FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

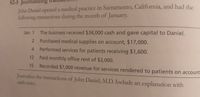

Transcribed Image Text:S2-5 Journalizing

John Daniel opened a medical practice in Sacramento, California, and had the

following transactions during the month of January.

Jan. 1 The business received $34,000 cash and gave capital to Daniel.

Purchased medical supplies on account, $17,000.

4 Performed services for patients receiving $1,600.

12 Paid monthly office rent of $3,000.

15

Recorded $7,000 revenue for services rendered to patients on account.

Journalize the transactions of John Daniel, M.D. Include an explanation with

each entry.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journal Entires for transaction June 20 Repaired a damaged steering mechanism for customer Darren O'Malley and also installed a new Hickster Pipe. Mr. O'Malley was billed for 3.25 hours of labor, accessories totaling $430.00, plus sales tax. He paid with a bank credit card. Merchandise listed on the sales invoice: Stock Number....................Item.................Quantity.............Net Cost Per Unit BM102 .......................HICKSTER PIPE............1...........................$215.00 Sales Tax 8% Labor cost $65/hourarrow_forwardform the Journal entry of the given transaction: date/s transaction debit credit Sep-02 Garcia invested P30,000 cash to start his business. 2 Purchased medical Supplies on account, P10,000 3 Paid monthly office rent of P4,000. 4 Recorded P5,000 revenue for service rendered to patients: received cash of P2,000 and sent bills to patients for the remainder. 10 Borrowed P50,000 from the bank, signing a note payable 15 Performed service for patients on account, P3,600 22 Received cash from patients billed on September 3, P2,000 25 Received and paid a utility bill, P200 26 Paid monthly salary to nurses, P3,000 30 Paid interest expense of P200arrow_forwardFinancial Transactions: Journalize the following transactions that occurred during the year: January 1: Received $100,000 cash in exchange for common stock. January 1: Purchased a delivery truck for $36,000 by paying $6,000 in cash and signing a note f remainder. January 15: Purchased $1,200 of supplies on account July 1: Paid $12,000 for an annual insurance policy. December 31: Made sales of $500,000 on the account. The Cost of Goods Sold was $300,000.arrow_forward

- Determine the following (1-3)::: 1. What is the accounts receivable balance, net of uncollectible accounts, at the end of December? 2. What is the accounts payable at the end of December? 3. What is the retained earnings at the end of December?arrow_forwardAnalyzing and journalizing transactions, posting, and preparing a trial balance Vince Rockford practices medicine under the business title Vince Rockford, M.D., P.C. During March, the medical practice completed the following transactions: L Mar 1 Rockford deposited $74,000 cash in the business bank account. The business issued common stock to Rockford. 5 Paid monthly rent on medical equipment, $560. 1. 2. 3. 31 Revenues earned during the month included $7,100 cash and $4,700 on account. 31 Paid employees' salaries $2,000, office rent $1,600, and utilities $320. Make a single compound entry. 31 Paid cash dividends of $8,000. M 9 Paid $24,000 cash to purchase land for an office site. 10 Purchased supplies on account, $1,300. 19 Borrowed $19,000 from the bank for business use. Rockford signed a note payable to the bank in the name of the business. 22 Paid $900 on account. N 0 Q R Requirements Journalize each transaction, as shown for March 1. Explanations are not required. Post the…arrow_forwardYou are an accounting intern working for SpringFit Corporation. You have recently been assigned to help one of the accountants who is doing an internal audit of the business. You will be assisting with a review of the payables issued by SpringFit Corporation. Your first task is to review the previous year’s journal entries, shown as follows: Journal Entries, Year 1 PAGE 15 GENERAL JOURNAL ACCOUNTING EQUATION DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 Jan. 1 Cash 1,062,060.00 ↑ 2 Premium on Bonds Payable 62,060.00 ↑ 3 Bonds Payable 1,000,000.00 ↑ 4 Jun. 30 Interest Expense 19,397.00 ↓ 5 Premium on Bonds Payable 3,103.00 ↓ 6 Cash 22,500.00 ↓ 7 Jul. 1 Cash 1,921,280.00 ↑ 8 Discount on Bonds Payable 78,720.00 ↓…arrow_forward

