FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Journalize the following transactions for Stillwater Spa Consultants:

| Oct. | 1 | Sold services for $100,000 to customers using debit cards. Assume the bank charges 0.5% for all debit card transactions. |

| 7 | Sold services to customers for $12,000 cash. | |

| 8 | Recorded Visa credit card sales totaling $58,000. Assume visa applies fees of 2%. | |

| 10 | Sold $42,000 of services to Edson Community Health Clinic, terms 2/15, n/30. | |

| 25 | Collected the amount owing regarding the October 10 sale. |

Record-

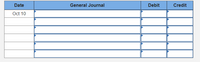

1. Record the sale of services; terms 2/15, n/30 (Oct 10)

2. Record the collection of the Oct. 10 credit sale. (Oct 25)

Image attached for reference:

Transcribed Image Text:Date

General Journal

Debit

Credit

Oct 10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On June 1, Target sold 100 HP laptops to UCF for $500 each with terms of 3/15, n30. On June 11, UCF paid their invoice and took the discount. What journal entry (debit and credit) should Target record on June 11? (Select all answers that apply) O Debit Sales Discounts $1,500 O Credit Sales Revenue $48,500 O Credit Sales Discounts $1,500 O Debit Accounts Receivable $48,500 O Credit Accounts Receivable $50,000 O Debit Cash $48,500 O Debit Accounts Receivable $50,000 O Credit Accounts Receivable $48,500 O Credit Sales Revenue $50,000 O Debit Cash $50,000 ASUS f4 f5 f6 X f7 f9 f10 f11 4. 5 6 7 8. 图arrow_forwardJournalize the transactions shown below in the two-column general journal that follows. Calculate HST (13%) on all sales transactions. | Oct. 2 Cash Sales Slip No. 102 to S. Stewart, $102.50 plus taxes. 6 Sales Invoice No. 617 to Jack Morrison, $250.90 plus taxes. Cheque Copy 10 No. 910 to Industrial Suppliers, $500 on account. Cash Receipt From Jack Mahoney, $322.50 on account. 12 18 Purchase Invoice From Grand's Stationers, S60.50 for office supplies taxes. 20 Cheque Copy No. 911 to Jack Whitcombe, $525 for personal use. 24 Bank Debit Memo $31.90 for bank service charge. Cash Sales Slip No. 103 to J. Beck, $450 plus taxes. 31arrow_forwardMelody, Inc., accepts a national credit card. The collection fee is 6%. If credit card sales are $500, the correct journal is a. Accounts receivables 470 Sales 470 b. Accounts receivables 470 Credit card expense 30 Sales 500 c. Accounts receivables 500 Sales 500 d. Accounts receivable 500 Credit card discount 30 Sales 470arrow_forward

- Please answer the question correctly. Thank youarrow_forwardRestaurants do a large volume of business by credit and debit cards. Suppose Chocolate Passion restaurant had these transactions on January 28: View the transactions. Read the requirements. ☑ Requirement 1. Suppose Chocolate Passion's processor charges a 6% fee and deposits sales net of the fee. Journalize these sale transactions for the restaurant. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Journalize the credit sales net of the fee, first. Date Accounts and Explanation Transactions Debit Credit National Express credit card sales $ 10,700 ValueCard debit card sales 8,000 Print Done ☑ Requirements - Suppose Chocolate Passion's processor charges a 6% fee and deposits sales net of the fee. Journalize these sales transactions for the restaurant. 2. Suppose Chocolate Passion's processor charges a 6% fee and deposits sales using the gross method. Assume that on January 28, the company pays the fees assessed by the credit card…arrow_forwardPlease help with the following question Q3: Shafer Company has the following accounts in its general ledger atJuly 31: Accounts Receivable $49,000 and Allowance for Doubtful Accounts $3,400. During August, the following transactions occurred. Aug.15Sold $30,000 of accounts receivable to More Factors, Inc. who assesses a 2% finance charge. 25Made sales of $2,500 on Visa credit cards. The credit card service charge is 3%. 28Made sales of $4,000 on Shafer credit cards. Instructions (a)Journalize the transactions. (b)Indicate the statement presentation of service charges. BR,arrow_forward

- Current Attempt in Progress Crane Company has the following accounts in its general ledger at July 31: Accounts Receivable $32,800 and Allowance for Doubtful Accounts $2,050. During October, the following transactions occurred. Oct. 15 Sold $13,100 of accounts receivable to Nelson Factors, Inc. who assesses a 4% finance charge. 25 Made sales of $800 on VISA credit cards. The credit card service charge is 3%. Journalize the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Creditarrow_forwardBritta's Sandwiches operates as a sandwich and wrap shop. Its customers can pay by cash, debit or credit card. For each debit transaction, Britta pays $0.20. For credit cards, Britta pays 3% of the total credit card transactions. On September 10, 2022, Britta compiled the following summary for the work day. Transaction Type Total Number of Transactions Cash $413 50 Debit Card $318 43 Credit Card $0 0 Required Do not enter dollar signs or commas in the input boxes. a) Calculate the total debit/credit card expense for September 10. Total Debit/Credit Card Expense = $8.60 b) Record the journal entry for the day's sales ignoring Cost of Goods Sold.arrow_forwarddo not provide answer in image formatarrow_forward

- 3. On March 3, Greentree Appliances sells $480,000 of its receivables to Naomi Factors, Inc. Naomi Factors assesses a finance charge of 6% of the amount of receivables sold. Prepare the entry on Greentree Appliance's books to record the sale of the receivables. List two advantages to Greentree to using a factor. Date Account Titles and Explanation Ref Debit Credit EXTRA CREDIT: List two advantages to Greentree due to using a factor.arrow_forwardSales revenue for Hy Marx Tutoring was $620,000. The following data are from the accounting records of Marx: Accounts receivable, January 1 $ 106,000 Accounts receivable, December 31 75,000 The cash received from customers was: Multiple Choice $545,000. $651,000. $589,000. $620,000.arrow_forwardAI Kamil Hypermarket accepted a Bank Muscat credit card for a RO 7,500 purchase. Bank Muscat charges a 4% fee. Al Kamil Hypermarket should record Service Charge Expense as a Select one: O a Debit of RO 7,500 O b. None of the answers are correct O c Credit of RO7,200 O d. Credit of RO 300 O e. Debit of RO 300arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education