FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

RIRA Company makes attachments such as backhoes and grader and bulldozer blades for construction equipment. The company uses a job order cost system. Management is concerned about cost performance and evaluates the

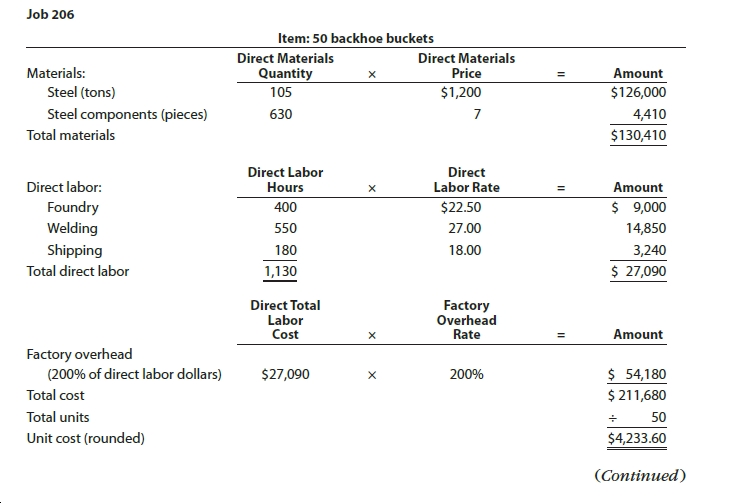

Transcribed Image Text:Job 206

Item: 50 backhoe buckets

Direct Materials

Direct Materials

Price

Materials:

Quantity

105

Amount

Steel (tons)

$1,200

$126,000

Steel components (pieces)

630

4,410

Total materials

$130,410

Direct

Labor Rate

Direct Labor

Hours

Direct labor:

Amount

$ 9,000

Foundry

Welding

$22.50

400

550

27.00

14,850

Shipping

3,240

180

18.00

$ 27,090

Total direct labor

1,130

Direct Total

Labor

Cost

Factory

Overhead

Rate

Amount

Factory overhead

(200% of direct labor dollars)

$ 54,180

$ 211,680

200%

$27,090

Total cost

Total units

50

Unit cost (rounded)

$4,233.60

(Continued)

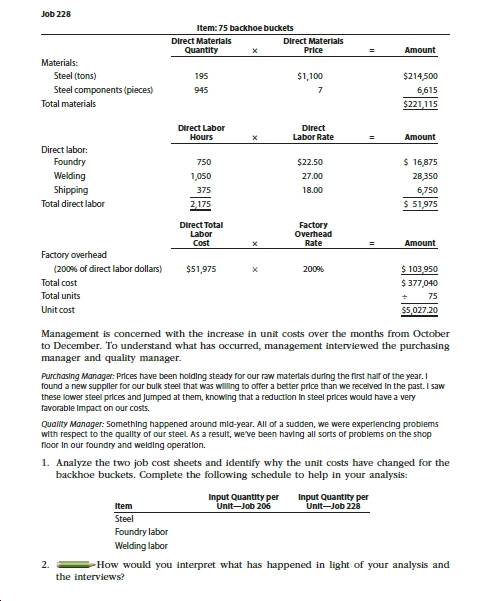

Transcribed Image Text:Job 228

Item: 75 backhoe buckets

Direct Matertals

Quantity

Direct Materlals

Price

Amount

Materials:

Steel (tons)

$1,100

$214,500

195

Steel components (pieces)

Total materials

945

6,615

$221,115

Direct Labor

Direct

Labor Rate

Amount

Hours

Direct labor:

$ 16,875

Foundry

$22.50

750

Welding

28,350

1,050

27.00

Shipping

375

18.00

6,750

$ 51,975

Total direct labor

2,175

Direct Total

Labor

Cost

Factory

Overhead

Rate

Amount

Factory overhead

$ 103950

$ 377,040

(200% of direct labor dollars)

$51,975

200%

Total cost

Total units

75

Unit cost

$5,027.20

Management is concerned with the increase in unit costs over the months from October

to December. To understand what has occurred, management interviewed the purchasing

manager and quality manager.

Purchasing Manager: Prices have been holding steady for our raw materlals during the first half of the year.I

found a new suppler for our bulk steel that was willing to offer a better price than we recelved In the past. I saw

these lower steel prices and Jumped at them, knowing that a reduction In steel prices would have a very

favorable Impact on our costs.

Quality Manager: Something happened around mid-year. All of a sudden, we were experlencing problems

with respect to the quallty of our steel. As a result, we've been having all sorts of problems on the shop

floor In our foundry and welding operation.

1. Analyze the two job cost sheets and identify why the unit costs have changed for the

backhoe buckets. Complete the following schedule to help in your analysis:

Input Quantity per

Unit-Job 228

Input Quantity per

Unit-Job 206

Item

Steel

Foundry labor

Welding labor

-How would you interpret what has happened in light of your analysis and

2.

the interviews?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bret's RV Manufacturing uses job order costing to account for it's manufacturing costs. The company estimates total manufacturing overhead costs for the coming year to be $282,783. The total direct materials costs are estimated to be $784,555. The total direct labor hours are estimated to be 67,670 hours with direct labor costs estimated at $541,365. What is the Predetermined Overhead rate if the company applies overhead based on direct labor hours? 52.24% 36.04% O417.89% 23.93% O4,18%arrow_forwardFrame Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine- hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates: Machine-hours Direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour O $24,000 O $110,400 $86,400 Casting Customizing 19,000 1,000 $ 138,700 $ 1.60 The estimated total manufacturing overhead for the Customizing Department is closest to: $60,379 11,000 8,000 $ 86,400 S 3.00arrow_forwardMoody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Required: 1. Compute the plantwide predetermined overhead rate. 2. During the year, Job 400 was started and completed. The following information was available with respect to this job: Direct materials Direct labor cost Machine-hours used $ 400 $ 270 34 Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 50 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 130% of its total manufacturing cost, then what selling price per unit would it have established for Job 400? Complete this question by entering your answers in the tabs below. 156,000 $ 651,000 4.70 S Required 1 Required 2 If Job 400…arrow_forward

