FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Accounting equation

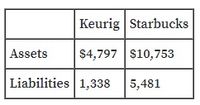

The total assets and total liabilities (in millions) of Keurig Green Mountain Coffee, Inc. and Starbucks Corporation follow:

Refer image

Determine the

Transcribed Image Text:Keurig Starbucks

Assets

$4,797 $10,753

Liabilities 1,338

5,481

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The total assets and total liabilities (in millions) of McDonald’s Corporation (MCD) and Starbucks Corporation (SBUX) follow: McDonald’s Starbucks Assets $37,939 $14,330 Liabilities 30,851 8,446 Determine the stockholders’ equity of each companyarrow_forwardCompute the missing amounts on the company’s financial statements. (Hint: What’s the difference between the acid-test ratio and the current ratio?)13. Total liabilities14. Common stock capital15. Total stockholders' equityarrow_forwardBased on the information in financial statements for Emerson Corporation, the operating margin is Note: Round your intermediate and final answer to two decimal places. Emerson Corporationarrow_forward

- Please help me with show all answers I will give upvote thankuarrow_forwardA7 please help....arrow_forwardA company's financial statements include the following selected data ($ in millions): Sales, $22,600; Net income, $900; Beginning stockholders' equity, $3,540; Ending stockholders' equity, $4,200.Calculate the return on equity. (Round your answer to 1 decimal place.) Return on equity: _________%arrow_forward

- Please help me with show all calculation thankuarrow_forwardThe right side of the balance sheet shows the firm’s liabilities and stockholders’ equity. Which of the following best describes shareholders’ equity? Equity is the difference between the company’s assets and retained earnings. Equity is the sum of shareholders’ capital provided by shareholders and retained earnings. NOW Inc. released its annual results and financial statements. Grace is reading the summary in the business pages of today’s paper. In its annual report this year, NOW Inc. reported a net income of $192 million. Last year, the company reported a retained earnings balance of $442 million, whereas this year it increased to $520 million. How much was paid out in dividends this year? $3 million $114 million $270 million $575 millionarrow_forwardMarriott International, Inc., and Hyatt Hotels Corporation are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions):Please see the attachment for details:1. Determine the following ratios for both companies, rounding ratios and percentages to one decimal place:a. Return on total assetsb. Return on stockholders’ equityc. Times interest earnedd. Ratio of total liabilities to stockholders’ equity2. Based on the information in (1), analyze and compare the two companies’ solvency and profitability.arrow_forward

- I need help with this question to understand the topicarrow_forwardNakamura,Incorporated, has a total debt ratio of. 75, total debt of $576,000, aND net income of $27,340. What is the companys reternal on equity?arrow_forwardIn alphabetical order below are balance sheet items for Robinson Company at December 31, 2022. Sandra Robinson is the owner of Robinson Company. Accounts payable Accounts receivable Cash Owner's capital Total Assets Liabilities $94,600 Prepare a balance sheet. (List Assets in order of liquidity.) Owner's Equity 72,400 45,700 23,500 ROBINSON COMPANY Balance Sheet For the Year Ended December 31, 2022 Assets Liabilities and Owner's Equity Total Liabilities and Owner's Equity $ $ $ 118,100 94,600 23,500 118,100arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education