Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

What is the total cost of the job?

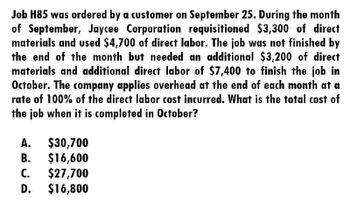

Transcribed Image Text:Job H85 was ordered by a customer on September 25. During the month

of September, Jaycee Corporation requisitioned $3,300 of direct

materials and used $4,700 of direct labor. The job was not finished by

the end of the month but needed an additional $3,200 of direct

materials and additional direct labor of $7,400 to finish the job in

October. The company applies overhead at the end of each month at a

rate of 100% of the direct labor cost incurred. What is the total cost of

the job when it is completed in October?

A.

$30,700

B.

$16,600

C. $27,700

D. $16,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cycle Specialists manufactures goods on a job order basis. During the month of June, three jobs were started in process. (There was no work in process at the beginning of the month.) Jobs Sprinters and Trekkers were completed and sold, on account, during the month (selling prices: Sprinters, 22,000; Trekkers, 27,000); Job Roadsters was still in process at the end of June. The following data came from the job cost sheets for each job. The factory overhead includes a total of 1,200 of indirect materials and 900 of indirect labor. Prepare journal entries to record the following: a. Materials used. b. Factory wages and salaries earned. c. Factory Overhead transferred to Work in Process d. Jobs completed. e. Jobs sold.arrow_forwardRulers Company is a neon sign company that estimated overhead will be $60,000, consisting of 1,500 machine hours. The cost to make Job 416 is $95 in neon, 15 hours of labor at $13 per hour, and five machine hours. During the month, it incurs $95 in indirect material cost, $130 in administrative labor, $320 in utilities, and $350 in depreciation expense. What is the predetermined overhead rate if machine hours are considered the cost driver? What is the cost of Job 416? What is the overhead incurred during the month?arrow_forwardDuring August, Skyler Company worked on three jobs. Data relating to these three jobs follow: Overhead is assigned on the basis of direct labor hours at a rate of 2.30 per direct labor hour. During August, Jobs 39 and 40 were completed and transferred to Finished Goods Inventory. Job 40 was sold by the end of the month. Job 41 was the only unfinished job at the end of the month. Required: 1. Calculate the per-unit cost of Jobs 39 and 40. (Round unit costs to nearest cent.) 2. Compute the ending balance in the work-in-process inventory account. 3. Prepare the journal entries reflecting the completion of Jobs 39 and 40 and the sale of Job 40. The selling price is 140 percent of cost.arrow_forward

- Abbey Products Company is studying the results of applying factory overhead to production. The following data have been used: estimated factory overhead, 60,000; estimated materials costs, 50,000; estimated direct labor costs, 60,000; estimated direct labor hours, 10,000; estimated machine hours, 20,000; work in process at the beginning of the month, none. The actual factory overhead incurred for November was 80,000, and the production statistics on November 30 are as follows: Required: 1. Compute the predetermined rate, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Using each of the methods, compute the estimated total cost of each job at the end of the month. 3. Determine the under-or overapplied factory overhead, in total, at the end of the month under each of the methods. 4. Which method would you recommend? Why?arrow_forwardPocono Cement Forms expects $900,000 in overhead during the next year. It does not know whether it should apply overhead on the basis of its anticipated direct labor hours of 60,000 or its expected machine hours of 30,000. Determine the product cost under each predetermined allocation rate if the last job incurred $1,550 in direct material cost, 90 direct labor hours, and 75 machine hours. Wages are paid at $16 per hour.arrow_forwardPotomac Automotive Co. manufactures engines that are made only on customers orders and to their specifications. During January, the company worked on Jobs 007, 008, 009, and 010. The following figures summarize the cost records for the month: Jobs 007 and 008 have been completed and delivered to the customer at a total selling price of 426,000, on account. Job 009 is finished but has not yet been delivered. Job 010 is still in process. There were no materials or work in process inventories at the beginning of the month. Material purchases were 115,000, and there were no indirect materials used during the month. Required: 1. Prepare a summary showing the total cost of each job completed during the month or in process at the end of the month. 2. Prepare the summary journal entries for the month to record the distribution of materials, labor, and overhead costs. 3. Determine the cost of the inventories of completed engines and engines in process at the end of the month. 4. Prepare the journal entries to record the completion of the jobs and the sale of the jobs. 5. Prepare a statement of cost of goods manufactured.arrow_forward

- When setting its predetermined overhead application race, Tasty Box Meals estimated its overhead would be $100,000 and would require 25,000 machine hours in the next year. At the end of the year. It found that actual overhead was $102,000 and required 26,000 machine hours. Determine the predetermined overhead rate. What is the overhead applied during the year? Prepare the journal entry to eliminate the under applied or over applied overhead.arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forwardYork Company Is a machine shop that estimated overhead will be $50,000, consisting of 5,000 hours of direct labor. The cost to make job 0325 is $70 in aluminum and two hours of labor at $20 per hour. During the month. York incurs $50 in indirect material cost. $150 in administrative labor, $300 in utilities, and $250 in depreciation expense. What is the predetermined overhead rate if direct labor hours are considered the cost driver? What is the cost of Job 0325? What is the overhead incurred during the month?arrow_forward

- A company has the following transactions during the week. Purchase of $3,000 raw materials inventory Assignment of $700 of raw materials inventory to Job 7 Payroll for 10 hours and $3,000 is assigned to Job 7 Factory depreciation of $1,750 Overhead applied at the rate of $200 per hour What is the cost assigned to Job 7 at the end of the week?arrow_forwardDuring the month, Job Arch2 used specialized machinery for 350 hours and incurred $700 in utilities on account. $400 in factory depreciation expense, and $200 in property tax on the factory. Prepare journal entries for the following: A. Record the expenses incurred. B. Record the allocation of overhead at the predetermined rate of $1.50 per machine hour.arrow_forwardA company has the following transactions during the week. Purchase of $1,000 raw materials inventory Assignment of $500 of raw materials inventory to Job 5 Payroll for 20 hours with $1,000 assigned to Job 5 Factory utility bills of $750 Overhead applied at the rate of $10 per hour What is the cost assigned to Job 5 at the end of the week?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,