Concept explainers

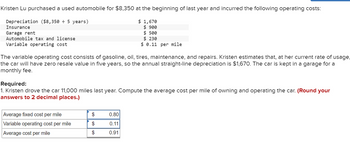

Kristen Lu purchased a used automobile for $8,350 at the beginning of last year and incurred the following operating costs:

| $ 1,670 | ||

| Insurance | $ 900 | |

| Garage rent | $ 500 | |

| Automobile tax and license | $ 230 | |

| Variable operating cost | $ 0.11 | per mile |

The variable operating cost consists of gasoline, oil, tires, maintenance, and repairs. Kristen estimates that, at her current rate of usage, the car will have zero resale value in five years, so the annual straight-line depreciation is $1,670. The car is kept in a garage for a monthly fee.

Required:

1. Kristen drove the car 11,000 miles last year. Compute the average cost per mile of owning and operating the car. (Round your answers to 2 decimal places.)

2. Kristen is unsure about whether she should use her own car or rent a car to go on an extended cross-country trip for two weeks during spring break. What costs above are relevant in this decision? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.)

check all that apply

- Variable operating costs

- Depreciationunanswered

- Automobile taxunanswered

- License costsunanswered

- Insurance costs

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- Kristen Lu purchased a used automobile for $10,100 at the beginning of last year and incurred the following operating costs: Depreciation ($10,100 ÷ 5 years) Insurance Garage rent Automobile tax and license Variable operating cost $ 2,020 $ 1,100 $ 500 $ 280 $ 0.11 per mile The variable operating cost consists of gasoline, oil, tires, maintenance, and repairs. Kristen estimates, at her current rate of usage, the car will have zero resale value in five years, so the annual straight-line depreciation is $2,020. The car is kept in a garage for a monthly fee. Required: 1. Kristen drove the car 13,000 miles last year. Compute the average cost per mile of owning and operating the car. Note: Round your answers to 2 decimal places. × Answer is complete but not entirely correct. Average fixed cost per mile $ 0.30 Variable operating cost per mile $ 0.41 Average cost per mile $ 0.71arrow_forwardOn April 30, 2021, Leo purchased and placed in service a new car that cost $69,600. The business use percentage for the car is always 100%. He does not take the additional first-year depreciation or any § 179. If required, round your answers to the nearest dollar. Click here to access the depreciation table of the textbook. Click here to access the limits for certain automobiles. a. What MACRS convention applies to the new car? Half-year b. Is the automobile considered "listed property"? Yes c. Leo's cost recovery deduction in 2021 is $ 10,000 X and for 2022 is $ 16,000 Xarrow_forwardJaylee purchased a large piece of equipment for their business costing $50,000 with a life of 10 years. The equipment qualifies for regular depreciation, bonus depreciation, and Section 179. Explain to Jaylee these cost recovery methods and what the deduction would be for the first, second, and third years for the equipment for each of these methods.arrow_forward

- Maria is a wedding planner. She purchases a laserjet printer for invitations, save-the-date postcards, etc. The laserjet costs $400. The laserjet has an expected life of 5 years; at the end of which time Maria expects a rebate of $20.00 when she turns in her old laserjet and purchases a new one. Maria uses the sum-of-the-years'-digits method to calculate depreciation.What is the annual depreciation in the first year?$What is the book value at the end of the second year?$What is the accumulated depreciation by the end of year 3?$arrow_forwardOn July 1, 2018, Brent purchases a new automobile for $40,000. He uses the car 80% for business and drives the car for business purposes as follows: 8,000 miles in 2018, 19,000 miles in 2019, 20,000 miles in 2020, and 15,000 miles in 2021. Brent uses the actual cost method. [Assume that no § 179 expensing is claimed and that 200% declining-balance cost recovery with the half-year convention is used. The recovery limitation for an auto placed in service in 2018 is as follows: $10,000 (first year), $16,000 (second year), $9,600 (third year), and $5,760 (fourth year).] a. Compute his depreciation deductions for the years 2018, 2019, 2020, and 2021. What is Brent's adjusted basis in the auto on January 1, 2022?arrow_forwardYam-Hash Corporation currently uses a water purification machine that was purchased 2 years ago. This machine is being depreciated on a straight-line basis, and it has 6 years of remaining life. Its current book value is Rs.2,100, and it can be sold for Rs.2,500 at this time. If old machine is not replaced, then it can be sold for Rs.500 at the end of its useful life. Yam-Hash is offered a replacement machine that has a cost of Rs.8,000, an estimated useful life of 6 years, and an estimated salvage value of Rs.800. This machine falls into the MACRS 5-year class, so the applicable depreciation rates are 20%, 32%, 19%, 12%, 11%, and 6%. The replacement machine is expected to save Rs. 4300 per year. The new machine would require that inventories be increased by Rs.2,000, but accounts payable would simultaneously increase by Rs.500. Yam-Hash fall under tax bracket of 40%, what is the terminal year cash flow?arrow_forward

- Henry Oldham purchased the office building in which his CPA firm was housed in 1983 . Henny purchased the building for $225,000. Henry replaced the windows in the building and restructured the lay-out of the offices in the builing. His costs were $32,000 for the improvement. Henry is retiring and has just sold the buulding lor $495,000. Heny has claimed $55,000 in depreciation. Henry will have selling costs of $5,000. What is Henn's gain on the slie?arrow_forwardNancy purchased a projector screen on July 15, 2019, for $1,200. The screen was used 70% of the time in her business and the rest of the time her children used the screen to watch movies. In 2019, the computer was used 40% for business and 60% for personal use. What are the cost recovery deductions for 2019 and 2020? (No §179 or bonus). Is there any recapture of depreciation in 2020?arrow_forwardKristen Lu purchased a used automobile for $8,350 at the beginning of last year and incurred the following operating costs: Depreciation ($8,350 ÷ 5 years) $ 1,670 Insurance $ 900 Garage rent $ 500 Automobile tax and license $ 230 Variable operating cost $ 0.11 per mile The variable operating cost consists of gasoline, oil, tires, maintenance, and repairs. Kristen estimates that, at her current rate of usage, the car will have zero resale value in five years, so the annual straight-line depreciation is $1,670. The car is kept in a garage for a monthly fee. Required: 1. Kristen drove the car 11,000 miles last year. Compute the average cost per mile of owning and operating the car. (Round your answers to 2 decimal places.)arrow_forward

- Terry purchased a machine for $15,000; the seller is holding the note. Terry paid $2,500 for the required wiring and installation. Terry has deducted depreciation on the machine for 3 years totaling $4,500. Terry owes $5,000 to the Seller. What is Terry’s adjusted basis in the machine? $10,500 $8,000 $13,000 $5,500arrow_forwardAlexandra purchased a $55,200 automobile during 2021. The business use was 60 percent. What is the allowable depreciation for the current year? (Ignore any possible bonus depreciation.)arrow_forwardA mixer was purchased two years ago for $63346 and can be sold for $171667 today. The mixer has been depreciated using the MACRS 5-year recovery period and the firm pays 40 percent taxes on both ordinary income and capital gain. Find the after tax proceeds.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education