FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

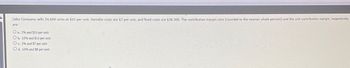

Transcribed Image Text:Zeke Company sells 24,600 units at $15 per unit. Variable costs are $7 per unit, and fixed costs are $38,500. The contribution margin ratio (rounded to the nearest whole percent) and the unit contribution margin, respectively,

are

O a. 2% and $15 per unit

Ob. 53% and $15 per unit

O c. 2% and $7 per unit

O d. 53% and $8 per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Rooney Corporation sells products for $38 each that have variable costs of $17 per unit. Rooney's annual fixed cost is $493,500. Required Use the per-unit contribution margin approach to determine the break-even point in units and dollars. Break-even point in units Break-even point in dollarsarrow_forwardZeke Company sells 24,500 units at $15 per unit. Variable costs are $7 per unit, and fixed costs are $36,300. The contribution margin ratio (rounded to the nearest whole percent) and the unit contribution margin are a. 53% and $15 per unit, respectively b. 1% and $15 per unit, respectively c. 53% and $8 per unit, respectively d. 1% and $7 per unit, respectivelyarrow_forwardHarry Company sells 37,000 units at $44 per unit. Variable costs are $36.52 per unit, and fixed costs are $96,900. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) operating income. a. Contribution margin ratio (Enter as a whole number.) b. Unit contribution margin (Round to the nearest cent.) per unit C. Operating incomearrow_forward

- ABC Ltd produces a single product. The selling price is OMR 50 a unit and the variable costs is OMR 30 a unit. The annual fixed costs of the business are OMR 4000. calculate BEP in units Select one: O a. 210 Units O b. 200 Units O c. 220 Units O d. 250 Unitsarrow_forwardFill the tablesarrow_forwardSteven Company has fixed costs of $365,640. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below. Product Selling Price per Unit Variable Cost per Unit Contribution Margin per Unit X $1,408 $528 $880 Y 710 380 330 The sales mix for Products X and Y is 60% and 40%, respectively. Determine the break-even point in units of X and Y. Round answers to the nearest whole number.fill in the blank 1 units of Xfill in the blank 2 units of Yarrow_forward

- Morrison Company sells 124,000 units at $16 per unit. Variable costs are $12 per unit, and fixed costs are $144,000. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) income from operations.arrow_forwardA company has $7.90 per unit in variable costs and $4.80 per unit in fixed costs at a volume of 50,000 units. If the company marks up total cost by 0.52, what price should be charged if 68,000 units are expected to be sold? Round to two decimal places.arrow_forwardSteven Company has fixed costs of $431,844. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below. Product Selling Price per Unit Variable Cost per Unit Contribution Margin per Unit X $1,344 $504 $840 Y 710 380 330 The sales mix for Products X and Y is 60% and 40%, respectively. Determine the break-even point in units of X and Y. Round answers to the nearest whole number. ____units of X ____units of Yarrow_forward

- When Isaiah Company has fixed costs of $133,840 and the contribution margin is $28, the break-even point is Oa. 9,560 units Ob. 14,270 units Oc. 5,920 units Od. 4,780 unitsarrow_forwardSteven Company has fixed costs of $443,940. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below. Product Selling Priceper unit Variable Cost per unit Contribution Marginper unit X $1,216 $456 $760 Y 710 380 330 The sales mix for products X and Y is 60% and 40% respectively. Determine the break-even point in units of X and Y combined. Round answer to nearest whole number.fill in the blank 1unitsarrow_forwardSanjuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education