FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

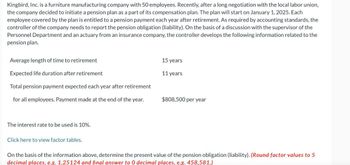

Transcribed Image Text:Kingbird, Inc. is a furniture manufacturing company with 50 employees. Recently, after a long negotiation with the local labor union,

the company decided to initiate a pension plan as a part of its compensation plan. The plan will start on January 1, 2025. Each

employee covered by the plan is entitled to a pension payment each year after retirement. As required by accounting standards, the

controller of the company needs to report the pension obligation (liability). On the basis of a discussion with the supervisor of the

Personnel Department and an actuary from an insurance company, the controller develops the following information related to the

pension plan.

Average length of time to retirement

Expected life duration after retirement

Total pension payment expected each year after retirement

15 years

11 years

for all employees. Payment made at the end of the year.

$808,500 per year

The interest rate to be used is 10%.

Click here to view factor tables.

On the basis of the information above, determine the present value of the pension obligation (liability). (Round factor values to 5

decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Flounder, Inc. is a furniture manufacturing company with 50 employees. Recently, after a long negotiation with the local labor union, the company decided to initiate a pension plan as a part of its compensation plan. The plan will start on January 1, 2020. Each employee covered by the plan is entitled to a pension payment each year after retirement. As required by accounting standards, the controller of the company needs to report the pension obligation (liability). On the basis of a discussion with the supervisor of the Personnel Department and an actuary from an insurance company, the controller develops the following information related to the pension plan. Average length of time to retirement Expected life duration after retirement Total pension payment expected each year after retirement for all employees. Payment made at the end of the year. 15 years 11 years $811.400 per year The interest rate to be used is 8%. Click here to view factor tables On the basis of the information…arrow_forwardRefer to the financial statements and related disclosure notes of Microsoft Corporation (www.microsoft.com).Required:1. What type of pension plan does Microsoft sponsor for its employees? Explain.2. Who bears the “risk” of factors that might reduce retirement benefits in this type of plan? Explain.3. Assuming that employee and employer contributions vest immediately, suppose a Microsoft employee contributes $1,000 to the pension plan during her first year of employment and directs investments to a bondmutual fund. If she leaves Microsoft early in her second year, after the mutual fund’s value has increased by2%, how much will she be entitled to roll over into an Individual Retirement Account (IRA)?4. How did Microsoft account for its participation in the pension plan in fiscal 2015?arrow_forwardPronghorn, Inc. is a furniture manufacturing company with 50 employees. Recently, after a long negotiation with the local labor union, the company decided to initiate a pension plan as a part of its compensation plan. The plan will start on January 1, 2025. Each employee covered by the plan is entitled to a pension payment each year after retirement. As required by accounting standards, the controller of the company needs to report the pension obligation (liability). On the basis of a discussion with the supervisor of the Personnel Department and an actuary from an insurance company, the controller develops the following information related to the pension plan. Average length of time to retirement Expected life duration after retirement Total pension payment expected each year after retirement for all employees. Payment made at the end of the year. 15 years 11 years $816,100 per year The interest rate to be used is 8%. Click here to view factor tables. On the basis of the information…arrow_forward

- Please help me. Thankyou.arrow_forwardStanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2024. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of return. The actual return was also 10% in 2024 and 2025.* A consulting firm, engaged as actuary, recommends 5% as the appropriate discount rate. The service cost is $180,000 for 2024 and $230,000 for 2025. Year-end funding is $190,000 for 2024 and $200,000 for 2025. No assumptions or estimates were revised during 2024. *We assume the estimated return was based on the actual return on similar investments at the Inception of the plan and that, since the estimate didn't change, that also was the actual rate in 2025. Required: Calculate each of the following amounts as of both December 31, 2024, and December 31, 2025: Note: Enter your answers in thousands (l.e., 200,000 should be entered as 200). Enter a llability as a negative amount. 1.…arrow_forwardHow do I go about calculating pension payouts to determine a company's financial obligation? Additional info is below: Postretirement BenefitsPeyton Approved has revised its postretirement plan. It will now provide health insurance to retired employees. Management has requested that you report the short- and long-term financial implications of this. The company is currently employing 60, and actuaries estimate that the company has a pension liability of $107,041.70. The estimated cost of retired employees’ health insurance is $43,718.91. Prepare adjusting entries for the pension liability and the health insurance liabilityarrow_forward

- Stanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2024. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of return. The actual return was also 10% in 2024 and 2025. A consulting firm, engaged as actuary, recommends 5% as the appropriate discount rate. The service cost is $240,000 for 2024 and $330,000 for 2025. Year-end funding is $250,000 for 2024 and $260,000 for 2025. No assumptions or estimates were revised during 2024. "We assume the estimated return was based on the actual return on similar investments at the inception of the plan and that, since the estimate didn't change, that also was the actual rate in 2025. Required: Calculate each of the following amounts as of both December 31, 2024, and December 31, 2025. Note: Enter your answers in thousands (i.e., 200,000 should be entered as 200). Enter a liability as a negative amount. 1.…arrow_forwardIvanhoe, Inc. has a defined-benefit pension plan covering its 50 employees. Ivanhoe agrees to amend its pension benefits. As a result, the projected benefit obligation increased by $2790000. Ivanhoe determined that all its employees are expected to receive benefits under the plan over the next 5 years. In addition, 10 employees are expected to retire or quit each year. Assuming that Ivanhoe uses the years-of-service method of amortization for prior service cost, the amount reported as amortization of prior service cost in year one after the amendment is $558000. O $651000. $930000. O $186000.arrow_forwardwifty Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the year 2020 in which no benefits were paid. 1. The actuarial present value of future benefits earned by employees for services rendered in 2020 amounted to $55,500. 2. The company’s funding policy requires a contribution to the pension trustee amounting to $144,729 for 2020. 3. As of January 1, 2020, the company had a projected benefit obligation of $908,100, an accumulated benefit obligation of $802,100, and a debit balance of $400,100 in accumulated OCI (PSC). The fair value of pension plan assets amounted to $601,200 at the beginning of the year. The actual and expected return on plan assets was $54,100. The settlement rate was 9%. No gains or losses occurred in 2020 and no benefits were paid. 4. Amortization of prior service cost was $50,500 in 2020. Amortization of net gain or loss was not required in 2020. (a)…arrow_forward

- The trustee for the Bronson Corporation defined benefit pension plan sent a report to the CEO with the following information for the fiscal year: Beginning balance of plan assets at fair value $ 1,560,000 Actual return on plan assets $ 210,000 Employer’s contribution $ 150,000 Distributions to retirees $ 75,000 Service cost $ 125,000 Interest cost $ 156,000 Loss from changes in benefits or assumptions $ 35,000 Beginning balance of the PBO $ 1,580,000 The ending balance of plan assets is: Multiple Choice $1,770,000. $1,845,000. $1,920,000. $1,955,000.arrow_forwardClassified Electronics has an unfunded retiree health care plan. Each of the company’s three employees has been with the firm since its inception at the beginning of 2020. As of the end of 2021, the actuary estimates the total net cost of providing health care benefits to employees during their retirement years to have a present value of $69,000. Each of the employees will become fully eligible for benefits after 21 more years of service but aren’t expected to retire for 35 more years. The interest rate is 5%. Required:1. What is the expected postretirement benefit obligation at the end of 2021?2. What is the accumulated postretirement benefit obligation at the end of 2021?3. What is the expected postretirement benefit obligation at the end of 2022?4. What is the accumulated postretirement benefit obligation at the end of 2022?arrow_forwardHijo Corp. is a publicly accountable entity that operates a defined benefit plan for its employees. Data relating to the pension plan is as follows: Defined benefit obligation (DBO), December 31, 2019 $22,300,000 Plan assets, December 31, 2019 24,500,000 Current service costs (CSC), December 31, 2020 2,200,000 Benefits paid to retirees, December 31, 2020 1,000,000 Actual return on plan assets, December 31, 2020 800,000 DBO, December 31, 2020, per actuary 24,000,000 Yield on high-quality corporate bonds 4% What is the total gain or loss that will flow to the other comprehensive income (OCI) part of the statement of comprehensive income for the year ended December 31, 2020? Question 12 options: a) $572,000 loss b) $180,000 loss c) $212,000 gain d) $392,000 gainarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education