FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:K

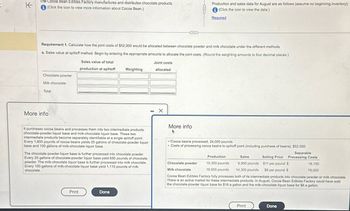

The Cocoa Bean Edibles Factory manufactures and distributes chocolate products.

(Click the icon to view more information about Cocoa Bean.)

Production and sales data for August are as follows (assume no beginning inventory):

(Click the icon to view the data.)

Required

Requirement 1. Calculate how the joint costs of $52,000 would be allocated between chocolate powder and milk chocolate under the different methods.

a. Sales value at splitoff method. Begin by entering the appropriate amounts to allocate the joint costs. (Round the weighting amounts to four decimal places.)

Sales value of total

Joint costs

Chocolate powder

Milk chocolate

Total

More info

production at splitoff

Weighting

-

allocated

More info

It purchases cocoa beans and processes them into two intermediate products:

chocolate-powder liquor base and milk-chocolate liquor base. These two

intermediate products become separately identifiable at a single splitoff point.

Every 1,600 pounds of cocoa beans yields 25 gallons of chocolate-powder liquor

base and 100 gallons of milk-chocolate liquor base.

The chocolate-powder liquor base is further processed into chocolate powder.

Every 25 gallons of chocolate-powder liquor base yield 690 pounds of chocolate

powder. The milk-chocolate liquor base is further processed into milk chocolate.

Every 100 gallons of milk-chocolate liquor base yield 1,110 pounds of milk

chocolate.

Cocoa beans processed, 24,000 pounds

•Costs of processing cocoa beans to splitoff point (including purchase of beans), $52,000

Separable

Selling Price Processing Costs

$11 per pound $

$8 per pound $

Production

Chocolate powder

10,350 pounds

16,650 pounds

Sales

6,900 pounds

14,300 pounds

Milk chocolate

18,150

78,000

Cocoa Bean Edibles Factory fully processes both of its intermediate products into chocolate powder or milk chocolate.

There is an active market for these intermediate products. In August, Cocoa Bean Edibles Factory could have sold

the chocolate-powder liquor base for $16 a gallon and the milk-chocolate liquor base for $6 a gallon.

Print

Done

Print

Done

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Need help with question B sales vale at split off point. Please show how you got the numbers. I really need help calculating cost per liter for each product. Thanksarrow_forwardRalston Dairy gathered this data about the two products that it produces: Products Current SalesValue Estimated AddedProcessing Costs Sales Value IfProcessing Further Frozen yogurt $8,100 $1,900 $10,900 Ice cream 11,900 7,100 17,900 Which of the products should be processed further? because profits $fill in the blank 3.arrow_forwardPlease help mearrow_forward

- 9. Ralston Dairy gathered this data about the two products that it produces: Product Current Sales Value Estimated Added Processing Cost Sales Value If Processed Further Frozen yogurt $8,000 $2,000 $11,000 Ice Cream 12,000 7,000 18,000 PLEASE NOTE: All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). If needed, a Net Loss or decrease will be shown in whole dollars with "$" and parentheses - ($12,345). If processed further, what is the Frozen Yogurt's incremental profit or loss? If processed further, what is the Ice Cream's incremental profit or loss? Which of the products should be processed further? . Please note: Your answer is either "Frozen Yogurt" or "Ice Cream" - capital first letters and no quotes.arrow_forwardSolve all pleasearrow_forwardPlease help mearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education