FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

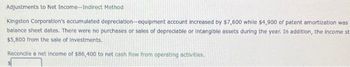

Transcribed Image Text:Adjustments to Net Income-Indirect Method

Kingston Corporation's accumulated depreciation-equipment account increased by $7,600 while $4,900 of patent amortization was

balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income st

$5,800 from the sale of investments.

Reconcile a net income of $86,400 to net cash flow from operating activities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lok Company reports net sales of $5,705,000 for Year 2 and $7,621,000 for Year 3. End-of-year balances for total assets are Year 1, $1,652,000; Year 2, $1,841,000; and Year 3, $1,964,000. (1) Compute Lok's total asset turnover for Year 2 and Year 3. (2) Lok's competitor has a Total Asset Turnover of 3.0 during Year 3. Is Lok performing better or worse than its competitor on the basis of total asset turnover?arrow_forwardDurrand Corporation's accumulated depreciation increased by $13,827, while patents decreased by $2,267 between consecutive balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a gain of $4,191 from sale of land. The company earned a net income of $41,464. Assuming there were no changes in noncash current assets and liabilities, determine the net cash flows from operating activities under the indirect method. $fill in the blank 1arrow_forwardDurrand Corporation's accumulated depreciation increased by $13,421, while patents decreased by $2,088 between consecutive balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a gain of $3,367 from sale of land. The company earned a net income of $53,251. Assuming there were no changes in noncash current assets and liabilities, determine the net cash flows from operating activities under the indirect method. $fill in the blank 1arrow_forward

- On December 31, Strike Company sold one of its batting cages for $22,244. The equipment had an initial cost of $247,161 and had accumulated depreciation of $222,445. Depreciation has been recorded up to the end of the year. What is the amount of the gain or loss on this transaction? a.Loss of $200,201 b.Gain of $224,917 c.Loss of $2,472 d.Gain of $2,472arrow_forwardA6arrow_forwardsarrow_forward

- Gates Inc., a calendar year firm, currently uses a plant asset in operations that originally cost $110,000 and has a useful life of eight years and a $10,000 residual value. Gates uses the straight line depreciation method. As an impairment indicator was present, Gates reviewed the asset for impairment. At January 1 of the current year, which is the beginning of the asset's third year of useful life, total remaining cash inflows attributable to the asset are estimated to be $120,000, while total cash outflows in running and maintaining the machine are estimated to be $65,000, Based on quoted prices and the condition of the asset, Gates estimates the fair value of the asset to be $40.000. The cost to sell the asset is approximately $5,000. Gates plans to continue to use the asset in production, although at a much lower rate of utilization. Required a. Record the impairment loss on January 1 of the current year, Date Jan 1 Account Name Date Dec 31 To record met Dr. b. Record depreciation…arrow_forwardDurrand Corporation's accumulated depreciation increased by $14,848, while patents decreased by $3,349 between consecutive balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a gain of $3,791 from sale of land. The company earned a net income of $59,832. Assuming there were no changes in noncash current assets and liabilities, determine the net cash flows from operating activities under the indirect method. $arrow_forwardThe draft financial statements of Enjoy Ltd for the year ended 31 December 20X6 are given below. The following additional information is also provided: (i) Plant with an original cost of $800 and accumulated depreciation of $600 was sold for $200. (ii) Interest expense was $350 of which $140 was paid during the period. $130 relating to interest expense of the prior period was also paid during the period. (iii) Investment income included $250 of interest that was received during the period and $250 of interest still to be received. The $250 of interest still to be received is included within other receivables. (iv) Investment income also included $300 of dividend that was received. Statement of Profit and Loss for the year ended 31 December 20X6: Sales 44,870 Cost of sales 31,000 Gross Profit…arrow_forward

- Quavo Mining Co. acquired mineral rights for $16,500,000. The mineral deposit is estimated at 36,500,000 tons. During the current year, 10,037,500 tons were mined and sold. a. Determine the amount of depletion expense for the current year. Do not round intermediate calculation and round your answer to nearest whole value.$fill in the blank 1 b. Illustrate the effects on the accounts and financial statements of the depletion expense. For decreases in accounts or outflows of cash, enter your answers as negative numbers. If no account or activity is affected, select "No effect" from the dropdown and leave the corresponding number entry box blank. Balance Sheet Assets = Liabilities + Stockholders' Equity - Accumulated depletion + No effect = No effect + Retained earnings fill in the blank 6 fill in the blank 7 fill in the blank 8 fill in the blank 9 Statement of Cash Flows Income Statement No effect fill in the blank 11 Depletion expense…arrow_forwardAt the beginning of the year, a company acquired a patent for $830,000, and also a trademark for $240,000. They amortize intangible assets with finite useful lives using the straight-line method, no residual value, and a four-year service life. What is the total amount of amortization expense that would appear in the company's income statement for the first year related to these items? Amortization expense: ____________arrow_forwardRipley corporarion's accumulated depreciation - equipment account increased by 15325 while 3800 of patent amortization was recognized bewtween balance sheet dates. There were no purchases of sales of depreciation or intangible assets during the year. In addition the income statement showed a gain of 22420 from the salem of investments. Reconcile a net income of 286900 to net cash flow from operetatimg activitiesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education