FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

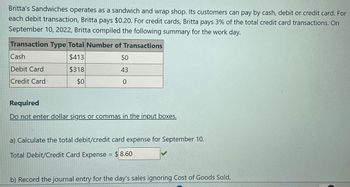

Transcribed Image Text:Britta's Sandwiches operates as a sandwich and wrap shop. Its customers can pay by cash, debit or credit card. For

each debit transaction, Britta pays $0.20. For credit cards, Britta pays 3% of the total credit card transactions. On

September 10, 2022, Britta compiled the following summary for the work day.

Transaction Type Total Number of Transactions

Cash

$413

50

Debit Card

$318

43

Credit Card

$0

0

Required

Do not enter dollar signs or commas in the input boxes.

a) Calculate the total debit/credit card expense for September 10.

Total Debit/Credit Card Expense = $8.60

b) Record the journal entry for the day's sales ignoring Cost of Goods Sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Pagan Restaurants accepts credit and debit cards as forms of payment. Assume Pagan had $10,000 of credit and debit card sales on April 30, 2023. 9. 10. Suppose Pagan's processor charges a 1% fee and deposits sales net of the fee. Joumalize the sales transaction for the restaurant. Suppose Pagan's processor charges a 1% fee and deposits sales using the gross method. Journalize the sales transaction for the restaurant. 9. Suppose Pagan's processor charges a 1% fee and deposits sales net of the fee. Journalize the sales transaction for the restaurant. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Apr. 30 10. Suppose Pagan's processor charges a 1% fee and deposits sales using the gross method. Joumalize the sales transaction for the restaurant. Date Apr. 30 Accounts and Explanation Debit Creditarrow_forwardFrom the following facts, Molly Roe has requested you to calculate the average daily balance. The customer believes the average daily balance should be $877.67. Respond to the customer’s concern. Note: Round your final answer to the nearest cent. 28-day billing cycle 3/18 Billing date $ 672 Previous balance 3/24 Payment $ 59 Credit 3/29 Charge: Sears 218 4/5 Payment 17 Credit 4/9 Charge: Macy’s 166 Average daily balance:arrow_forwardPlease answer question correctlyarrow_forward

- For the accounts receive and interest revenue I for march 20, I got 13, however its wrong, can you tell me what I am doing wrong? our answer is partially correct. Try again. On January 10, Molly Amise uses her Windsor, Inc. credit card to purchase merchandise from Windsor, Inc. for $1,500. On February 10, Molly is billed for the amount due of $1,500. On February 12, Molly pays $1,300 on the balance due. On March 10, Molly is billed for the amount due, including interest at 1% per month on the unpaid balance as of February 12.Prepare the entries on Windsor, Inc.’s books related to the transactions that occurred on January 10, February 12, and March 10. (Omit cost of goods sold entries.) (Round answers to 0 decimal places, e.g. 825. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit choose a transaction…arrow_forwarddo not provide answer in image formatarrow_forwardThe activity date, company, and amount for your credit card bill is shown below. The due date of the bill is September 15. Activity Date Company Amount August 15 Unpaid Balance $1236.43 August 16 Veterinary Clinic 125.00 August 17 Gasoline 23.56 August 18 Olive’s Restaurant 53.45 August 20 Seaside Market 41.36 August 22 Monterey Hotel 223.65 August 25 Airline Tickets 310.00 August 30 Bike 101 23.26 September 1 Trattoria Maria 36.45 September 12 Seaside Market 41.25 September 13 Credit Card Payment 1345.00 Find the finance charge on your September 15 bill if the interest rate is 18% APR.arrow_forward

- On June 14, Year 1, Sure-Fit Shoe Store sold $13,000 of merchandise that cost $8,700 and accepted credit cards as payment. Sure-Fit electronically transmitted the credit card forms to the credit card company which charges a 4% fee to handle such transactions. On June 18, Year 1, Sure-Fit received the proceeds from the credit card company. Required: a. How will the entry to record the sale of the merchandise on June 14, Year 1, affect the company's financial statements? b. How will the entry to record the credit card proceeds on June 18, Year 1, affect the company's financial statements? Complete this question by entering your answers in the tabs below. Required A Required B How will the entry to record the sale of the merchandise on June 14, Year 1, affect the company's financial statements? Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Assets Balance Sheet Liabilities Stockholders' Equity Revenue Income…arrow_forwardAinsley Emporium sells gift cards to customers. In December, customers purchased $10,000 of gift cards. During December, the gift card recipients used gift cards to purchase $3,000 of goods. Prepare Ainsley’s entry for (1) the sale of the gift cards and (2) the year-end adjusting entry. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit (To record cash received for goods to be provided at a later date) (To record the sale of merchandise using a gift card)arrow_forwardOn July 4, Ivanhoe’s Restaurant accepts a Visa card for a $500 dinner bill. Visa charges a 2% service fee.Prepare the entry on Ivanhoe’s books related to this transaction. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit July 4arrow_forward

- Zane Enterprises accepts a credit card as payment for $1,000 of services provided to a customer. The credit card company charges a 4% handling charge for its collection services. Based on this information Multiple Choice Zane will pay the credit card company $1,000 cash. Zane will collect $1,000 cash from the credit card company. Zane will pay the credit card company $960 cash. Zane will collect $960 cash from the credit card company.arrow_forwardEX.06.206.ALGO On March 4, Micro Sales makes $8,400 in sales on bank credit cards that charge a 3% service charge. Funds are deposited net of credit card expenses into Micro Sales' bank account at the end of the business day. Journalize the sales and recognition of expense as a single journal entry. If an amount box does not require an entry, leave it blank. Mar. 4 fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 fill in the blank 8 fill in the blank 9arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education