FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Exam Midterm_F22_C_send.pdf X +

ure.com/courses/69731/quizzes/431211/take

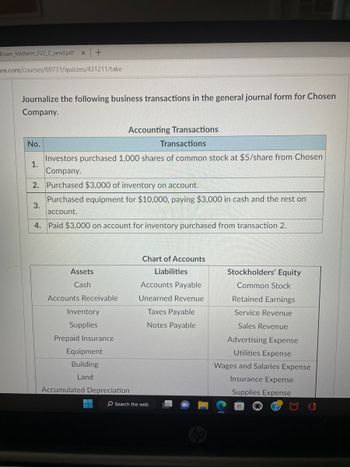

Journalize the following business transactions in the general journal form for Chosen

Company.

Accounting Transactions

Transactions

Investors purchased 1,000 shares of common stock at $5/share from Chosen

Company.

2. Purchased $3,000 of inventory on account.

Purchased equipment for $10,000, paying $3,000 in cash and the rest on

account.

4. Paid $3,000 on account for inventory purchased from transaction 2.

No.

1.

3.

Assets

Cash

Accounts Receivable

Inventory

Supplies

Prepaid Insurance

Equipment

Building

Land

Accumulated Depreciation

Chart of Accounts

Liabilities

Accounts Payable

Unearned Revenue

Taxes Payable

Notes Payable

O Search the web

Stockholders' Equity

Common Stock

Retained Earnings

Service Revenue

Sales Revenue

Advertising Expense

Utilities Expense

Wages and Salaries Expense

Insurance Expense

Supplies Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me with all answers I will give upvote thankuarrow_forwardprepare a balance sheet and income statement from the following information: Cash $625.00 Revenue $21,000.00 Note Payable $5,000.00 Retained Earnings $10,600.00 Expenses $7,000.00 Issued Capital Stock $500.00 Accounts Receivable $2,500.00 Inventory $6,900.00 Accounts Payable $1,000.00 Cost of Goods Sold $10,500.00 Accrued Sales Tax $1,425.00 Prepaid Insurance $12,000.00 Plz answer fast without plagiarism i give up votearrow_forwardbalance sheets Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Current liabilities Long-term notes payable Common stock, $5 par value Retained earnings Total liabilities and equity Problem 13-5A (Algo) Part 1 $ 19,500 37,400 84,640 5,900 350,000 $ 497,440 $ 33,000 56,400 134,500 6,900 304,400 $ 535,200 $ 68,340 86,800 190,000 152,300 $ 497,440 $ 535,200 $ 91,300 115,000 206,000 122,900 statement Sales Cost of goods sold Interest expense Income tax expense Net income Basic earnings per share Cash dividends per share Beginning-of-year balance sheet data Accounts receivable, net Merchandise inventory Total assets Common stock, $5 par value Retained earnings Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) invent sales in inventory, and () days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company…arrow_forward

- Presented below are selected account balances for Skysong Co. as of December 31, 20X1. Inventory 12/31/X1 Common Stock Retained Earnings Dividends Sales Returns and Allowances $60,380 73,910 44,880 18,039 Cost of Goods Sold Selling Expenses Administrative Expenses Income Tax Expense $224,260 16,250 37,419 29,860 11,879 Sales Discounts 15,240 Sales Revenue 417,310 Prepare closing entries for Skysong Co. on December 31, 20X1.arrow_forwardAn excerpt from Ivanhoe Company's accounting records is provided below. Sales revenue $627,000 Cost of goods sold 346,500 Wages expense 123,750 Depreciation expense 15,675 Rent expense 50,325 Interest expense 4,950 Income tax expense 14,850 Retained earnings 36,300 Dividends declared 16,500 Wages payable 12,375 Cash 41,250 Accounts receivable 61,875 Accounts payable 82,500 M σε Ac Q Ac Q Ac Using only the data provided above, record all the required closing entries using proper Journal Entry form. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Q Ac A C M Narrow_forwardSubject: acountingarrow_forward

- Question 1 The following are financial statements of Crane Company. Crane CompanyIncome StatementFor the Year Ended December 31, 2022 Net sales $2,192,500 Cost of goods sold 1,010,500 Selling and administrative expenses 900,500 Interest expense 78,000 Income tax expense 62,500 Net income $ 141,000 Crane CompanyBalance SheetDecember 31, 2022 Assets Current assets Cash $ 55,100 Debt investments 89,000 Accounts receivable (net) 168,400 Inventory 236,500 Total current assets 549,000 Plant assets (net) 572,500 Total assets $ 1,121,500 Liabilities and Stockholders’ Equity Current liabilities Accounts payable $ 152,000 Income taxes payable 31,000 Total current liabilities 183,000 Bonds payable 220,740 Total liabilities 403,740 Stockholders’ equity Common stock 345,000 Retained earnings 372,760…arrow_forward1arrow_forwardSingle-Step Income Statement The following selected accounts and their current balances appear in the ledger of Prescott Inc. for the fiscal year ended September 30, 20Y8: Cash $187,875 Retained Earnings $ 571,050 Accounts Receivable 337,500 Dividends 281,250 Inventory 855,000 Sales 8,025,750 Estimated Returns Inventory 78,750 Cost of Goods Sold 4,893,750 Office Supplies 33,750 Sales Salaries Expense 874,800 Prepaid Insurance 27,000 Advertising Expense 103,275 Office Equipment 259,200 Depreciation Expense— Store Equipment 18,675 Accumulated Depreciation— Office Equipment 111,375 Miscellaneous Selling Expense 4,500 Store Equipment 1,150,875 Office Salaries Expense 174,150 Accumulated Depreciation— Store Equipment 420,075 Rent Expense 89,775 Accounts Payable 109,350 Insurance Expense 51,638 Customer Refunds Payable 78,750 Depreciation Expense— Office Equipment 36,450…arrow_forward

- J. P. Robard Mfg., Inc. Balance Sheet ($000) Cash $470 Accounts receivable 2,100 Inventories 940 Current assets $3,510 Net fixed assets 4,590 Total assets $8,100 Accounts payable $1,120 Accrued expenses 580 Short-term notes payable 280 Current liabilities $1,980 Long-term debt 2,040 Owners' equity 4,080 Total liabilities and owners' equity $8,100 (Click on the icon in order to copy its contents into a spreadsheet.) J. P. Robard Mfg., Inc. Income Statement ($000) Net sales (all credit) $8,010 Cost of goods sold (3,300) Gross profit $4,710 Operating expenses (includes $500 depreciation) (3,090) Net operating income $1,620 Interest expense (360) Earnings before taxes $1,260 Income taxes (35%) (441) Net income $819arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education