FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

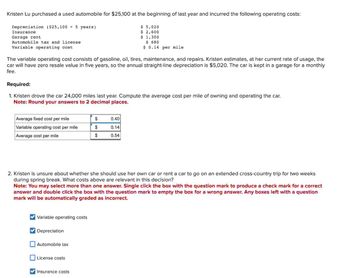

Transcribed Image Text:Kristen Lu purchased a used automobile for $25,100 at the beginning of last year and incurred the following operating costs:

Depreciation ($25,100 ÷ 5 years)

$ 5,020

Insurance

Garage rent

Automobile tax and license

Variable operating cost

$ 2,600

$ 1,300

$ 680

$ 0.14 per mile

The variable operating cost consists of gasoline, oil, tires, maintenance, and repairs. Kristen estimates, at her current rate of usage, the

car will have zero resale value in five years, so the annual straight-line depreciation is $5,020. The car is kept in a garage for a monthly

fee.

Required:

1. Kristen drove the car 24,000 miles last year. Compute the average cost per mile of owning and operating the car.

Note: Round your answers to 2 decimal places.

Average fixed cost per mile

$

0.40

Variable operating cost per mile

Average cost per mile

$

0.14

$

0.54

2. Kristen is unsure about whether she should use her own car or rent a car to go on an extended cross-country trip for two weeks

during spring break. What costs above are relevant in this decision?

Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct

answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question

mark will be automatically graded as incorrect.

Variable operating costs

Depreciation

Automobile tax

License costs

Insurance costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Power Manufacturing has equipment that it purchased 7 years ago for $2,350,000. The equipment was used for a project that was intended to last for 9 years. However, due to low demand, the project is being shut down. The equipment was depreciated using the straight-line method and can be sold for $360,000 today. The company's tax rate is 21 percent. What is the aftertax salvage value of the equipment? Multiple Choice $486,000 $303,222 $394,067 $360,000 О $388,389arrow_forwardJennifer installed a new enery-efficient tankless water heater in 2021 at a cost of $5,000. She replaced a similar unit in 2006 and claimed a nonbusiness energy property credit of $400 at that time. What is the amount of her nonbusiess energy property credit for 2021?arrow_forwardThis year, Barney and Betty sold their home (sales price $750,000; cost $200,000). All closing costs were paid by the buyer. Barney and Betty owned and lived in their home for 18 months. Assuming no unusual or hardship circumstances apply, how much of the gain is included in gross income? Multiple Choice $550,000 $300,000 $250,000 >arrow_forward

- Terry purchased a machine for $12,000; the seller is holding the note. Terry paid $2,400 for the required wiring and installation. Terry has deducted depreciation on the machine for 3 years totaling $3,600. Terry owes $8,000 to the Seller. What is Terry’s adjusted basis in the machine? Group of answer choices $10,800 $8,400 $2,800 $16,400arrow_forwardRobert purchased a new 3-D printer for $560,850. Although this printer is expected to last for ten years, Robert knows the technology will become old quickly, so he plans to replace this printer in three years. At that point, Robert believes he will be able to sell the printer for $45,000. Calculate depreciation using the straight-line method.arrow_forwardanswer in text form please (without image)arrow_forward

- On September 8, 2020, Holly purchased a residential apartment building. The cost basis assigned to the building is $197,400. Holly also owns another residential apartment building that she purchased on November 15, 2020, with a cost basis of $214,000. a. Calculate Holly's total depreciation deduction for the apartments for 2020 using MACRS. b. Calculate Holly's total depreciation deduction for the apartments for 2021 using MACRS.arrow_forwardKristen Lu purchased a used automobile for $10,100 at the beginning of last year and incurred the following operating costs: Depreciation ($10,100 ÷ 5 years) Insurance Garage rent Automobile tax and license Variable operating cost $ 2,020 $ 1,100 $ 500 $ 280 $ 0.11 per mile The variable operating cost consists of gasoline, oil, tires, maintenance, and repairs. Kristen estimates, at her current rate of usage, the car will have zero resale value in five years, so the annual straight-line depreciation is $2,020. The car is kept in a garage for a monthly fee. Required: 1. Kristen drove the car 13,000 miles last year. Compute the average cost per mile of owning and operating the car. Note: Round your answers to 2 decimal places. × Answer is complete but not entirely correct. Average fixed cost per mile $ 0.30 Variable operating cost per mile $ 0.41 Average cost per mile $ 0.71arrow_forwardOn April 30, 2021, Leo purchased and placed in service a new car that cost $69,600. The business use percentage for the car is always 100%. He does not take the additional first-year depreciation or any § 179. If required, round your answers to the nearest dollar. Click here to access the depreciation table of the textbook. Click here to access the limits for certain automobiles. a. What MACRS convention applies to the new car? Half-year b. Is the automobile considered "listed property"? Yes c. Leo's cost recovery deduction in 2021 is $ 10,000 X and for 2022 is $ 16,000 Xarrow_forward

- A taxpayer acquires office equipment for $10,000. Which one of the following choices is not an acceptable cost recovery period under either MACRS (regular or alternate) or ADS? O Straight-line for 7 years O straight-line for 10 years O 150% declining balance for 7 years O 150% declining balance for 10 yearsarrow_forwardKristen Lu purchased a used automobile for $26,800 at the beginning of last year and incurred the following operating costs: Depreciation ($26,800 ÷ 5 years) $ 5,360 Insurance $ 2,800 Garage rent $ 1,500 Automobile tax and license $ 740 Variable operating cost $ 0.13 per mile The variable operating cost consists of gasoline, oil, tires, maintenance, and repairs. Kristen estimates that, at her current rate of usage, the car will have zero resale value in five years, so the annual straight-line depreciation is $5,360. The car is kept in a garage for a monthly fee. Required: 1. Kristen drove the car 26,000 miles last year. Compute the average cost per mile of owning and operating the car. (Round your answers to 2 decimal places.) 2. Kristen is unsure about whether she should use her own car or rent a car to go on an extended cross-country trip for two weeks during spring break. What costs above are relevant in this decision? Assume that…arrow_forwardOn July 1, 2018, Brent purchases a new automobile for $40,000. He uses the car 80% for business and drives the car for business purposes as follows: 8,000 miles in 2018, 19,000 miles in 2019, 20,000 miles in 2020, and 15,000 miles in 2021. Brent uses the actual cost method. [Assume that no § 179 expensing is claimed and that 200% declining-balance cost recovery with the half-year convention is used. The recovery limitation for an auto placed in service in 2018 is as follows: $10,000 (first year), $16,000 (second year), $9,600 (third year), and $5,760 (fourth year).] a. Compute his depreciation deductions for the years 2018, 2019, 2020, and 2021. What is Brent's adjusted basis in the auto on January 1, 2022?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education