Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

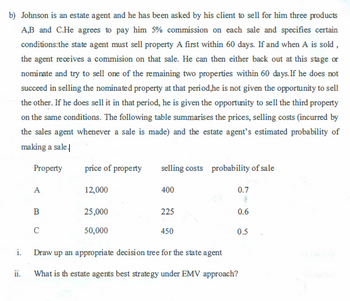

Transcribed Image Text:b) Johnson is an estate agent and he has been asked by his client to sell for him three products

A,B and C.He agrees to pay him 5% commission on each sale and specifies certain

conditions: the state agent must sell property A first within 60 days. If and when A is sold,

the agent receives a commision on that sale. He can then either back out at this stage or

nominate and try to sell one of the remaining two properties within 60 days. If he does not

succeed in selling the nominated property at that period,he is not given the opportunity to sell

the other. If he does sell it in that period, he is given the opportunity to sell the third property

on the same conditions. The following table summarises the prices, selling costs (incurred by

the sales agent whenever a sale is made) and the estate agent's estimated probability of

making a sale.

Property

i.

ii.

A

B

price of property

12,000

C

25,000

50,000

selling costs probability of sale

400

225

0.7

(

0.6

0.5

450

Draw up an appropriate decision tree for the state agent

What is th estate agents best strategy under EMV approach?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Similar questions

- If the seller has already sent a counteroffer to one prospective buyer and then receives another offer from a second prospective buyer that is even better: They are free to respond to the new offer from the second prospective buyer without withdrawing their counteroffer to the first prospective buyer. They should withdraw the counteroffer to the first prospective buyer before responding to the new offer from the second prospective buyer. They must tell the first prospective buyer about the new offer from the second prospective buyer and give the first prospective buyer an opportunity to match the new amount. They cannot do anything until they hear back from the first prospective buyer +arrow_forwardIn 2019 Lisa and Fred a married couple had taxable income of $312000, if they were to file seperate returns Lisa would have reported taxable income of $129,000 and Fred would have reported taxable income of 183,000. What is the couple's marriage penaty or benefit?arrow_forwardSteve was hired to paint the outside of Denise's house for a price of $1500. Steve showed up everyday to paint and the job was completed in about three weeks. He told Denise he would come- to pick up his payment on Thursday. On Wednesday, Denise me py noticed that one of the spots on the back of the house needed to re-done because it looked messy. When Steve asked for payment Denise refused to pay him anything telling him that he did a messy job and he would have to sue her. Steve is entitled to payment under a theory of subjective contracts. Denise will win because Steve breached the contract. Steve is entitled to payment under a theory of substantial performance. Denise will win and not have to pay anything.arrow_forward

- Daniel, a property developer, is selling a house to Peter, who is 25 years old and intellectually impaired. Houses of an equivalent size and quality in the area generally go for about half the price that Daniel has negotiated with Peter. Peter has paid the deposit and waived the cooling off period under the contract. Peter’s cousin, Jeremy, learns of the deal and is very concerned. Jeremy is Peter’s legal guardian. What can he do legally to help Peter? (Explain how those laws may be interpreted by existing common law and equitable rules and applied to property laws).arrow_forwardTo acquire a 400,000 square foot industrial park in Boca Raton, Florida at a purchase price of $40 million, an investor put down 40% and borrowed $24 million with a 30-year fully amortizing fixed rate mortgage loan at an annual contract interest rate of 5% payable monthly. The borrower was charged two points by the lender that was deducted from the loan amount at closing. If the monthly payments on the loan were paid on time each month and if the loan was fully repaid at the end of 10 years with no prepayment penalty, what was the effective annual yield on the loan to the payoff date? a.5.28% b.5.38% c.5.18% d.5.08%arrow_forwardWhat was the correct interpretation of condition 4 in DTR Nominees Pty Ltd v Mona Homes Pty Ltd (1978) 138 CLR 423? Choose one of the following. A plan containing the 9 lots being sold should have already been lodged for registration at the time of contract. The plan attached to the contract containing 35 lots could be registered in 2 stages, so long as the plan already lodged at the time of contract contained the 9 lots being sold. The plan attached to the contract containing 35 lots should have already been lodged for registration at the time of contract. The plan attached to the contract containing 35 lots could be lodged within 14 days of the contract being signed.arrow_forward

- Under what conditions might you consider single-sourcing an item in the leveraging category of the portfolio matrix?arrow_forwardArthur owns a property with a large back yard that is usually lit at night by bright floodlights. For months he has been asking local teenagers to stop using his yard as a ‘short-cut’ to the bus stop, but they continue to ignore him. Arthur decides to install an in-ground swimming pool. Last Saturday night, after the pool contractor has spent the day excavating a large hole, Arthur decided not to switch on the floodlights. At 11 pm, one of the teenagers, Gerry, fell into the hole and suffered serious injuries. Explain whether Arthur is likely to be liable in negligence. (Explain the operation of the Australian legal systems and processes relevant to contract and consumer law, including basic principles of the law of torts, particularly relating to negligence and negligent misstatement).arrow_forwardSkip and Jack are the shareholders of the Blue Fish Event Corporation. Skip and Jack regularly put on classy events on or near the beach, so they have a special insurance policy to protect their assets. Business has been slow as fewer large beach weddings are taking place, so Skip and Jack use a large fan to blow down and damage most of their décor assets, some of which were personal assets of Skip and Jack, to collect the insurance benefits. (a) Assuming their acts are proven, will a court allow Skip and Jack to recover the insurance money? (b) Is this a situation where the corporate veil may be pierced? Why or why not? (c) What would it mean for Skip and Jack if the corporate veil is pierced in this situation?arrow_forward

- Marigold finds her dream home in the Rocky Mountains. She wants to buy it but is unsure whether she can get a loan. She signs a contract with the seller that she will buy the home provided that she can obtain a loan. Marigold also includes a clause in the contract with the seller stating that if she loses her job before the date the purchase contract is signed, the seller will release her from any obligation. After obtaining a loan and buying the home, Marigold decides she wants to have new windows installed. She enters into a contract with a window contractor. The window contractor visits the home, but never finds Marigold there. The contractor makes several attempts to reach Marigold, but Marigold does not return phone calls and makes no attempt to assist the contractor in arranging the window installation. What is the provision that the seller will release Marigold unless she is able to obtain a loan called? An exculpatory condition A condition precedent A condition…arrow_forwardAnthony wishes to start a business and his cousin offers him a loan of $10,000 at 4% interest to be repaid in two years. The loan amount, interest rate and repayment period are all put down in an email between Anthony and his cousin. Anthony soon takes steps to start his business by conducting market research, developing a business plan, choosing a business structure, registering his business and obtaining licenses and permits. However, his cousin fails to provide the funds and Anthony now must borrow from the bank at much higher commercial rates. Anthony wants to know whether he can sue his cousin for breach of contract. 1. To determine whether there is a breach of contract by Anthony’s cousin, Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardNylah and Toddare friends. Nylah is engaged and wants to have the wedding of her dreams, but she cannot afford it. Todd wants to help with this, so he tells Nylah he will give her $10,000 today, and she can pay him back in monthly installments of $100 beginning next month when she returns from her honeymoon. Nylah agrees and does have the wedding of her dreams. A month later, Todd asks Nylah for the first installment of $100. Nylah refuses. Todd sues Nylah. The court will a. order Nylah to pay Todd the money because there was consideration. b. not order Nylah to pay the money because there was nothing in writing. c. not order Nylah to pay the money because they are friends. d. order Nylah to pay Todd the money because there was noconsideration.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.