FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

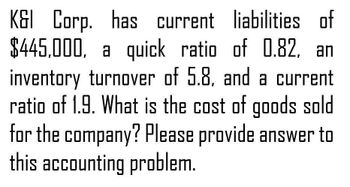

Transcribed Image Text:K&I Corp. has current liabilities of

$445,000, a quick ratio of 0.82, an

inventory turnover of 5.8, and a current

ratio of 1.9. What is the cost of goods sold

for the company? Please provide answer to

this accounting problem.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- K&I Corp. has current liabilities of $445,000, a quick ratio of 0.82, an inventory turnover of 5.8, and a current ratio of 1.9. What is the cost of goods sold for the company? Please provide answer to this accounting problem.arrow_forwardFor Crane Company, the following information is available: Cost of goods sold $386750 Dividend revenue Income tax expense Operating expenses Sales revenue 17300 35800 133500 595000 In Crane's single-step income statement, gross profit O should not be reported. O should be reported at $208250. O should be reported at $225550. O should be reported at $53100.arrow_forwardNeed help with this questionarrow_forward

- Jackson, Inc. has the following information is available: Cost of goods sold Dividend revenue Income tax expense Operating expenses Sales $148500 3750 3000 79500 255000 In Jackson's multiple-step income statement, gross profit O will not be reported. O will be reported at $24000. O will be reported at $27000. O will be reported at $106500.arrow_forwardWhat is the accounts receivable turnover rate on these accounting question?arrow_forwardWalker Corp, has current liabilities of $440,000, a quick ratio of .81, Inventory turnover of 5.7. and a current ratio of 1.8. What is the cost of goods sold for the company? (Do not round Intermedlate calculations.) Cost of goods sold 益券arrow_forward

- Use the following information to construct an income statement. Interest Expense Cost of Goods Sold Other Operating Expenses $350,196 $11,519,888 $244,807 Sales Depreciation Expense Flat Tax Rate $19,244,808 $467,723 21% What was the firms Net Profit Margin? (answer in decimal form and round to three decimal places; 7.6% = .076)arrow_forwardSolve this one for general accountingarrow_forwardCage Corporation has current liabilities of $510,000, a quick ratio of .93, inventory turnover of 6.9, and a current ratio of 1.5. What is the cost of goods sold for the company? (Do not round intermediate calculations.)arrow_forward

- Do not give image formatarrow_forwardIn analyzing the financial statements which are given can you please compute the following ratios: 1. EARNINGS PER SHARE 2.BOOK VALUE PER SHARE 3. MARKET PRICE TO BOOK VALUE PER SHARE 4.RECEIVABLE TURNOVER 5.AVERAGE COLLECTION PERIODarrow_forwardThe following information comes from the accounting records of Wildhorse Ltd.: Statement of Financial Position Assets Cash Accounts receivable Inventory Capital assets (net) Other assets Liabilities and shareholders' equity Accounts payable Long-term debt Common shares Retained earnings Statement of Income Sales Cost of goods sold Other expenses Income tax Net income (a1) Sales Cost of goods sold Gross margin Other expenses Income taxes Net income Current ratio Quick ratio A/R turnover Average collection period Inventory turnover 2022 Days to sell inventory $34,900 101,700 164,000 639,000 345,000 $149,000 300,000 779,000 757,000 402,000 $1,284,600 $1,341,000 $1,556,000 56,600 254,160 2022 21,180 17,000 $4,180 100 % 74 % $1,284,600 $1,341,000 26 % $1,059,000 $1.199,000 783,660 24 % 1.6 % 0.39 % 2022 2023 $32,000 3.2 119,000 9.5 195,000 Based on the above information, analyze the changes in the company's profitability and liquidity, in addition to the management of accounts receivable…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education