FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

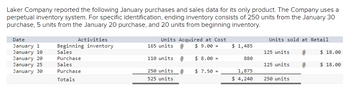

Transcribed Image Text:Laker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 250 units from the January 30 purchase, 5 units from the January 20 purchase, and 20 units from beginning inventory.

| Date | Activities | Units Acquired at Cost | Units Sold at Retail |

|------------|---------------------|-------------------------|----------------------|

| January 1 | Beginning inventory | 165 units @ $9.00 = $1,485 | |

| January 10 | Sales | | 125 units @ $18.00 |

| January 20 | Purchase | 110 units @ $8.00 = $880 | |

| January 25 | Sales | | 125 units @ $18.00 |

| January 30 | Purchase | 250 units @ $7.50 = $1,875 | |

| **Totals** | | **525 units** = $4,240 | **250 units** |

![## Laker Company Inventory Analysis

### Instructions

1. **Compute gross profit for the month of January for Laker Company using the four inventory methods**:

- Specific Identification

- Weighted Average

- FIFO (First-In, First-Out)

- LIFO (Last-In, First-Out)

2. **Determine which method yields the highest gross profit.**

3. **Assess whether the gross profit using the weighted average method falls between that of using FIFO and LIFO.**

4. **Analyze the scenario where costs are rising instead of falling, and identify which method would yield the highest gross profit.**

### Calculation Guidelines

Complete this analysis by entering your answers in the designated tabs.

#### Data Table: Gross Profit Computation

- **Sales**: To be computed for each method.

- **Cost of Goods Sold (COGS)**: To be computed for each method.

- **Gross Profit**: Calculate for each method using the formula:

\[

\text{Gross Profit} = \text{Sales} - \text{Cost of Goods Sold}

\]

**Note**: Round cost per unit to two decimal places and final answers to the nearest whole dollars.

---

This exercise will help you understand the impact of different inventory valuation methods on gross profit, vital for strategic financial planning and analysis.](https://content.bartleby.com/qna-images/question/1f9c2d6c-22c5-4836-99bd-5f88f6a141ee/1156f34e-f8fc-434b-a3a6-d72a46554794/0shskka_thumbnail.png)

Transcribed Image Text:## Laker Company Inventory Analysis

### Instructions

1. **Compute gross profit for the month of January for Laker Company using the four inventory methods**:

- Specific Identification

- Weighted Average

- FIFO (First-In, First-Out)

- LIFO (Last-In, First-Out)

2. **Determine which method yields the highest gross profit.**

3. **Assess whether the gross profit using the weighted average method falls between that of using FIFO and LIFO.**

4. **Analyze the scenario where costs are rising instead of falling, and identify which method would yield the highest gross profit.**

### Calculation Guidelines

Complete this analysis by entering your answers in the designated tabs.

#### Data Table: Gross Profit Computation

- **Sales**: To be computed for each method.

- **Cost of Goods Sold (COGS)**: To be computed for each method.

- **Gross Profit**: Calculate for each method using the formula:

\[

\text{Gross Profit} = \text{Sales} - \text{Cost of Goods Sold}

\]

**Note**: Round cost per unit to two decimal places and final answers to the nearest whole dollars.

---

This exercise will help you understand the impact of different inventory valuation methods on gross profit, vital for strategic financial planning and analysis.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 200 units from the January 30 purchase, 5 units from the January 20 purchase, and 25 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 View transaction list 110 units 90 units 200 units $16.50 $16.50arrow_forwardLaker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 270 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. 28 Date January 1 January 10 January 20 January 25 January 30 Required: S ual Activities Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost 180 units @ $ 10.50 = 110 units @ Units sold at Retail $ 1,890 140 units @ $ 19.50 $9.50- 1,045 130 units @ $ 19.50 270 units @ 560 units $ 9.00 = 2,430 $ 5,365 270 units 1. Compute gross profit for the month of January for Laker Company for the four inventory methods. 2. Which method yields the highest gross profit? 3. Does gross profit using weighted average fall between that using FIFO and LIFO? 4. If costs were rising instead of falling, which method would yield the highest gross profit? งarrow_forwardThe following information applies to the questions displayed below.]Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date Activities Units Acquired at Cost Units Sold at Retail March 1 Beginning inventory 120 units @ $51.40 per unit March 5 Purchase 235 units @ $56.40 per unit March 9 Sales 280 units @ $86.40 per unit March 18 Purchase 95 units @ $61.40 per unit March 25 Purchase 170 units @ $63.40 per unit March 29 Sales 150 units @ $96.40 per unit Totals 620 units 430 units 4. Compute gross profit earned by the company for each of the four costing methods. For specific identification, units sold include 75 units from beginning inventory, 205 units from the March 5 purchase, 55 units from the March 18 purchase, and 95 units from the March 25 purchase. (Round weighted average cost per unit to two decimals and final answers to nearest…arrow_forward

- Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Units Sold at Retail Units Acquired at Cost 100 units @ $50 per unit 400 units@ $55 per unit Date Mar. Mar. Mar. Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales Activities 1 Beginning inventory 5 Purchase 9 Sales 420 units @ $85 per unit 120 units @ $60 per unit 200 units @ $62 per unit 160 units @ $95 per unit Totals 820 units 580 units 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, the March 9 sale consisted of 80 units from beginning inventory and 340 units from the March 5 purchase; the March 29 sale consisted of 40 units from the March 18 purchase and 120 units from the March 25 purchase. es Complete this question by einering your answers in the tabs below. Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to…arrow_forwardMontoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions. Date Activities Units Acquired at Cost Units Sold at Retail January 1 Beginning inventory 700 units @ $50 per unit February 10 Purchase 300 units @ $46 per unit March 13 Purchase 100 units @ $40 per unit March 15 Sales 780 units @ $70 per unit August 21 Purchase 110 units @ $55 per unit September 5 Purchase 570 units @ $52 per unit September 10 Sales 680 units @ $70 per unit Totals 1,780 units 1,460 units Required:1. Compute cost of goods available for sale and the number of units available for sale. 2. Compute the number of units in ending inventory Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (For specific identification, units sold consist of 700 units from beginning inventory, 200 from the February…arrow_forwardintorn tion [The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 355 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Activities Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost @ $ 14.00 = @ @ 215 units 160 units 355 units 730 units $ 13.00 = $ 11.00 = $ 3,010 2,080 3,905 $ 8,995 Units sold at Retail 3. Does gross profit using weighted average fall between that using FIFO and LIFO? 4. If costs were rising instead of falling, which method would yield the highest gross profit? 165 units 190 units 355 units 1. Compute gross profit for the month of January for Laker Company for the four inventory methods. 2. Which method yields…arrow_forward

- [The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 270 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Assume the perpetual inventory system is used. Required: Activities Beginning inventory Sales Purchase Sales Purchase Totals Specific Identification Purchase Date January 1 January 20 January 30 Complete this question by entering your answers in the tabs below. FIFO Activity Units Acquired at Cost 180 units @ $10.50 = LIFO Available for Sale Beginning inventory Purchase Purchase 110 units 270 units @ 560 units # of units 1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. 2. Determine the cost assigned to ending inventory…arrow_forwardLaker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 180 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Activities Beginning inventory Sales Purchase Sales Purchase Totals Specific Id Weighted Average Units Acquired at Cost @ $6.00 = @ $5.00 = @ $ 4.50 = FIFO 140 units Complete this question by entering your answers in the tabs below. LIFO 60 units 180 units 380 units $ 840 300 810 $ 1,950 Units sold at Retail The Company uses a periodic inventory system. For specific identification, ending inventory consists of 180 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Determine the cost assigned to ending inventory and to cost of goods sold using (a) specific identification, (b) weighted average, (c) FIFO,…arrow_forwardRequired information [The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 200 units from the January 30 purchase, 5 units from the January 20 purchase, and 25 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Activities Beginning inventory Sales Purchase Sales Purchase Totals Assume the perpetual inventory system is used. Required: Sales Cost of goods sold Gross profit LAKER COMPANY For Month Ended January 31 Weighted Average Units Acquired at Cost $ 7.50 = Specific Identification 150 units @ 80 units 0 $ 0 $ 200 units 430 units @ @ 3. Does gross profit using weighted average fall between that using FIFO and LIFO? 4. If costs were rising instead of falling, which method would yield the highest gross profit? FIFO $ 6.50 = Compute gross profit for the month of January for Laker…arrow_forward

- The following information applies to the questions displayed below; Hemming Company reported the following current-year purchases and sales for its only product. Date Activities January 1 Beginning inventory January 10 Sales March 14 Purchase March 15 Sales- July 30 Purchase October S October 26 Sales Purchase Totals 275 units 450 units 475 units Units Acquired at Cost $13.00- $18.00 $23.00- Units Sold at Retail $3,575 230 units $43.00 8,100 10,925 408 units 455 units $43.00 $43.00 175 units 1,375 units @$28.90 4,900 $ 27,500 1,885 units Hemming uses a periodic inventory system. (a) Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. (b) Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. (c) Compute the gross profit for each method. a) Periodic FIFO Beginning inventory Purchases March 14 July 30 October 28 Total b) Periodio LIFO Beginning inventory Purchases: Cost of Goods Available for Sale Cost of Goods Sold…arrow_forwardBeech Soda, Incorporated uses a perpetual inventory system. The company's beginning inventory of a particular product and its purchases during the month of January were as follows: Beginning inventory (January 1) Purchase (January 11) Purchase (January 20) Total Quantity 23 26 37 86 Unit Cost $ 25 $31 $ 33 Total Cost $ 575 806 1,221 $ 2,602 On January 14, Beech Soda, Incorporated sold 39 units of this product. The other 47 units remained in inventory at January 31. Assuming that Beech Soda uses the LIFO cost flow assumption, the cost of goods sold to be recorded at January 14 is:arrow_forwardSalmone Company reported the following purchases and sales of its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to the ending inventory using FIFO. Date Activities Units Acquired at Cost Units Sold at Retail May 1 Beginning inventory 190 units @ $10 = $1,900 May 5 Purchase 260 units @ $12 = $3,120 May 10 Sales 180 units @ $20 May 15 Purchase 140 units @ $13 = $1,820 May 24 Sales 130 units @ $21 $3,500 $3,340 $3,370 $3,110 $3,380arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education