- business issued a credit memo $235 to NECinc.regarding the sales on oct 1 give journal entryarrow_forwardPrepare the journal entries for the following transactions, provided the chart accounts below: DATE:APRIL 2022TransactionsApril 01 -Completion of a denture worth 6,000 April 02 - Received 7,000 in total from appointed patients for the whole dayApril 03 -received 7,000 in total from appointed patients for the whole dayApril 04 -received 2,500 in total from appointed patientsApril 05- paid 36,000 for car loan for business/personal useApril 06- received 1,500 from one patient that dayApril 07 -received 3,000 from appointed patients that dayApril 08- purchased dental supplies, 4,500April 09- received 4,000 from appointed patients April 10-received 3,000 in total from appointed patients April 11-received 1,500 from one patient that dayApril 12-paid 10,000 for dental laboratory feeApril 13-received 20,000 from a prosthodontic caseApril 15-paid 13,000 for a lot for future investment/businessApril 15 -paid 7,500 for dental assistantApril 16-received 2500 in total from appointed patientsApril…arrow_forwardJournalize the following transactions in the accounts of Arrow Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. 19. Sold merchandise on account to Dr. Sinclair Welby, $38,700. The cost of the merchandise sold was $20,900. July 7. Received $8,100 from Dr. Sinclair Welby and wrote off the remainder owed on the sale of January 19 as uncollectible. Nov. 2. Reinstated the account of Dr. Sinclair Welby that had been written off on July 7 and received $30,600 cash in full payment. If an amount box does not require an entry, leave it blank. Jan. 19-sale - Select - - Select - - Select - - Select - Jan. 19-cost - Select - - Select - - Select - - Select - July 7 - Select - - Select - - Select - - Select - - Select - - Select - Nov. 2-reinstate - Select - - Select - - Select - - Select - Nov. 2-collection - Select - - Select -…arrow_forward

- Record the following transactions for the Scott Company: Transactions: Nov. 4 Received a $6,500, 90-day, 6% note from Tim’s Co. in payment of the account. Dec. 31 Accrued interest on the Tim’s Co. note. Feb. 2 Received the amount due from Tim’s Co. on the note. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to two decimal places. Assume a 360-day year when calculating interest. CHART OF ACCOUNTS Scott Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Batson Co. 122 Accounts Receivable-Bynum Co. 123 Accounts Receivable-Calahan Inc. 124 Accounts Receivable-Dodger Co. 125 Accounts Receivable-Fronk Co. 126 Accounts Receivable-Miracle Chemical 127 Accounts Receivable-Solo Co. 128 Accounts Receivable-Tim’s Co. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable-Tim’s Co. 141…arrow_forwardYou have a Visa credit card account lemi with a 24.99% annual percentage rate calculated on the average daily balance. The billing date is the first day of each month, and the billing cycle is the number of days in that month. Your credit card balance on June 1 was $252. On June 8th you made a $109 purchase. You made another purchase, a $75 gift card, on June 18th. You made a $100 payment on June 28th. Show your work for all parts of the problem. (a) What is the average daily balance for July? (b) What is your finance charge on the account as of July 1st? (c) What is your new credit card balance?arrow_forwardA dentist opens a dental practice by depositing $10,000 into a bank account in the business name The dental business borrows $100,000 from the bank The dentist pays for malpractice insurance for the month, $2,000 Purchases for cash dental equipment, including X-ray machine, chair, etc. $60,000 The dentist pays for a billboard to advertise his services for one month, $500 The dentist performs dental services for the first half of the month and receives $8,000 for services January 1 January 2 January 3 January 4 January 20 January 21 rendered January 29 January 31 Pays the dental hygienist $2500 Bills patients for services rendered that have not been paid $5,000 Date Account Debit Credit 1/1/16 Cash 10000 Сapital 10000 Chart of Accounts: 1/2/16 Cash Accounts Receivable 1/3/16 Equipment Notes Payable 1/4/06 Сapital Fees Earned 1/20/16 Insurance Expense Advertising Expense 1/21/16 Salaries Expense 1/29/16 1/31/16 1. What is the net income for January? 2. How much do patients owe the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education