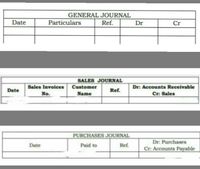

Journalize the transactions in a merchandising business in general journal - purchase and sales. See the template below for general journal, purchase journal, and sales journal. (This is the correct template please be guided)

Write your answer on a columnar sheet.

On January 15, Aeron Trading purchased from Victoria Merchandising goods amounting to ₱30,000

on term 50% down, balance 2/10, n/30. The next day, Aeron Trading issued a ₱2,000 debit

memorandum to Victoria Merchandising for the return of defective merchandise bought. On January

20, Aeron Trading paid ₱10,000 as partial payment. Aeron Trading settled in full the outstanding

account with Victoria Merchandising on January 25.

1. Journalize the above transactions using periodic inventory system and general

journal of:

A. Aeron Trading

B. Victoria Merchandising

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- Fill in the blanks for question: Dec. 15: Received a check from Stewart Office Supply for full amount owed on Nov. 15 sale. Transactions with dates are in picture/ screenshot.arrow_forwardPrepare journal entries for the following transactions from Barrels Warehouse. Jul. 1 Sold 5,000 barrels with a sales price of $40 per barrel to customer Luck’s Vineyards. Luck’s Vineyards paid with cash.The cost for this sale is $20 per barrel. Jul. 3 Sold 1,500 barrels with a sales price of $32 per barrel to customer Paramount Apparel.Paramount paid using its in-house credit account. Terms of the sale are 3/10, n/30. The cost for this sale is $17 per barrel. Jul. 5 Sold 1,400 barrels with a sales price of $35 per barrel to customer Melody Sharehouse. Melody paid using her MoneyPlus credit card.The cost for this sale is $18 per barrel. MoneyPlus Credit Card Company charges Barrels Warehouse a 2% usage fee based on the total sale per transaction. Jul. 8 MoneyPlus Credit Card Company made a cash payment in full to Barrels Warehouse for the transaction from July 5, less any usage fees. Jul. 13 Paramount Apparel paid its account in full with a cash payment, less any discounts.…arrow_forwardPets Unlimited sells pet supplies to retailers. The company uses a perpetual inventory. Journalize the following transactions for the company: June 1 Sold merchandise for $6,250 with terms 2/10, n/30. Inventory cost was $5,000. 5 Sold merchandise for $10,000 with terms 3/10, n/30. Inventory cost was $6,000. 11 Received a check from the customer paying the balance due within the discount period.arrow_forward

- Prepare journal entries 1-7 please and thank you.arrow_forward1. During October, the company had several transactions. Prepare journal entries for the transactions below and post them to the t-accounts. a. Sold merchandise with an original cost of $73,000 on account for a total selling price of $170,000. DR Accounts Receivable CR Revenue DR COGS CR Inventory DR Inventory DR PP&E I b. Purchased merchandise inventory on account from various suppliers for $92,600. 92,600 CR Accounts Payable Paid rent of $23,500 for the month of October. CR Cash 170,000 23,500 73,000 23,500 170,000 73,000 92,600arrow_forwardThe following transactions occurred during the month of November in the operation of Wonderful Buy, Inc, a retailer of electronic merchandise. Record each transaction listed below to show its impact on the accounting equation in the table provided on the next page for that purpose. For any entry that impacts Retained Earnings, write a brief description in the column provided. November 4 Purchased merchandise for $6,000 on account from International Fragrance Corporation, terms: 3/10, n/60. November 16 Sold merchandise to a customer on account for $8,000, terms 2/10, n/30. The merchandise had cost Wonderful Buy’s $4,000. November 18 Sold merchandise to a customer for cash, $850. The merchandise had cost Wonderful Buy’s $350. November 19 Customer returned $200 of the merchandise from the sale on November 18 and was given a refund. The…arrow_forward

- Please help mearrow_forwardDirections: Below are the accounts of Llamado Poultry Supply Store for the year ended June 30, 2020. 1. Create SCI using a multi-step approach. Please make the proper indention of accounts as you write them in the SCI. 2. The indention will serve as your guide in computing and will make your document look formal. Sales P 100,000 Sales Returns and Allowances 1,000 1,500 Sales Discount Merchandise Inventory, Beginning 38,000 Purchases 30,000 Purchase Returns and Allowances. 2,000 Purchase Discount 1,000 Freight-in Merchandise Inventory, Ending 700 20,000 Interest Income 7,000 Rent Income 3,000 Sales Salaries 12,000 Depreciation Expense - Store Equipment Utilities Expense-Store 9,000 2,000 Office Salaries 12,000 Office Supplies 1,000 Bad Debts 1,300 Finance Cost 2,100arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education