FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

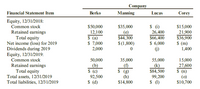

| Data from the financial statements of four different companies are presented in separate columns in the table below. Each column has one or more data items missing. Required: Use your understanding of the relationships among the financial statement items to determine the missing values (a–o). |

Transcribed Image Text:Company

Financial Statement Item

Berko

Manning

Lucas

Corey

Equity, 12/31/2018:

$ 1)

26,400

$66,400

$ 6,000

()

$15,000

21,900

$36,900

$ (m)

1,400

Common stock

Retained earnings

Total equity

Net income (loss) for 2019

Dividends during 2019

Equity, 12/31/2019:

Common stock

$50,000

12,100

$ (a)

$ 7,000

2,000

$35,000

(e)

$44,300

$(1,800)

Retained earnings

Total equity

Total assets, 12/31/2019

Total liabilities, 12/31/2019

50,000

(b)

$ (c)

92,500

$ (d)

35,000

(f)

$ (g)

(h)

$14,800

55,000

(k)

$84,500

99,200

$ 1)

15,000

27,600

$ (n)

(0)

$10,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Respond to the following in a minimum of 175 words: Describe the purpose of the five primary financial statements. Statement of Comprehensive Income Income Statement Balance Sheet Statement of Cash Flows Statement of Shareholder's Equity Give an example of a profitability, liquidity, and solvency ratio and explain the components and which financial statement would provide the information.arrow_forwardThe balance sheet includes information on the resources,financial structure,solvency and adaptability of a reporting entity. Discuss in 250 words or less.arrow_forwardThe four major financial reports that summarize the effects of economic events (like the results of operations) on a business for a specific time period or accounting period are called what? Group of answer choices tax returns managerial statements financial statements economic statementsarrow_forward

- Can you explain why the four financial statements are ranked that way?arrow_forwardWhich of the given series have the same normal balances in the Accounting Equitation? Select one: a. Assets & Expenses b. Assets & Liabilities c. Revenue & Owner's Drawings d. Liabilities & Expensesarrow_forwardA trial balance can best be explained as a list of a. The income statement accounts used to calculate net income. b. Revenue, expense, and dividend accounts used to show the balances of the components of retained earnings. c. The balance sheet accounts used to show the equality of the accounting equation. d. All accounts and their balances at a particular date.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education