FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

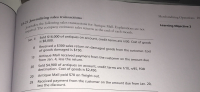

Transcribed Image Text:Journalize the following sales transactions for Antique Mall. Explanations are not

E5-21 Jo

required. The company estimates sales returns at the end of each month.

Sold $16,000 of antiques on account, credit terms are n/30. Cost of goods

Jan. 4

is $8,000.

Received a $300 sales return on damaged goods from the customer. Cost

8.

of goods damaged is $150.

13 Antique

Antique Mall received payment from the customer on the amount due

from Jan. 4, less the return.

20

Sold $4,900 of antiques on account, credit terms are 1/10, n/45, FOB

destination. Cost of goods is $2,450.

Antique Mall paid $70 on freight out.

20

Received payment from the customer on the amount due from Jan. 20,

29

less the discount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journalize the transactions in the accounts of zippy interiors company. Se for unction civadies, using allowance method Chart of Accounts General Journal Instructions May Sept Dec. 24 Sold merchandise on account to Old Town Cafe $36,010. The cost of goods sold was $22,050. 30 Received $11,500 from Old Town Cafe and wrote off the remainder owed on the sale of May 24 as uncollectible. Rei ated account of Old Town Cafe that been ritten off on September 30 and received $24,510 cash in full payment. Joumalize the above transactions in the accounts of Zippy Interiors Company, a restaurant supply company that uses the allowance method of accounting for uncollectible receivarrow_forwardDo not give answer in imagearrow_forwardRecord the transactions on the books of Martinez corporation.arrow_forward

- 10 Record journal entries for the following transactions of Furniture Warehouse. A. Aug. 3: Sold 15 couches at $500 each to a customer, credit terms 2/15, n/30, invoice date August 3; the couches cost Furniture Warehouse $150 each. B. Aug. 8: Customer returned 2 couches.for a full refund. The merchandise was in sellable condition at the original cost. C. Aug. 15: Customer found 4 defective couches but kept the merchandise for an allowance of $1,000. D. Aug. 18: Customer paid their account in full with cash. Solution Debit Credit Date Accounts and Explanationarrow_forwardquestion on the imagesarrow_forwardMake a Sales journal entries for the following: EA11. L0 6.4 Record the journal entry or entries for each of the following sales transactions. Glow Industriessells 240 strobe lights at $40 per light to a customer on May 9. The cost to Glow is $23 per light. The terms ofthe sale are 5/15, n/40, invoice dated May 9. On May 13, the customer discovers 50 of the lights are the wrongcolor and are granted an allowance of $10 per light for the error. On May 21, the customer pays for the lights,less the allowance. Check Figures:• May 9th entry should include a credit toInventory of $5,520• May 21st entry should include a credit toA/R for $9,100 I've attached the exa exercise below to support for your work ?arrow_forward

- Please provide answer in text (Without image), every entry should have narration pleasearrow_forwardReview the following situations and record any necessary journal entries for Mequon’s Boutique. May 10 Mequon’s Boutique purchases $2,700 worth of merchandise with cash from a manufacturer. Shipping charges are an extra $110 cash. Terms of the purchase are FOB Shipping Point. May 14 Mequon’s Boutique sells $3,400 worth of merchandise to a customer who pays with cash. The merchandise has a cost to Mequon’s of $1,800. Shipping charges are an extra $150 cash. Terms of the sale are FOB Shipping Point. If an amount box does not require an entry, leave it blank. Assume the perpetual inventory system is used.arrow_forwardRecord the following purchase transactions of Money Office Supplies. Aug. 3 Purchased 30 chairs on credit, at a cost of $60 per chair. Shipping charges are an extra $5 cash per chair and are not subject to discount. Terms of the purchase are 4/10, n/60, FOB Shipping Point, invoice dated August 3. Aug. 7 Purchased 22 chairs with cash, at a cost of $50 per chair. Shipping charges are an extra $3.50 cash per chair and are not subject to discount. Terms of the purchase are FOB Destination. Aug. 12 Money Office Supplies pays in full for their purchase on August 3. If an amount box does not require an entry, leave it blank. Assume the perpetual inventory system is used. Aug. 3 Purchase Merchandise Inventory Merchandise Inventory Accounts Payable Accounts Payable Aug. 3 Shipping charges Merchandise Inventory Merchandise Inventory Cash Cash Aug. 7 Purchase with cash Merchandise Inventory Merchandise Inventory Cash Cash Aug. 12…arrow_forward

- Pass the journal entries for the following : Jan 27 - purchased goods on credit, $4000 less trade discount 25% Feb 15 - sold household furniture for $1200 and paid the money into business casharrow_forwardPlease answer the question correctly. Thank youarrow_forwardInstructions May Sept Dec. 24 Sold merchandise on account to Old Town Cafe $39,560. The cost of the goods sold was $24,540. Received $11,930 from Old Town Cafe and wrote off the remainder owed on the sale of May 24 as uncollectible 30 7 Reinstated the account of Old Town Cafe that had been written off on September 30 and received $27,630 cash in full payment. Journalize the above transactions in the accounts of Zippy Interiors Company, a restaurant supply company that uses the allowance method of accounting for uncollectible receivables Refer to the Chart of Accounts for exact wording of account t untitlesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education