FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is Ken's gross income?

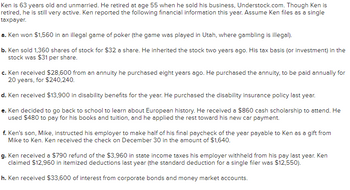

Transcribed Image Text:Ken is 63 years old and unmarried. He retired at age 55 when he sold his business, Understock.com. Though Ken is

retired, he is still very active. Ken reported the following financial information this year. Assume Ken files as a single

taxpayer.

a. Ken won $1,560 in an illegal game of poker (the game was played in Utah, where gambling is illegal).

b. Ken sold 1,360 shares of stock for $32 a share. He inherited the stock two years ago. His tax basis (or investment) in the

stock was $31 per share.

c. Ken received $28,600 from an annuity he purchased eight years ago. He purchased the annuity, to be paid annually for

20 years, for $240,240.

d. Ken received $13,900 in disability benefits for the year. He purchased the disability insurance policy last year.

e. Ken decided to go back to school to learn about European history. He received a $860 cash scholarship to attend. He

used $480 to pay for his books and tuition, and he applied the rest toward his new car payment.

f. Ken's son, Mike, instructed his employer to make half of his final paycheck of the year payable to Ken as a gift from

Mike to Ken. Ken received the check on December 30 in the amount of $1,640.

g. Ken received a $790 refund of the $3,960 in state income taxes his employer withheld from his pay last year. Ken

claimed $12,960 in itemized deductions last year (the standard deduction for a single filer was $12,550).

h. Ken received $33,600 of interest from corporate bonds and money market accounts.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education