Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Lakeside inc. estimated

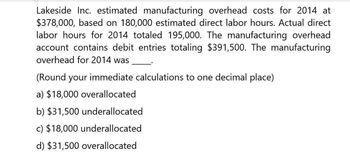

Transcribed Image Text:Lakeside Inc. estimated manufacturing overhead costs for 2014 at

$378,000, based on 180,000 estimated direct labor hours. Actual direct

labor hours for 2014 totaled 195,000. The manufacturing overhead

account contains debit entries totaling $391,500. The manufacturing

overhead for 2014 was

(Round your immediate calculations to one decimal place)

a) $18,000 overallocated

b) $31,500 underallocated

c) $18,000 underallocated

d) $31,500 overallocated

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardA company estimates its manufacturing overhead will be $840,000 for the next year. What is the predetermined overhead rate given each of the following Independent allocation bases? Budgeted direct labor hours: 90,615 Budgeted direct labor expense: $750000 Estimated machine hours: 150,000arrow_forwardLakeside Inc. estimated manufacturing overhead costs for 2014 at $378,000, based on 180,000 estimated direct labor hours. Actual direct labor hours for 2014 totaled 195,000. The manufacturing overhead account contains debit entries totaling $391,500. The manufacturing overhead for 2014 was (Round your immediate calculations to one decimal place) a) $18,000 overallocated b) $31,500 underallocated c) $18,000 underallocated d) $31,500 overallocatedarrow_forward

- Ansarrow_forwardLakeside Company estimated manufacturing overhead costs for 2014 at $390,000, based on 160,000 estimated direct labor hours. Actual direct labor hours for 2014 totaled 195,000. The manufacturing overhead account contains debit entries totaling $391,500. The manufacturing overhead for 2014 was: (Round your intermediate calculations to one decimal place)arrow_forwardPlease give me correct solutionarrow_forward

- Please solve this question general accountingarrow_forwardPlease provide correct answer accountingarrow_forwardCalculate the predetermined overhead rate for 2017, assuming Lott Company estimates total manufacturing overhead costs of $907,200, direct labor costs of $756,000, and direct labor hours of 21,600 for the year. (Round answer to the nearest whole percent, e.g. 25%.) Predetermined overhead ratearrow_forward

- Marquis Company estimates that annual manufacturing overhead costs will be $894,600. Estimated annual operating activity bases are direct labor cost $497,000, direct labor hours 49,700, and machine hours 99,400.Compute the predetermined overhead rate for each activity base. (Round answers to 2 decimal places, e.g. 10.50% or 10.50.) Overhead rate per direct labor cost enter percentages rounded to 2 decimal places % Overhead rate per direct labor hour $enter a dollar amount rounded to 2 decimal places Overhead rate per machine hourarrow_forwardStrong Company applies overhead based on machine hours. At the beginning of 2018, the company estimated that manufacturing overhead would be OMR 120,000, and machine hours would total 15,000. By 2018 year-end, actual overhead totaled OMR 140,000, and actual machine hours were 20,000. On the basis of this information, the 2018 predetermined overhead rate was:arrow_forwardCullumber Company estimates that annual manufacturing overhead costs will be $ 1,166,000. Estimated annual operating activity bases are direct labor cost $530,000, direct labor hours 53,000, and machine hours 106,000. Compute the predetermined overhead rate for each activity base. (Round answers to 2 decimal places, e.g. 10.50% or 10.50.) Overhead rate per direct labor cost Overhead rate per direct labor hour Overhead rate per machine hour $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College