FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

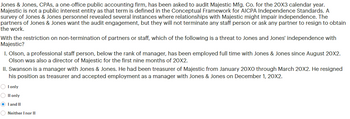

Transcribed Image Text:Jones & Jones, CPAS, a one-office public accounting firm, has been asked to audit Majestic Mfg. Co. for the 20X3 calendar year.

Majestic is not a public interest entity as that term is defined in the Conceptual Framework for AICPA Independence Standards. A

survey of Jones & Jones personnel revealed several instances where relationships with Majestic might impair independence. The

partners of Jones & Jones want the audit engagement, but they will not terminate any staff person or ask any partner to resign to obtain

the work.

With the restriction on non-termination of partners or staff, which of the following is a threat to Jones and Jones' independence with

Majestic?

1. Olson, a professional staff person, below the rank of manager, has been employed full time with Jones & Jones since August 20X2.

Olson was also a director of Majestic for the first nine months of 20X2.

II. Swanson is a manager with Jones & Jones. He had been treasurer of Majestic from January 20X0 through March 20X2. He resigned

his position as treasurer and accepted employment as a manager with Jones & Jones on December 1, 20X2.

OI only

O II only

● I and II

Neither I nor II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Andrew Wilson, CPA, has assembled the financial statements of Texas Mirror Co. Texas Mirror is a small nonpublic company. Wilson has not performed an audit of the financial statements in accordance with generally accepted auditing standards. Wilson is confused about the standards applicable to this type of engagement. Please discuss the following: Identify and Explain where Wilson should look for guidance concerning this engagement. Discuss Wilson’s responsibilities with respect to a preparation of these financial statements.arrow_forwardOpal Ltd has had an internal audit function for 15 years. Until they retired three months ago, the Chief Internal Auditor (CIA) had been in post since the function was established. An interim replacement has been appointed. The function was always well resourced with a good number of professional and specialist staff. However, a number of staff left when the previous CIA retired and there are rumours that the remaining staff are dissatisfied with the appointment of a relatively inexperienced replacement, who is close friends with the Director of Finance. Due to the need for the organisation to make significant financial savings, the need for the internal audit function is greater than ever yet recent months have also seen increased resistance to, and criticism of, the recommendations made by the function. Senior management is now considering the best delivery model for the function. Explain two advantages and two disadvantages to Opal of outsourcing their internal audit function.arrow_forwardAn audit manager has led the audit of Topaz Ltd for the last three years. Evidence of a fraud involving the falsification of timesheets and supplier invoices to a significant value have been found. Senior management within Topaz are implicated. Discuss the extent to which the external auditor should be criticised for not discovering this fraud.arrow_forward

- You are the audit partner at Parkville & Associates, a mid-tier audit firm. You are responsible for theaudits of the following four independent entities for the year ended 30 June 2018:(a) Human Help Ltd is a non-profit entity. You have discovered that it has not kept substantiating vouchers or receipts for more than 55 percent of its expenses, excluding salaries and allowances(b) JJ King Ltd is a building contractor with a varying workload. In order to compensate for the irregularity of its contracted building projects, JJ King also purchases large vacant blocks of land that it later subdivides for the construction of houses and units. JJ King then sells these on its own account. Your analysis strongly suggests that the apportionment of costs to houses and units sold has been kept low to boost profits. In your opinion, this has resulted in the overvaluation of the unsold properties. The directors of the company do not agree and hold to their view that the stock of properties is…arrow_forwardLuxwell, a Copenhagen, Denmark company that manufactures security devices, has contacted Christian Jespersen, certified auditor, to submit a proposal to do a financial statement audit. Luxwell was a bit taken aback when saw the cost of the financial audit, even though the fees were about average for an audit of a company Luxwell's size. The board of directors determined that the company could not afford to pay the price.Required: 1. Discuss the alternatives to having a financial statement audit2. What should Luxwell consider when choosing the assurance service?arrow_forwardThe CPA firm of Webster, Warren, & Webb LLP issued an adverse opinion on the internal control of Alexandria Financial, a public company, due to a material weakness. The weakness involved the lack of sufficient accounting expertise to evaluate and adopt appropriate accounting principles. Subsequent to issuance of the report, management of Alexandria hired a new controller to eliminate the weakness. a. Describe what steps Alexandria must perform to engage Webster, Warren, & Webb to issue a report indicating that the weakness no longer exists. b. Describe how Webster, Warren, & Webb should approach the engagement. c. Describe what Webster, Warren, & Webb must do if, during the course of the engagement, a member of the audit team discovers another material weakness in internal control over financial reporting. Will the new weakness affect the auditors’ report?arrow_forward

- When Congress passed the Sarbanes-Oxley Act of 2002, it imposed greater regulation on issuers and their auditors and required increased accountability. Which of the following is not a provision of the act? O Lead engagement team partners must be rotated at least every 5 years. Audit firms must be rotated at least every 5 years. Auditors of public companies may no longer provide certain nonattest "expert services" to their clients. O The audit committee must be entirely made up of independent members. The audit committee must have at least one financial expert.arrow_forwardPhillips CPA Firm is auditing the accounts of Tojo Enterprises, Inc., a national distributor of kitchen appliances. After reviewing the minutes of board of directors meetings as well as recent SEC filings, Phillips CPA firm have noted that key executives are extremely close to achieving a substantial bonus if the firm's stock price achieves a certain level in the market. Based on this finding, what might Phillips CPA Firm decide to do? O Phillips CPA Firm are likely to audit competing companies within the same industry as a basis for comparison. O Phillips CPA Firm are likely to assess control risk as low on the premise that management's desire to achieve stock price forecasts will increase fraud risk. O Phillips CPA Firm are likely to assume fraud risk is high, due to senior management's proximity to achieving certain desired stock prices. O None of these answer choices are correct.arrow_forwardThe Ministry of Magic, the regulator of businesses, is concerned about the public financial reporting that was produced by Eeylops Owl Emporium Ltd. The Ministry was aware that the emporium had not indicated that it was discontinuing a division of its business and that for the last financial year it had not included an acquisition of a new building in its balance sheet, which it had purchased some three months before the end of the financial year. Explain why the regulator is concerned with such oversights and what the emporium is required to do in each case.arrow_forward

- You are an assurance services senior at Bailey & Associates and have noted the following independent issues in relation to the audit of Sleek Ltd: (i) The accounting system at Sleek Ltd did not operate effectively during the first year of operations. Consequently, some general ledger accounts had to be based on estimates, as the actual data relating to these balances had been lost. (ii) As a result of cost constraints, the directors of Sleek Ltd did not implement effective internal controls for debt collection. The debtors’ turnover is 3.2 times. Required: Explain the impact of each of these separate issues on your assessment of audit risk, and the audit strategy that would be adopted.arrow_forwardSam Jones has been the controller of Downtown Tires for 25 years. Ownership of the firm recently changed hands and the new owners are conducting an audit of the financial records. The audit has been unable to reproduce financial reports that were prepared by Sam. While there is no evidence of wrongdoing, the auditors are concerned that the discrepancies might contribute to poor decisions. Which of the following characteristics of useful information is absent in the situation described above? timelyaccessibleverifiablecompleterelevantarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education