FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Don't give answer in image format

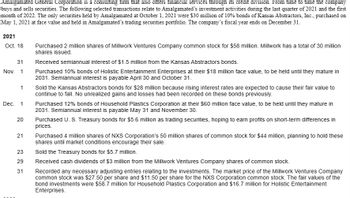

Transcribed Image Text:Amalgamated General Corporation is a consulting firm that also offers financial services through its credit division. From time to time the company

buys and sells securities. The following selected transactions relate to Amalgamated's investment activities during the last quarter of 2021 and the first

month of 2022. The only securities held by Amalgamated at October 1, 2021 were $30 million of 10% bonds of Kansas Abstractors, Inc., purchased on

May 1, 2021 at face value and held in Amalgamated's trading securities portfolio. The company's fiscal year ends on December 31.

2021

Oct. 18

31

Nov. 1

1

Dec. 1

20

21

23

29

31

Purchased 2 million shares of Millwork Ventures Company common stock for $58 million. Millwork has a total of 30 million

shares issued.

Received semiannual interest of $1.5 million from the Kansas Abstractors bonds.

Purchased 10% bonds of Holistic Entertainment Enterprises at their $18 million face value, to be held until they mature in

2031. Semiannual interest is payable April 30 and October 31.

Sold the Kansas Abstractors bonds for $28 million because rising interest rates are expected to cause their fair value to

continue to fall. No unrealized gains and losses had been recorded on these bonds previously.

Purchased 12% bonds of Household Plastics Corporation at their $60 million face value, to be held until they mature in

2031. Semiannual interest is payable May 31 and November 30.

Purchased U. S. Treasury bonds for $5.6 million as trading securities, hoping to earn profits on short-term differences in

prices.

Purchased 4 million shares of NXS Corporation's 50 million shares of common stock for $44 million, planning to hold these

shares until market conditions encourage their sale.

Sold the Treasury bonds for $5.7 million.

Received cash dividends of $3 million from the Millwork Ventures Company shares of common stock.

Recorded any necessary adjusting entries relating to the investments. The market price of the Millwork Ventures Company

common stock was $27.50 per share and $11.50 per share for the NXS Corporation common stock. The fair values of the

bond investments were $58.7 million for Household Plastics Corporation and $16.7 million for Holistic Entertainment

Enterprises.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- e File Edit View History Bookmarks Profiles Tab Window Help Week 4 Home X Short Exercis X G Dalton Hair St X C For each acco X plus.pearson.com/products/658729f2-cb81-45ee-babb-bf032e847a35/pages/urn:pearso... ☆ 5 6 32 Total 33 Net (b) 34 Total 35 A partial worksheet for Ramey Law Firm is presented below. Solve for the missing information. A 6 32 Total 33 Net (c) 34 Total 35 End of Chapter: Completing the Accounting Cycle A J Income Statement Debit (a) 8,375 (d) Credit $ 24,850 (e) $ 24,850 JA 23 Income Statement Debit $ 22,400 K Credit (a) F4-34 S-F:4-8. Determining net loss using a worksheet (Learning Objective 2) A partial worksheet for Aaron Adjusters is presented below. Solve for the missing information. 5,300 (f) L ▶ M Balance Sheet Debit $ 211,325 C For each acce X (e) L Debit (b) (d) (g) Credit $ 202,950 tv (c) (f) Balance Sheet M Credit $61,400 + $ 61,400 AA ⠀arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardDo not give answer in imagearrow_forward

- Please do not give solution in image format ?arrow_forwardanswer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardChart of Accounts Common Stock Cash Accounts Receivable Retained Earnings Supplies Dividends Prepaid Rent Office Equipment Accounts Payable Notes Payable Unearned Fees Fees Earned Salary Expense Rent Expense Supplies Expense Interest Expense Utility Expense During the month of June, Acme Inc. entered into the following transactions: 1 Transferred cash from a personal bank account in exchange for stock, $100,000 3 Recorded services provided on account, $9,100 5 Received cash from clients as an advance payment for services to be provided in July, $12,500 7 Purchased Office Equipment for $5,000, paying $500 cash and signing a Note for the remainder. 9 Receive cash for services provided: $5,000 10 Paid part-time receptionist for two weeks' salary $1,750 12 Purchased office supplies from Staples on account, $1,200 14 Billed clients for fees earned; $2,500 16 Paid $1,000 for 3 months rent for the months of July - September 18 Paid Staples, $600 24 Received cash from clients on account,…arrow_forward

- im.2arrow_forwardCeradyne Limited accepts a three-month, 7%, $43,600 note receivable in settlement of an account receivable on April 1, 2018. Interest is due at maturity. Prepare the journal entries required by Ceradyne Limited to record the issue of the note on April 1, and the settlement of the note on July 1, assuming the note is honoured and that no interest has previously been accrued. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) te Account Titles and Explanation < Debit C Prepare the journal entries required by Ceradyne Limited to record the issue of the note on April 1, and the settlement of the note on July 1, assuming that the note is dishonoured, but eventual collection is expected. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account…arrow_forwardcan you provide me the listing and examples of the closing entriesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education