole. In addition, the following information is available about the three products: Large Medium Small Unit selling price $324 $286 $158 Unit variable cost 255 234 139 Unit contribution margin $ 69 $ 52 $ 19 Autoclave hours per unit 6 4 2 Total process hours per unit 18 8 6 Budgeted units of production 4,700 4,700 4,700 a. Determine the contribution margin by glass type and the total company income from operations for the budgeted units of production. Large Medium Small Total Units…arrow_forwardThe Rosa model of Mohave Corporation is currently manufactured as a very plain umbrella with no decoration. The company is considering changing this product to a much more decorative model by adding a silk-screened design and embellishments. A summary of the expected costs and revenues for Mohave's two options follows: Estimated demand Estimated sales price Estimated manufacturing cost per unit Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit manufacturing cost Additional development cost Rosa Umbrella 29,000 units $31.00 $ 21.50 4.50 3.50 6.00 $ 35.50 Decorated Umbrella 29,000 units $ 41.00 $ 23.50 7.00 5.50 6.00 $ 42.00 $ 12,000 Required: 1. Determine the increase or decrease in profit if Mohave sells the Rosa Umbrella with the additional decorations. 2. Should Mohave add decorations to the Rosa umbrella? 3-a.Suppose the higher price of the decorated umbrella is expected to reduce estimated demand for this product to 27,000 units.…arrow_forwardProduct Decisions Under Bottlenecked Operations Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $177,000 for the company as a whole. In addition, the following information is available about the three products: Large Medium Small Unit selling price $353 $99 $282 Unit variable cost 278 81 248 Unit contribution margin $ 75 $ 18 $ 34 Autoclave hours per unit 6 2 4 Total process hours per unit 18 6 8 Budgeted units of production 3,100 3,100 3,100 a. Determine the contribution margin by glass type and the total company income from operations for the budgeted units of production. Large Medium Small Total Units…arrow_forward

- Memanarrow_forwardAnswerarrow_forwardValmont Company has developed a new industrial piece of equipment called the XP-200. The company is considering two methods of establishing a selling price for the XP-200-absorption cost-plus pricing and value-based pricing. Valmont's cost accounting system reports an absorption unit product cost for XP-200 of $9,300. Its markup percentage on absorption cost is 85%. The company's marketing managers have expressed concerns about the use of absorption cost-plus pricing because it seems to overlook the fact that the XP-200 offers superior performance relative to the comparable piece of equipment sold by Valmont's primary competitor. More specifically, the XP-200 can be used for 18,000 hours before replacement. It only requires $1,900 of preventive maintenance during its useful life and it consumes $165 of electricity per 900 hours used. These figures compare favorably to the competing piece of equipment that sells for $18,000, needs to be replaced after 9,000 hours of use, requires $3,800…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education