FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

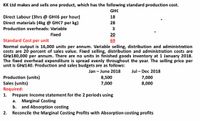

Transcribed Image Text:KK Ltd makes and sells one product, which has the following standard production cost.

GH¢

Direct Labour (3hrs @ GH¢6 per hour)

Direct materials (4kg @ GH¢7 per kg)

18

28

Production overheads: Variable

20

69

Fixed

Standard Cost per unit

Normal output is 16,000 units per annum. Variable selling, distribution and administration

costs are 20 percent of sales value. Fixed selling, distribution and administration costs are

GH¢180,000 per annum. There are no units in finished goods inventory at 1 January 2018.

The fixed overhead expenditure is spread evenly throughout the year. The selling price per

unit is GH¢140. Production and sales budgets are as follows:

Jan - June 2018

Jul - Dec 2018

Production (units)

Sales (units)

Required:

Prepare Income statement for the 2 periods using

Marginal Costing

and Absorption costing

Reconcile the Marginal Costing Profits with Absorption costing profits

8,500

7,000

7,000

8,000

1.

а.

b.

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- S Munoz Corporation sells products for $44 each that have variable costs of $19 per unit. Munoz's annual fixed cost is $560,000. Required Use the per-unit contribution margin approach to determine the break-even point in units and dollars. Break-even point in units Break-even point in dollars Marrow_forwardSteven Company has fixed costs of $181,104. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below. Product Selling Price per Unit Variable Cost per Unit Contribution Margin per Unit X $832 $312 $520 Y 430 230 200 The sales mix for Products X and Y is 60% and 40%, respectively. Determine the break-even point in units of X and Y. Round answers to the nearest whole number.fill in the blank 1 units of Xfill in the blank 2 units of Yarrow_forwardWang Company manufactures and sells a single product that sells for $640 per unit; variable costs are $352 per unit. Annual fixed costs are $985,500. Current sales volume is $4,390,000. Management targets an annual income of $1,315,000. Compute the unit sales to earn the target income. Select one: a. 6.164. Ob. 7,988. O c. 19,383. O d. 3,422. Oe. 4,934.arrow_forward

- uality Containers Industries Inc. has fixed costs of $368,000. The unit selling price, variable cost per unit, and contribution margin per unit for the company’s two products follow: Product Selling Price Variable Cost per Unit Contribution Margin per Unit AA $125 $85 $40 BB 90 40 50 The sales mix for Products AA and BB is 40% and 60%, respectively. Determine the break-even point in units of AA and BB. a. Product AA fill in the blank 1 unitsb. Product BB fill in the blank 2 unitsarrow_forwardSunn Company manufactures a single product that sells for $120 per unit and whose variable costs are $90 per unit. The company's annual fixed costs are $432.000 Management targets an annual income of $750,000. (1) Compute the unit sales to earn the target income. Numerator: 1 Denominator: (2) Compute the dollar sales to earn the target income.. Numerator: Denominator P M = Units to Achieve Target Units to achieve target Dollars to Achieve Target Dollars to achieve targetarrow_forwardZeke Company sells 24,500 units at $15 per unit. Variable costs are $7 per unit, and fixed costs are $36,300. The contribution margin ratio (rounded to the nearest whole percent) and the unit contribution margin are a. 53% and $15 per unit, respectively b. 1% and $15 per unit, respectively c. 53% and $8 per unit, respectively d. 1% and $7 per unit, respectivelyarrow_forward

- Bluegill Company sells 10,000 units at $400 per unit. Fixed costs are $200,000, and operating income is $1,800,000. Determine the following: a. Variable cost per unit $ b. Unit contribution margin $ per unit c. Contribution margin ratio %arrow_forwardABC Ltd produces a single product. The selling price is OMR 50 a unit and the variable costs is OMR 30 a unit. The annual fixed costs of the business are OMR 4000. calculate BEP in units Select one: O a. 210 Units O b. 200 Units O c. 220 Units O d. 250 Unitsarrow_forwardSteven Company has fixed costs of $365,640. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below. Product Selling Price per Unit Variable Cost per Unit Contribution Margin per Unit X $1,408 $528 $880 Y 710 380 330 The sales mix for Products X and Y is 60% and 40%, respectively. Determine the break-even point in units of X and Y. Round answers to the nearest whole number.fill in the blank 1 units of Xfill in the blank 2 units of Yarrow_forward

- Skolnick Corporation has provided the following information: Cost per Unit Direct materials $ 5.20 Direct labor $ 4.70 Variable manufacturing overhead $ 1.80 Cost per Period Fixed manufacturing overhead $ 126,000 Sales commissions $ 1.40 Variable administrative expense $ 0.60 Cost per Period Fixed selling and administrative expense $39,600 Selling price $20.6 per unit. The value of break-even point sales is:arrow_forwardAlgee Ltd plans to manufacture kettles and the following information is applicable: Estimated sales for the year 20.15 Estimated costs for the year 20.15 Direct material 14 000 units at R80 each R24 per unit Direct labour Factory overheads (all fixed) Selling expenses Administrative expenses (all fixed) R4 per unit R48 000 per annum 30% of sales R78 000 per annum 3.1 Calculate the break-even quantity 3.2 Calculate the break-even value using the marginal income ratio. 3.3 Calculate the selling price per unit if the profit per unit is R4. 3.4 Calculate the new break-even quantity and value if selling price is increased by 10%. 3.5 Calculate the selling price if 14 000 units provide an operating profit of RO after an additional advertising expense of R54 000arrow_forwardTackett Company sells a single product for $75 cach. the variable costs are $45 cach. Total fixed costs are $225,600. How many units must the company sell to achieve operating income of $90,000? O A. 7013 O B. 10520 O C. 6230 O D.4208arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education