FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

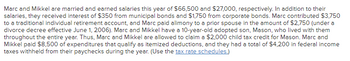

Transcribed Image Text:Marc and Mikkel are married and earned salaries this year of $66,500 and $27,000, respectively. In addition to their

salaries, they received interest of $350 from municipal bonds and $1,750 from corporate bonds. Marc contributed $3,750

to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $2,750 (under a

divorce decree effective June 1, 2006). Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them

throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and

Mikkel paid $8,500 of expenditures that qualify as itemized deductions, and they had a total of $4,200 in federal income

taxes withheld from their paychecks during the year. (Use the tax rate schedules.)

Transcribed Image Text:What is Marc and Mikkel's gross income?

What is Marc and Mikkel's adjusted gross income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 38 of 58. Which of the following factors may affect the claim for childcare expenses? O The age of the child The taxpayer's earned income The taxpayer's net income O All of the abovearrow_forwardHow is self-employment income treated differently than income earned when you work for an employer?arrow_forwardhow to calculate someones adjusted basis in taxarrow_forward

- Which of the following items IS included in gross income? O Municipal bond interest O Unemployment compensation received Scholarship for tuition and books O Inherited propertyarrow_forwardChild care expenses are generally deductible by the spouse with higher income in a two parents household. Question 5 options: True Falsearrow_forwardWhat are tax considerations of household employersarrow_forward

- Discuss the ethical implications of the estate, inheritance, and gift taxes.arrow_forwardWhich of the following types of income are not considered self-employment income? Select one: a. Rental income from real estate and personal property leased with the real estate when the taxpayer is not a real estate dealer b. Capital gains c. Dividend income d. Interest income e. None of the these are considered self-employment incomearrow_forwardFor purposes of computing the credit for child and dependent care expenses, the qualifying child or dependent care expenses are limited to the actual or deemed earned income of the lower earning spouse. True Falsearrow_forward

- Which of the following categories represent Deductions for AGIarrow_forwardWhich of the following is a deductible expense for an individual taxpayer? A) Rent payments for personal use B) Mortgage interest on a vacation home C) Childcare expenses while working D) Personal clothing purchasesarrow_forwardWhen determining earnings subject to SE tax, the taxpayer may want to use one of the optional methods whether if they have a small net profit or loss and which of the following conditions applies A. They are eligible to receive the Additional Child Tax Credit B. They can claim a Credit for Dependent or Child Care Expenses C. Taxpayer wants to receive a Credit for Social Security Benefit Coverage D. All of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education