Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

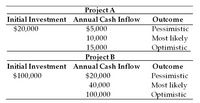

Kualoa Corporation is trying to assess the risk of two possible capital budgeting proposals. The company has developed pessimistic, most likely, and optimistic estimates of the annual

Transcribed Image Text:Project A

Initial Investment Annual Cash Inflow

Outcome

$20,000

$5,000

Pessimistic

Most likely

Optimistic

10,000

15,000

Project B

Initial Investment Annual Cash Inflow

Outcome

$100,000

$20,000

Pessimistic

Most likely

Optimistic

40,000

100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Compare and contrast the role and preparation of a master budget in a company's financial planning process, and discuss how it can be used to coordinate the activities of different departments and improve decision-making.arrow_forwardIn the prospectus for the Brazos Aggressive Growth fund, the fee table indicates that the fund has a 12b-1 fee of 0.35 percent and an expense ratio of 1.55 percent that is collected once a year on December 1. Joan and Don Norwood have shares valued at $114,500 on December 1. What is the amount of the 12b-1 fee this year? What is the amount they will pay for expenses this year?arrow_forwardRestituto Dimaalis is VP Corporate Planning of Philippine Canning Corp. (PCC), one of the biggest fish canning companies in the Philippines with Sales of about PhP 12.0 B in 2012. Its main product is tuna with the cannery located in General Santos City, South Cotabato. Its secondary product line is sardines with the cannery located just outside Zamboanga City. The company’s head office is located in Makati. Reviewing company performance over the past few years, Resituto thought the picture looked good. The cannery in Gen San, together with the corresponding fish port was new, having been completed 5 years ago. The company had invested a little over PhP 500.0 M in this project but it seemed to be paying off both in terms of increased efficiency as well as capacity. Most of the machinery and systems (60% of cost) was financed through 10 yr. US$ denominated debt while 30% of the balance was funded through long term PhP denominated debt and the rest through Retained Earnings. The…arrow_forward

- Companies vary in the amount of information they disclose about their criteria for selecting capital investments. Access the websites of two companies— for example, Coca-Cola and International Paper. Find management’s discussion and analysis (also called the financial review), which precedes the presentation of the financial statements. In that section, find the discussion of capital investments. Which company provides the more in-depth discussion? Does either disclose its criteria for making capital investment decisions? Also, look at the investing activities listed in the statement of cash flows for each company. What is the extent of capital expenditures for each company? Compare each company’s capital investments with the amount of total assets on the balance sheet. Which company is more of a growth company? Explain your answer.arrow_forwardYou are planning to rent a car for a one-week vacation. You have the option of buying an insurance that costs $80 dollars for a week. If you do not purchase insurance, you would be personally liable for any damages. You anticipate that a minor collision will cost $2,000, whereas a major accident might cost $16,000 in repairs. Develop a payoff table for this situation. What decision should you make using each strategy? Aggressive (Optimistic) Conservative (Pessimistic) Opportunity Loss You have recently read in a magazine that that the probability of a major accident is 0.05% and that the probability of a minor collision is 0.18%. Construct a decision tree and identify the best expected value decision.arrow_forwardMary is trying to qualify for a home loan but her lender tells her that her debt-to-income ratio is too high for FHA standards. What can Mary do to qualify for an FHA loan? О Transfer some of her existing debt to one or more credit cards. О Take out an equity line of credit to pay for the down payment. О Pay off one or more of her existing loans, such as a car loan or credit card debt. Decrease her credit score.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.