- Hallmark Furniture Company refinishes and reupholsters furniture. Hallmark Furniture uses a job order cost system. When a prospective customer asks for a price quote on a job, the estimated cost data are inserted on an unnumbered job cost sheet. If the offer is accepted, a number is assigned to the job, and the costs incurred are recorded in the usual manner on the job cost sheet. After the job is completed, reasons for the variances between the estimated and actual costs are noted on the sheet. The data are then available to management in evaluating the efficiency of operations and in preparing quotes on future jobs. On February 14, 20Y1, an estimate of $3,318 for reupholstering a chair and couch was given to Millard Schmidt. The estimate was based on the following data: Estimated direct materials: 30 meters at $30 per meter $ 900 Estimated direct labor: 28 hours at $30 per hour 840 Estimated factory overhead (75% of direct labor cost) 630 Total estimated…arrow_forwardHahn Company uses job-order costing. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $15 per hour. During the year, the company started and completed only two jobs-Job Alpha, which used 54,500 direct labor-hours, and Job Omega. The job cost sheets for these two jobs are shown below: Job Alpha Direct materials Direct labor Manufacturing overhead applied Total job cost Job Omega Direct materials Direct labor Manufacturing overhead applied Total job cost ? ? ? $ 1,533,500 $ 235,000 345,000 184,000 $ 764,000 Required: 1. Calculate the plantwide predetermined overhead rate. 2. Complete the job cost sheet for Job Alpha.arrow_forwardWheeler's Bike Company manufactures custom racing bicycles. The company uses a job order cost system to determine the cost of each bike. Estimated costs and expenses for the coming year follow: Bike parts Factory machinery depreciation Factory supervisor salaries Factory direct labor Factory supplies Factory property tax Advertising cost Administrative salaries Administrative-related depreciation Total expected costs Required: 1. Calculate the predetermined overhead rate per direct labor hour if the average direct labor rate is $11.91 per hour. 2. Determine the amount of applied overhead if 18,600 actual hours are worked in the upcoming year. Required 1 Required 2 Complete this question by entering your answers in the tabs below. $ 341,800 61,500 140,000 211,998 Predetermined Overhead Rate 39,400 33,750 22,500 55,000 19, 200 $925,148 Calculate the predetermined overhead rate per direct labor hour if the average direct labor rate is $11.91 per hour. Note: Round your answer to 2 decimal…arrow_forward

- Care Company uses job costing and has assembled the following cost data for the production and assembly of item X: (Click the icon to view the cost data.) Based on the above cost data, the manufacturing overhead for item X is A. $1,590 underallocated. B. $350 overallocated. C. $350 underallocated. D. $1,590 overallocated. Cost Data Direct manufacturing labor wages Direct material used Indirect manufacturing labor Utilities Fire insurance Manufacturing overhead applied Indirect materials Depreciation on equipment $ 36,000 100,000 3,800 450 490 10,000 6,500 350 Xarrow_forwardHahn Company uses a job-order costing system. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $21.50 per hour. During the year, the company started and completed only two jobs-Job Alpha, which used 64,900 direct labor-hours, and Job Omega. The job cost sheets for these two jobs are shown below: Job Alpha Direct materials Direct labor Manufacturing overhead applied Total job cost Job Omega Direct materials Direct labor Manufacturing overhead applied Total job cost $ 2,806,000 $ 443,900 571,900 385,700 $ 1,401,500 Required: 1. Calculate the plantwide predetermined overhead rate. 2. Complete the job cost sheet for Job Alpha. Required 1 Required 2 Complete this question by entering your answers in the tabs below. Calculate the plantwide predetermined overhead rate. (Round your answer to 2 decimal places.) Plantwide predetermined overhead rate Eper DLHarrow_forwardLumos Maxima corporation manufacturers lamps and flashlights. They use a job-order cost system to accumulate their manufacturing costs, and a traditional allocation method for applying manufacturing overhead costs. The predetermined overhead rate is $16.00 per direct labor hour. During the month, White corporation worked on two different jobs. Job W-100 was completed and sold by the end of the month. Job W-200 was unfinished at the end of the period. Job W-100 Job W-200 Beginning Balance $19,400 $29,800 Direct Materials $34,200 $21,100 Direct Labor $36,000 $35,200 Actual Direct Labor Hours 8,200 6,400 What is the beginning balance of work in process at the end of the month? A. $188,500 B. $175,700 C. $220,800 D. $409,300arrow_forward

- Moody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Required: 1. Compute the plantwide predetermined overhead rate. 2. During the year, Job 400 was started and completed. The following information was available with respect to this job: Direct materials Direct labor cost Machine-hours used $380 $ 270 39 Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 50 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 130% of its total manufacturing cost, then what selling price per unit would it have established for Job 400? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 152,000 $ 657,000…arrow_forwardHigh Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor- hours. At the beginning of the year, the company provided the following estimates: Direct labor-hours Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour Department Molding 38,500 81,000 $ 251,100 $ 2.60 Painting 50,000 40,000 $ 460,000 $ 4.60 Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Direct labor-hours Machine-hours Direct materials Direct labor cost Required: Department Molding 70 Painting 390 $ 934 $ 720 126…arrow_forwardComplete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Compute the Predetermined Overhead Rates used in the Molding Department and the Painting Department. (Round your answers to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education