Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

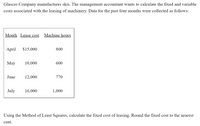

Transcribed Image Text:Glascro Company manufactures skis. The management accountant wants to calculate the fixed and variable

costs associated with the leasing of machinery. Data for the past four months were collected as follows:

Month Lease cost

Machine hours

April

$15,000

800

May

10,000

600

June

12,000

770

July

16,000

1,000

Using the Method of Least Squares, calculate the fixed cost of leasing. Round the fixed cost to the nearest

cent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- "Assuming that you have a land with an area of X m² (Y m x Z m), considering the lowest investment cost and the need to maintain sufficient stock to meet the N-month demand at any given time in the warehouse, design and size a rough warehouse layout (including support service units and surroundings). Determine the prerequisites for the system to operate at high performance (product placement, number of personnel, etc.). The pallet base area can be taken as 80x120 cm with a height of 120 cm. The warehouse primarily consists of 15 different product groups (PG), and the monthly demand for each product group is given in pallet units above." 18:59arrow_forward1.if manufacturing capacity can only be utlized in manufacturing the keyboards what should company do, make/buy? if the company could utlize the spare capacity in producing 30,000 modems,with vaiable cost $12 per unit.what should the company do, knowing that it can sell the modems at $22 per unit?arrow_forwardWhat are the various uses for break-even analysis?arrow_forward

- Easy-Tech Soft ware Corporation is evaluating theproduction of a new soft ware product to compete with thepopular word processing soft ware currently available. Annualfi xed costs of producing the item are estimated at $150,000, andthe variable cost is $10 per unit. Th e current selling price of theitem is $35 per unit, and the annual sales volume is estimated at50,000 units.(a) Easy-Tech is considering adding new equipment thatwould improve soft ware quality. Th e negative aspect ofthis new equipment would be an increase in both fi xedand variable costs. Annual fi xed costs would increase by$50,000 and variable costs by $3. However, marketingexpects the better-quality product to increase demandto 70,000 units. Should Easy-Tech purchase this newequipment and keep the price of their product the same?Explain your reasoning.(b) Another option being considered by Easy-Tech is theincrease in the selling price to $40 per unit to off set theadditional equipment costs. However, this increase…arrow_forward* 00 T 35 R Miles used the information on the table to develop a Decision Tree for this situation and indicate which type of truck should he select. What would Miles's decision be based on Baye's Decision Rule? $16,000 3. $19,000 2 $21,000 $15,000 .5 Compact 000'0 000 $24,000 2. Full-size .2 000 0 Subcompact Can't be determined with the information provided Compact All of the answer choices are correct Full size MacBook Air 000 000 DD F7 F2 F3 F5 F8 F4 & $ 9. 7. 4. J Karrow_forwardLMNO Gaskets has formulated a production plan for a product to meet demand over the upcoming four quarters. Demand in each of the four quarters and production, overtime, and subcontracting capacities are reported in the table below, in addition to the feasible production plan. The relevant costs are: • Regular time production cost is $10/unit. Overtime production cost is $14/unit. Subcontracting cost is $18/unit Inventory is held at a cost of $1/unit/quarter. • Units may be backordered at a cost of $4/unit/quarter. Production Resource Regular Time Q1 Overtime Q1 Subcontract Q1 Regular Time Q2 Overtime Q2 Subcontract Q2 Regular Time Q3 Overtime Q3 Subcontract Q3 Demand in Quarter Demand in Quarter Q2 0 20 0 550 Q1 550 230 0 0 0 0 40 40 0 860 250 470 0 40 0 1330 What is the inventory cost for the year? What is the backorder cost for the year? What is the total cost for the year? Q3 0 0 0 0 0 30 510 160 0 700 What is the total overtime production cost for the year? Capacity 550 250 500…arrow_forward

- The industry in which Morton Company operates is quite sensitive to cyclical movements in the economy. Thus, profits vary considerably from year to year according to general economic conditions. The company has a large amount of unused capacity and is studying ways of improving profits. Required: 1. New equipment has come onto the market that would allow Morton Company to automate a portion of its operations. Variable expenses would be reduced by $8.70 per unit. However, fixed expenses would increase to a total of $642,060 each month. Prepare two contribution format income statements, one showing present operations and one showing how operations would appear if the new equipment is purchased. 2. Refer to the income statements in (1). For the present operations and the proposed new operations, compute (a) the degree of operating leverage, (b) the break-even point in dollar sales, and (c) the margin of safety in dollars and the margin of safety percentage. 3. Refer again to the data in…arrow_forwardA 126,000 square foot office building in Plano, Texas is fully leased to the Dr. Pepper Snapple Group at a base rent of $2.50 per square foot per month. The building’s expenses total $0.90 per square foot per month and an expense stop in the Dr. Pepper lease is set at $6.00 per square foot per year. What is the annual NOI? a. $3,024,000 b. $3,175,200 c. $3,780,000 d. $2,419,200arrow_forwardThunderbird Manufacturing purchases a new stamping machine for $40,000. Its useful life is estimated to be 250,000 units with a salvage value of $5,000. Prepare a units-of-production (UOP) depreciation schedule based on the given annual usage (units produced) as shown below. chart attachedarrow_forward

- How did you calculate the reduced cost, allowable increase, and allowable decrease in the table for range of opitmality?arrow_forwardWhat is CAPACITY REQUIREMENTS FORECASTING?arrow_forwardAlar is a manager at Shoeless Joe's Sports Bar and Grill and was approached by a hockey team asking for sponsorship. Sponsorship would mean purchasing 18 jerseys for the team BUT would see the team visit the restaurant on a regular basis. • The EXPECTED RETURNS for the restaurant from these visits would be Gross Sales of $2,000 per year for an expected five years. (Assume the restaurants profit margin on food/alcohol sales is 40%, so USE NET PROFIT of $800 per year for all calculations). Further, the jerseys would have the Shoeless Joe's logo and act as advertising (a goodwill function in accounting), BUT this is not considered in the calculations. Alar remembers something about CLTV in college and wants to calculate the CLTV using different methods on ONLY the future expected business from the team ($800 per year) (ignore advertising or goodwill from the jerseys). Determine: a) The CLTV of the team for "five years" using the "Easy Method". b) The CLTV of the team using the "Simple…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.