FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Is the current-year return on assets better than the 10% return of competitors for (a) Apple and (b) Google?

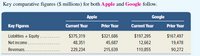

Transcribed Image Text:Key comparative figures ($ millions) for both Apple and Google follow.

Apple

Google

Key Figures

Current Year

Prior Year

Current Year

Prlor Year

Liabilittes + Equity.

$375,319

$321,686

$197,295

$167,497

Net Income

48,351

45,687

12,662

19,478

Revenues.

229,234

215,639

110,855

90,272

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- D All else being equal, which one of the following will decrease a firm's current ratio? Question 17 a decrease in the net fixed assets a decrease in depreciation O a decrease in accounts payable O a decrease in a counts receivablesarrow_forwardLiquity Rate A firm used 1 million in cash to puchase inventory. Will its current ratio rise or fall? Will its quick ratio rise or fall? Please cplain both.arrow_forwardA mature and stable company will likely have positive investing cash flows. O True O False All things that affect income this year either increase or decrease operating cash flows this year. O True O False A thriving company with positive income could still have negative total cash flows. True O False MacBook Proarrow_forward

- In the table below x denotes the X-Tract Company’s projected annual profit (in $1,000). The table also shows the probability of earning that profit. The negative value indicates a loss. x f(x) x = profit -100 0.01 f(x) = probability -200 0.04 0 100 0.26 200 0.54 300 0.05 400 0.02 10 On average, profit (loss) amounts deviate from the expected profit by ______ thousand. a $114.77 thousand b $112.52 thousand c $110.31 thousand d $108.15 thousandarrow_forwardYour company has a ROE of 18.5 which is very good for your industry. The company has an equity multiplier of 2.3 and a total asset turnover of 1.2. Both of these are higher than the industry average. What does this tell you about your company?arrow_forwardGive typing answer with explanation and conclusion _____ 2.) A company has a tax burden ratio of 0.4, a compound leverage factor of 0.6, a return on sales of 0.9, a leverage ratio of 0.7, and an asset turnover of 0.3. What is the ROE for the company? A.) 2.90% B.) 4.54% C.) 6.48% D.) 11.4% E.) None of the abovearrow_forward

- Based on the following information you have collected, what is the sustainable growth rate (SGR) for Leo's Photography Studio? Profit Margin Debt/Equity Ratio Capital Intensity Ratio Net Income Dividends O A. O B. O C. O D. 12.42% 8.52% 15.15% 13.63% 7.1% 0.60 0.75 $48,000 $10,000arrow_forwardIf a firm wants to increase its working capital efficiency, it should: Increase its days inventory and days receivable and decrease days payable Decrease days inventory and increase days receivable and days payable Decrease days inventory, days receivable and days payable Decrease days inventory and days receivable and increase days payable Decrease cost of goods sold and interest expensearrow_forwardLoreto Inc. has the following financial ratios: asset turnover = 2.40; net profit margin (i.e., net income/sales) = 5%; payout ratio = 30%; equity/assets = 0.40. a. What is Loreto's sustainable growth rate? b. What is its internal growth rate?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education