Question

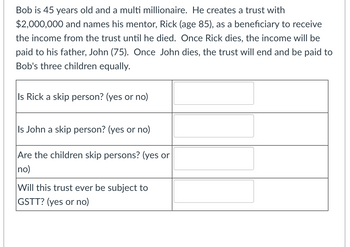

Transcribed Image Text:Bob is 45 years old and a multi millionaire. He creates a trust with

$2,000,000 and names his mentor, Rick (age 85), as a beneficiary to receive

the income from the trust until he died. Once Rick dies, the income will be

paid to his father, John (75). Once John dies, the trust will end and be paid to

Bob's three children equally.

Is Rick a skip person? (yes or no)

Is John a skip person? (yes or no)

Are the children skip persons? (yes or

no)

Will this trust ever be subject to

GSTT? (yes or no)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Martina and Andrew are friends. They both have a keen interest in technology. They decide to form a business to pursue various technology projects, and decide that a company will be the best business structure to adopt. They establish Apricot Pty Ltd. Martina and Andrew are its only shareholders, and they are also its only directors. Martina takes a much more active role in managing the company than Andrew. Andrew relies heavily upon Martine to provide him with information about the company, particularly in relation to its finances, and its dealings with other companies. Andrew does not himself investigate the finances or transactions of Apricot Pty Ltd, other than by relying on Martina to provide him with this information. In June 2017, Martina arranges for Apricot Pty Ltd to purchase a very large quantity of electronics components. The components are acquired from ErinElectronics Pty Ltd, a company that Martina has a significant shareholding in. The transaction generates significant…arrow_forwardWhich of the following statement concerning the legal limitations placed on the duration of trusts are correct? A state that does not have a rule against perpetuities is recommended for a revocable trust the common-law rule against perpetuities allow a trust to exist for 170 years. O A dynasty trust can be set up in any state within the U.S.arrow_forwardUrban LLC sponsors a profit-sharing plan that requires employees to complete one year of service and be 21 years old before entering the plan. The plan also excludes all commissioned sales people and all other allowable exclusions allowed under the IRC. Which of the following employees could be excluded? 1. Jax, age 20, who works in administration and has been with the company for 32 months. 2. Gemma, a commissioned sales person working in the Houston office. She is 37 years old and has been with the company for 3 years. 3. Clay works as the lead foreman in the company factory. He is 39 and has been with the company for 11 months and is covered under a collective bargaining agreement. A. 1 and 2. B. 1, 2, and 3. C. 3 only. D. 1 only.arrow_forward

- James Stilton is the chief executive officer (CEO) of RightLiving, Inc., a company that buys life insurance policies at a discount from terminally ill persons and sells the policies to investors. To RightLiving pays the terminally ill patients a percentage of the future death benefit (usually 65 percent) and then sells the policies to investors for 85 percent of the value of the future benefit. The patients receive the cash to use for medical and other expenses. The investors are “guaranteed” a positive return on their investment, and RightLiving profits on the difference between the purchase and sale prices. Stilton is aware that some sick patients might obtain insurance policies through fraud (by not revealing the illness on the insurance application). Insurance companies that discover this will cancel the policy and refuse to pay.Stilton believes that most of the policies he has purchased are legitimate, but he knows that some probably are not. Using the information presented in…arrow_forwardFreida, who lives in Covington, Louisiana purchased three bonds from a company based in Brazil that were yielding 9.75% and paid a 12% coupon, semi-annually. The company went bankrupt and Freida never received her money. What type of risk caused Freida's loss? Interest rate risk. Default risk. Exchange rate risk. Executive risk.arrow_forwardAssume Ethan Lester and Vick Jensen are CPAs. Ethan was seen as a “model employee” who deserved a promotion to director of accounting, according to Kelly Fostermann, the CEO of Fostermann Corporation, a Maryland-based, largely privately held company that is a prominent global designer and marketer of stereophonic systems. The company has an eleven person board of directors. Kelly considered Ethan to be an honest employee based on performance reviews and his unwillingness to accept the promotion, stating that he wasn’t ready yet for the position. Kelly admired his willingness to learn and grow, not just expect a promotion. Little did she know that Ethan was committing a $50,000 fraud during 2015 by embezzling cash from the company. In fact, no one seemed to catch on because Ethan was able to override internal controls. However, the external auditors were coming in and to solidify the deception, he needed the help of Vick Jensen, a close friend who was the accounting manager and also…arrow_forward

- Companies A and B differ only in their capital structure. A is financed 30% debt and 70% equity: B is financed 10% debt and 90% equity. The debt of both companies is risk-free. a. Rosencrantz owns 1% of the common stock of A. What other investment package would produce identical cash flow for Rosencrantz? b. Guildenstern owns 2% of common stock of B. What other investment package would produce identical cash flows for Guildenstern?arrow_forwardtrue or false and why? Michael is a worker at a large discount retailer and his wife works at a national bank with several branches. They recently adopted a child and agreed that each would take six weeks of leave from work in order to care for the child. According to the family and medical leave Act, one, but not both, are eligible for leave.arrow_forwardthe founder and chairman of the company is the same person. if he later sells the company and becomes executive director, will there be a conflict of interest? How could this be a corporate governance and ethics issue for the company and what steps/structures should be put in place to prevent this?arrow_forward

- his question comprises several partial subquestions. Please do not forget to answer all of them. This is all the available information - no other information may be added. The company "Señorío de Begué", originally from the province of Jaén (Spain), is dedicated to the sale and distribution of olive oil. For the next year, it intends to export its products outside of Spain. Señorío de Begué (a fictitious company), has a high-quality product, very prestigious and well known in Spain, as well as a good structure of production and sale for national trade. Although sales continue to increase in Spain, they have decided to make the leap to the international market to continue this line of growth. The company needs someone to take charge of this important new phase for Señorío de Begué. DEVELOP 1. In the first place, you will have to carry out a study of the product and the sector in Spain, as well as its competition. 2. Choose 3 countries to export and analyze the…arrow_forwardJames Stilton is the cief executive oiffcer (CEO) of Rightsliving. inc Company that buys life insurance policies at discount from terminally ill people and sells the policies to investors RightLiving pays the terminally ill pateitns a percentage of the future death benefits and then sells the policies to investors for 85% of the value of the future beneffits. The patients receive the cash to use for medical and other expenses and the investotors are gauranteed a postitive return on thier investment. The diffreence beteween the purchase and sale price is the RightLiving profit. Stilton is aware that some sick patiente may obtain insurance policies through fraud (by not revealing thier illness on the insurance app). An insurance company that discovers such fraud will cancel the policy and refuse to pay. Stilton believes that most of the policies he has purchases are legitimate but he knows that some are probably not. Question Under the categorical imperative, are the actions of…arrow_forward1-All businesses must start out as sole proprietorships before they can be partnerships. True or False 2-The right of survivorship attaches to joint tenants. True or False 3-Degree of control that one person exercises over the other is sufficient to determine whether there is an employment relationship. True or Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios