FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

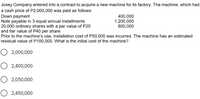

Transcribed Image Text:Josey Company entered into a contract to acquire a new machine for its factory. The machine, which had

a cash price of P2,000,000 was paid as follows:

Down payment

Note payable in 3 equal annual installments

20,000 ordinary shares with a par value of P25

and fair value of P40 per share

Prior to the machine's use, installation cost of P50,000 was incurred. The machine has an estimated

400,000

1,200,000

800,000

residual value of P100,000. What is the initial cost of the machine?

O 2,000,000

2,400,000

O 2,050,000

O 2,450,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- teele Corp. purchases equipment for $25,000. Regarding the purchase, Steele recorded the following transactions: • Paid shipping of $1,000• Paid installation fees of $2,000• Pays annual maintenance cost of $200• Received a 5% discount on $25,000 sales price Determine the acquisition cost of the equipment.arrow_forwardSteele Corp. purchases equipment for $20,000. Regarding the purchase, Steele recorded the following transactions: • Paid shipping of $900. • Paid installation fees of $1,800. • Pays annual maintenance cost of $280. • Received a 5% discount on $20,000 sales price. Determine the acquisition cost of the equipment.arrow_forwardBay Lake Mining Ltd. purchases earth-moving equipment on 1 August 20X6 and signs a three-year note with the supplier, agreeing to pay $430,000 on 31 July 20X9. There is no interest in the note. The equipment purchased does not have a readily determinable market value. (PV of $1. PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Does Bay Lake Mining Ltd. actually have a no-Interest loan? 1-b. This part of the question is not part of your Connect assignment. 2. Calculate the present value of the note payable, using an interest rate of 7%. (Round time value factor to 5 decimal places and final answer to the nearest dollar amount.) Present value Year 3. This part of the question is not part of your Connect assignment. 4. Prepare a table that shows the balance of the note payable and Interest expense over the life of the note. (Round your final answers to the nearest dollar amount.) No 1 Yes No 2 1 2 3 3 Answer is complete and correct. $…arrow_forward

- Steele Corp. purchases equipment for $20,000. Regarding the purchase, Steele recorded the following transactions: • Paid shipping of $800. • Paid installation fees of $1,600. Pays annual maintenance cost of $240. • Received a 5% discount on $20,000 sales price. Determine the acquisition cost of the equipment.arrow_forwardSushi Corp. purchased and installed electronic payment equipment at its drive-in restaurants in San Marcos, TX, at a cost of $51,300. The equipment has an estimated residual value of $3,300 The equipment is expected to process 267,000 payments over its three- year useful life. Per year, expected payment transactions are 64,080, year 1, 146,850, year 2, and 56,070, year 3. TIP: You cannot depreciation past residual/salvage value in the last year of depreciation. Required: Complete a depreciation schedule for each of the alternative methods. 1. Straight-line. 2. Units-of-production. 3. Double-declining-balance. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Complete a depreciation schedule for Straight-line method. (Do not round intermediate calculations.) Income Statement Year At acquisition 1 2 3 Depreciation Expense $ Cost 51,300 51,300 Balance Sheet wwwwww 51,300 Accumulated Depreciation Required 1 Book Value Required 2 >arrow_forwardAlgor Inc. entered into a $975,000 3-year contract to maintain a client's computer system. At the end of the first year, the costs incurred on the contract were $225,000 and it was estimated that a further $520,000 would be incurred over the remaining years of the contract. What is the amount of profit that can be recognized on this contract for the first year? $196,875 $69.463 $421,875 $294.463arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education